FX Daily Strategy: Asia, January 25th

ECB on hold but focus once again on rhetoric not action

EUR/USD risks slightly on the upside as ECB remains hawkish relative to the market

USD may get some support from solid US GDP data

Scope for further JPY gains as JGB yields rise.

ECB on hold but focus once again on rhetoric not action

EUR/USD risks slightly on the upside as ECB remains hawkish relative to the market

USD may get some support from solid US GDP data

Scope for further JPY gains as JGB yields rise.

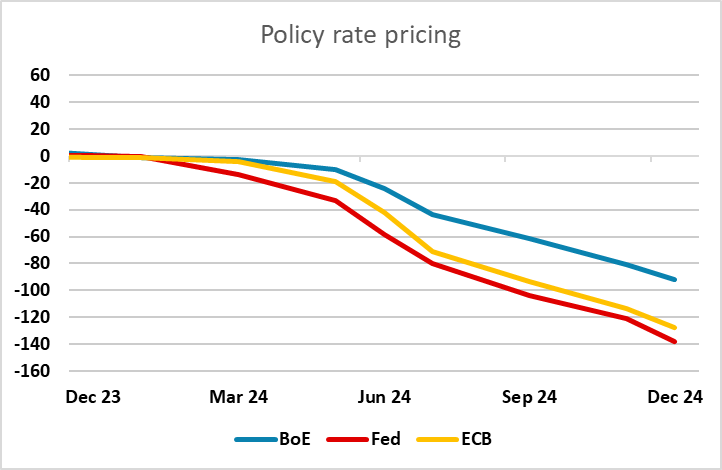

The ECB meeting is the main item on Thursday’s calendar. Once again the meeting is one where markets are not preoccupied with what the Council will do but rather what is said. Stable policy is just about nailed on, but the question is whether there will be any more formal attempt to redirect market thinking that still prices in around 130 bp of rate cuts in the coming year. Given divisions within the Council, which have surfaced in terms of the hawks showing reticence about easing so much, there is likely to be something of communication fudge about the policy outlook. Regardless, ECB rhetoric has changed markedly of late, similar to how market rate thinking has progressed. Indeed, President Lagarde is now suggesting rate cuts may occur in the summer, chiming with an interview from Chief Economist Lane who implied the June meeting will be critical. We still think that cuts may arrive sooner, although we still pencil in no more than 100 bp cuts this year to be followed by a similar sized fall in 2025.

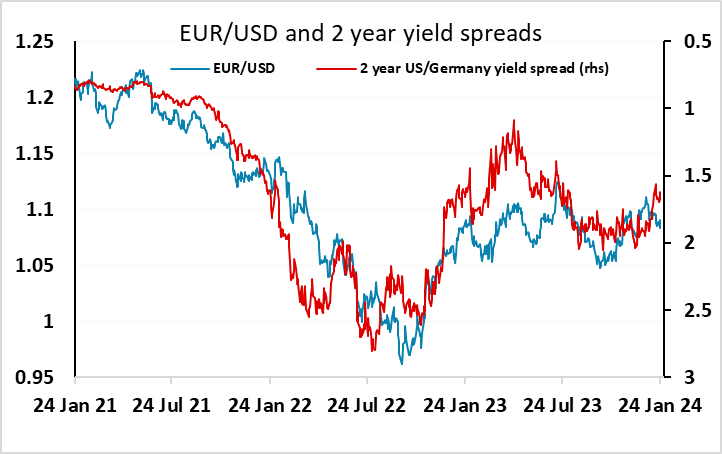

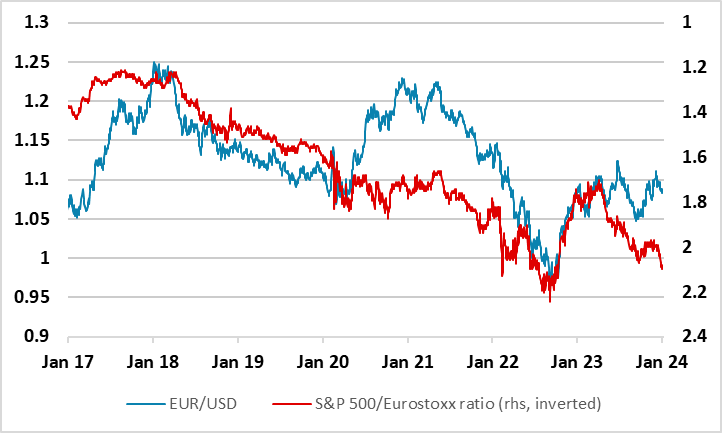

For EUR/USD, given the extent of rate cuts already priced in, and with an 80% chance of a rate cut priced for April, it’s hard to see a statement and press conference that suggests the first hike will be in the summer being negative for the currency. Spreads have moved slightly in the EUR’s favour in recent weeks, as the market has slightly reduced expectations of ECB easing, and our short term EUR/USD model suggests it is only the outperformance of US equities seen in the last few weeks that has prevented EUR/USD from rising back to 1.10. The risks may therefore be slightly on the upside for the EUR on the meeting, with a less dovish Fed view looking necessary to turn the picture more EUR negative.

