FX Daily Strategy: APAC, Sep 26th

Japanese Tokyo CPI may moderate JPY weakness for now

US PCE data could see more USD positive moves

Canadian GDP to provide short term CAD support only

Yield spreads suggest downside risks for EUR/USD

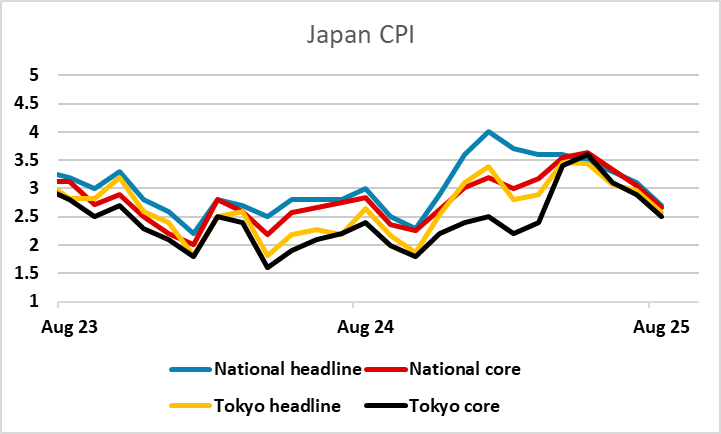

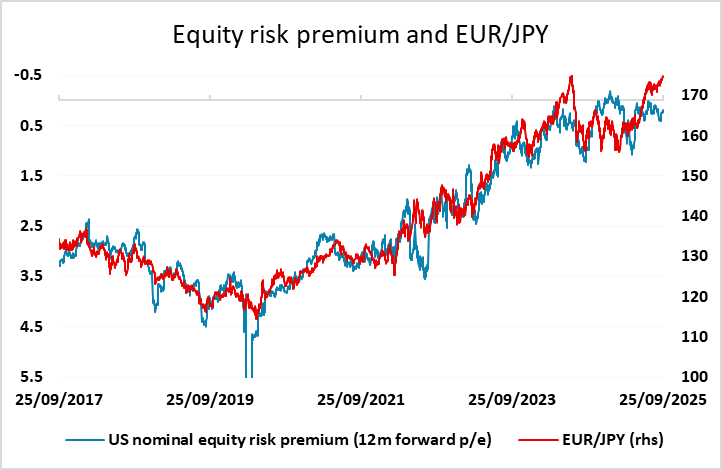

Japanese Tokyo CPI may moderate JPY weakness for now

US PCE data could see more USD positive moves

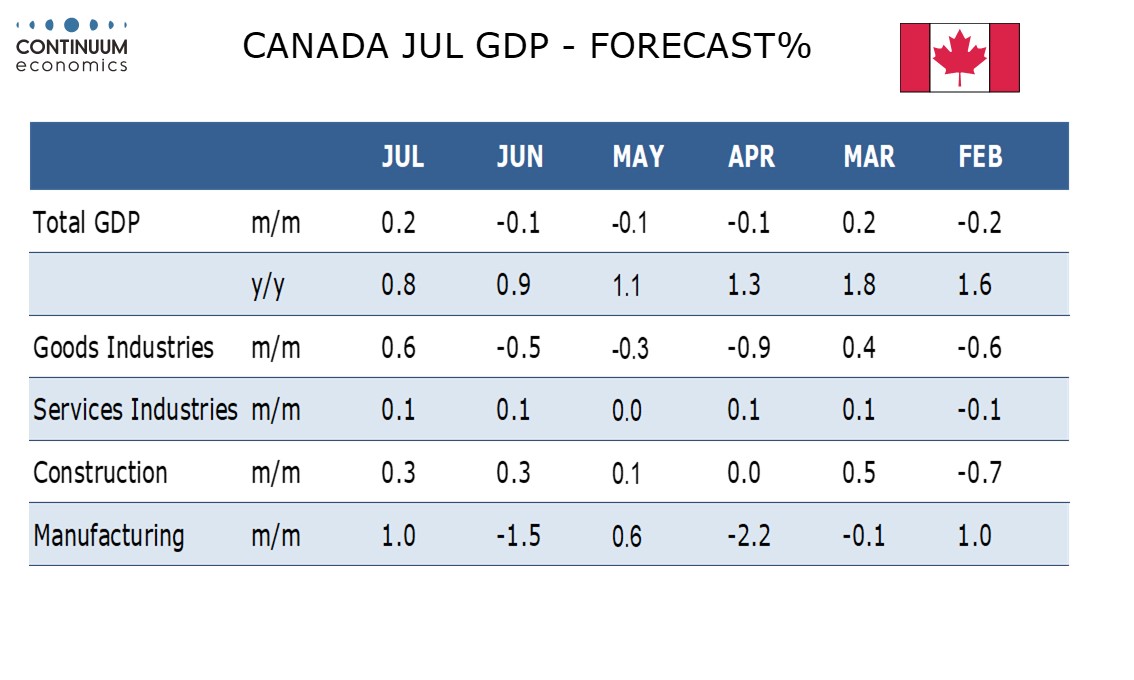

Canadian GDP to provide short term CAD support only

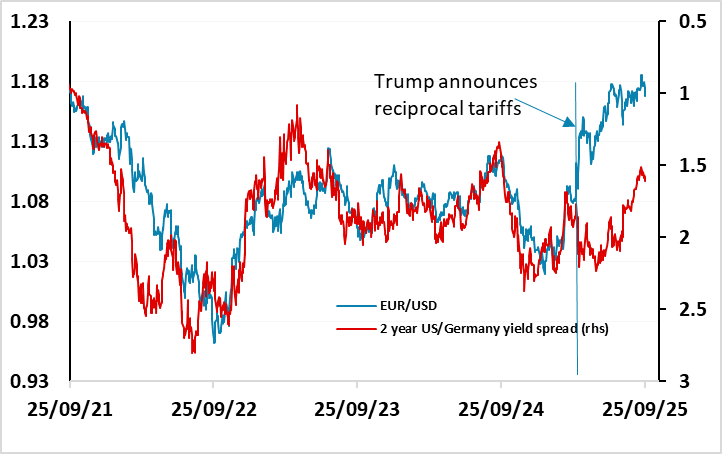

Yield spreads suggest downside risks for EUR/USD

Friday starts with September Tokyo CPI, which is effectively preliminary CPI for Japan. The weakness of the JPY in recent weeks has been undisturbed by increasing talk of an October BoJ rate hike, which is now priced as around a 55% chance. A strong Tokyo CPI number could further increase expectations, and may do something to moderate recent JPY weakness. The market consensus does anticipate a rise in the y/y rate to 2.8% from 2.5% in the core. But we suspect the market has its eyes on the all time high in EUR/JPY at 175.42 seen in July 2024, and it will take more than some increased expectation of a BoJ rate hike to turn the trend. Having said this, JPY weakness looks very overdone, even based on the correlation with risk premia that has broadly held on the JPY crosses in recent years, and we do expect a sharp correction before the end of the year. But it is likely to require an equity market correction to trigger it.

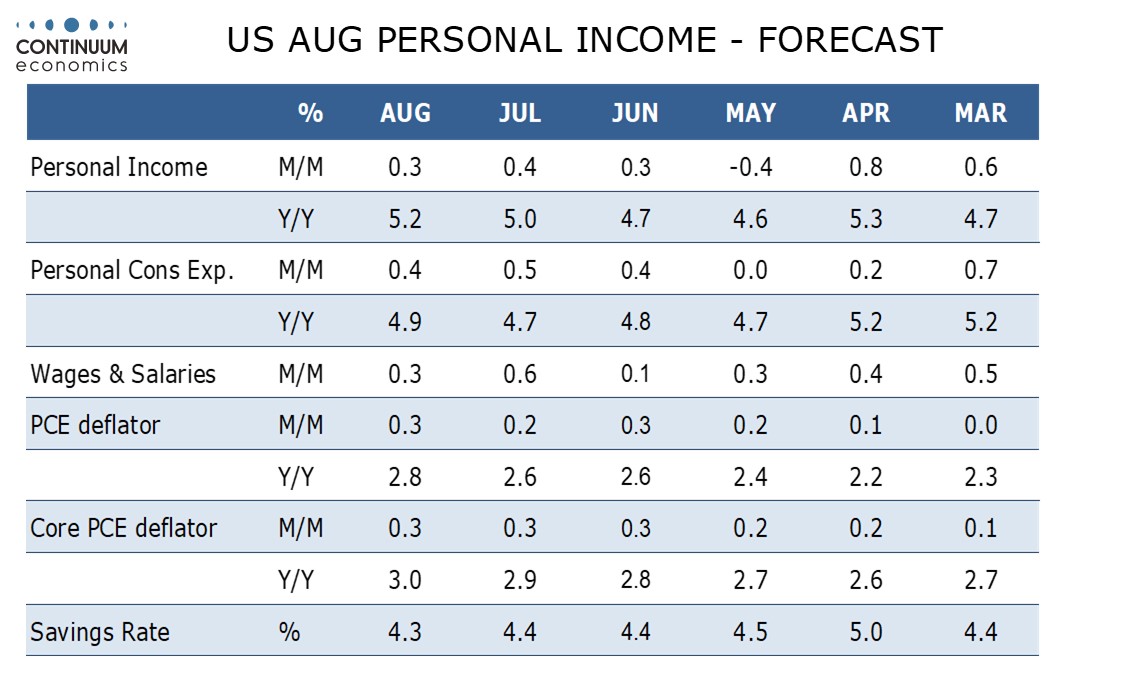

