GBP flows: GBP slumps as gilt yields rise sharply

GBP falling sharply in an echo of the post-Truss budget reaction of 2022. Hard to oppose GBP weakness.

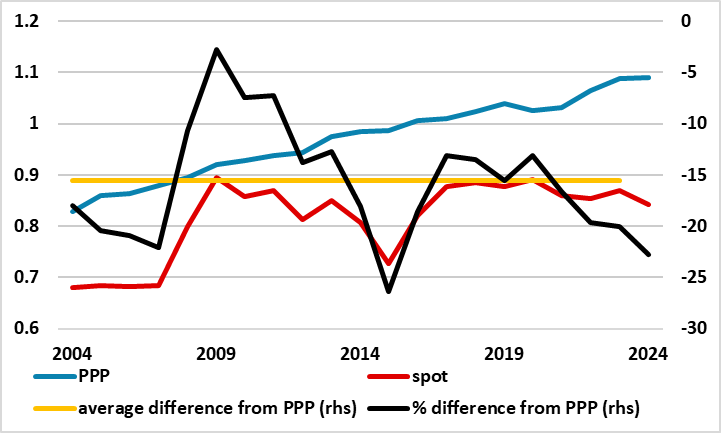

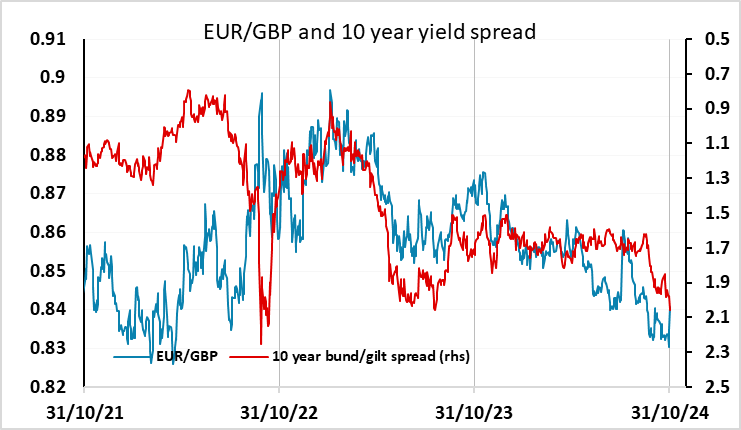

We are seeing a belated Truss 2022 style reaction to the UK budget, with yields up another 15bps on the day and GBP down across the board, with EUR/GBP trading up 40 pips to 0.8420. While it is not yet on the scale of the reaction to the Truss budget, it does suggest an increased risk premium on the pound, with both GBP and gilts falling at the same time. There is plenty of potential downside as GBP is expensive against the EUR at these levels based on long term fair value, even though current levels look justified on the basis of the historic relationship with yields. The Budget itself was not seen as fiscally irresponsible by many, but the weak growth projections from the OBR that have followed it have led many to be concerned about whether further easing will be seen down the road. There is little the UK authorities can do to steady the ship in these circumstances, as they are not about to get rid of the Chancellor or PM (as happened with Truss and Kwarteng) or change fiscal direction. The sharpness post-Truss move was in part a consequence of pension fund hedging, and one would expect that this is less likely to be a factor this time around, but for now it is hard to oppose GBP weakness.