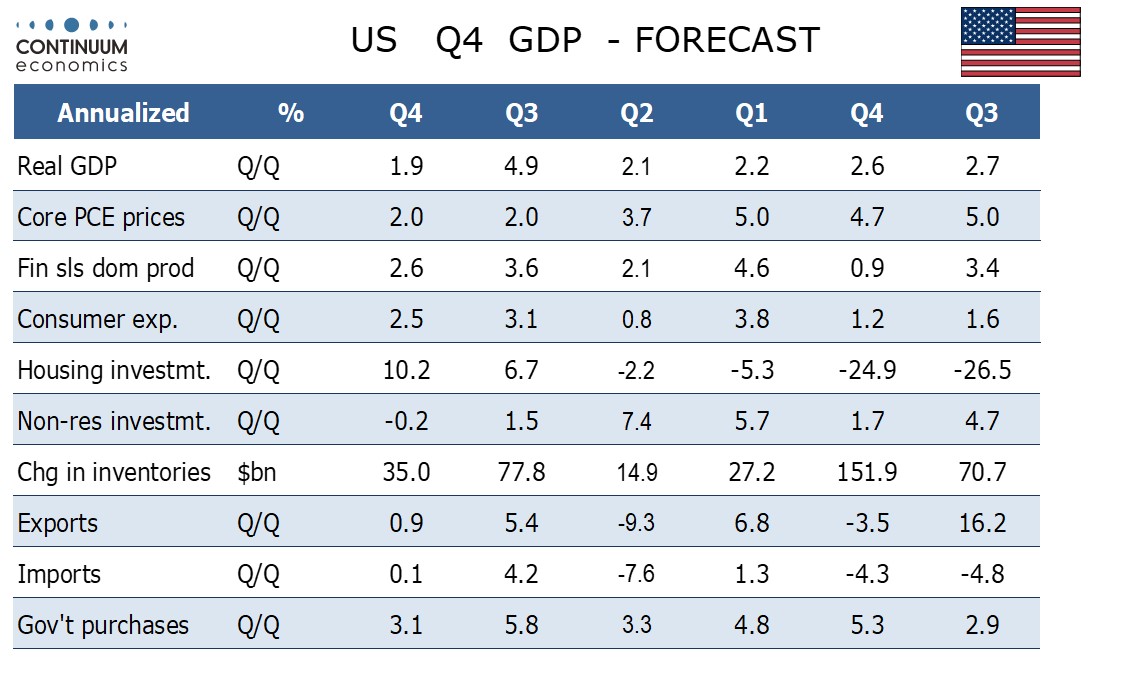

Thursday also sees the German IFO survey, but this has become more of a sideshow of late as the business climate index tends to shadow the S&P composite PMI very closely, so adds little new information. More significant should be the first take on the US Q4 GDP data. We expect a 1.9% annualized increase in Q4 GDP. While this would be the slowest since Q2 2022 saw a decline, and is a little below the market consensus of 2.0%, it would maintain a respectable pace and exceed our expectations at the start of the quarter. Given the 4.9% gain in Q3, such a number could hardly be seen as weak. GDP would be up a healthy 2.8% yr/yr in Q4, similar to Q3’s 2.9% while 2023 as a whole would be up by 2.4% from 2022, outpacing 2022’s 1.9% increase. There will also be interest in the price data. Slower price gains are supportive for real disposable income. We expect gains of 1.7% in the price indices for GDP and PCE, with core PCE at 2.0% consistent with the Fed’s target for a second straight quarter. All of this is quite a goldilocks picture for the US economy – solid growth with inflation coming back to target. As long as the price indices are subdued market expectations of Fed easing are likely to be maintained and there shouldn’t be much USD impact. However, we do see the risks as slightly on the USD upside, as there is a lot of easing priced into the US curve, and if we do see a “goldilocks” picture, supporting the idea of easing, it is likely to maintain the strength of the US equity market and consequently support the USD.

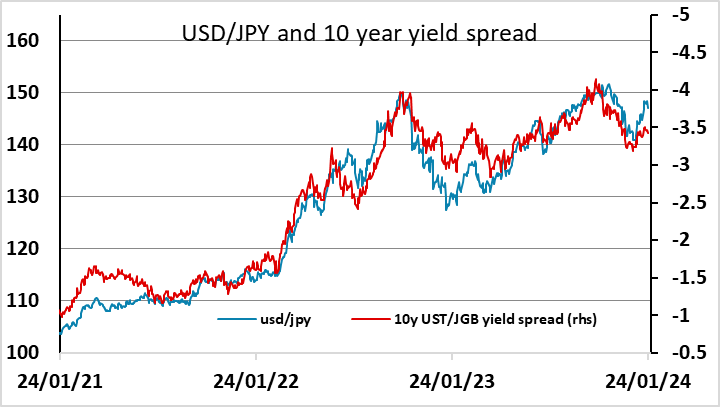

The USD lost some ground across the board on Wednesday, as US yields softened a little and global equities outperformed the US, and this still looks like the big picture risk given the high level of the USD and the high valuation of the US equity market, both on its own terms and relative to the rest of the world. It was notable that while US and Eurozone yields fell a little, despite solid PMIs, JGB yields moved higher as the market started to think about the BoJ’s potential exit form ultra easy monetary policy once again. Yield spreads for USD/JPY are now pointing significantly lower, and we should see some extension of the USD/JPY decline on Wednesday unless US yields move up on the GDP data.