The main data of the day is the US personal income, consumption and PCE deflator for August. We 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. August CPI rose by 0.382% before rounding while core CPI rise by 0.346%. We expect the core PCE price index will be close to 0.3% before rounding while PCE price data tends to be less sensitive to gasoline than the CPI, leaving both headline and core PCE prices up by 0.3%. Our forecast is on the high side of consensus, so the data may trigger higher US yields and a stronger USD. Whether this affects the EUR and the riskier currencies more than the JPY will depend on how the equity market reacts.

There is also Canadian July GDP due. We expect a rise of 0.2%, following three straight declines of 0.1%. A 0.2% rise would be slightly stronger than a preliminary estimate of 0.1% made with June’s report. The rise will come largely from a 0.6% increase in goods, more than fully reversing a 0.5% June decline. Manufacturing will lead after positive July shipments data though modest gains are also likely in construction, mining and utilities. This may help stem the CAD weakness seen on Thursday, but a weak Canadian economy combined with continuing evidence of solid US growth suggests the upside in USD/CAD is still favoured for now.

The USD made gains on Thursday after stronger than expected Q2 GDP numbers from the US. Even so, the first half of the year remains somewhat below trend, so we doubt the data will change the Fed stance significantly. But US yields were nevertheless higher and USD/JPY led the way up, hitting its highest level since August 1st. Yield spreads still don’t support this gain in USD/JPY, but do suggest scope for some further dip in EUR/USD.