FX Daily Strategy: N America, April 2nd

US tariff announcement the main focus

Significant increases already priced in but JPY still looks to have potential for gains

ADP unlikely to move market

Scandis staying strong, NOK favoured

US tariff announcement the main focus

Significant increases already priced in but JPY still looks to have potential for gains

ADP unlikely to move market

Scandis staying strong, NOK favoured

The focus on Wednesday will be on the US tariff announcement, although there will also be some interest in the ADP employment data. Trump said last week that reciprocal tariffs would be lenient and in some cases would not match the tariffs imposed on the U.S. by other countries. This suggests that the Trump administration is backing away from the idea of penal reciprocal tariffs that includes the full scope of non-tariffs e.g. VAT Rates. However, the president outlined his view that reciprocal tariffs will likely be applied on all countries without exemptions, which differs from reports earlier last week that only a dirty 15 would be hit. Trump also promised to announce lumber tariffs on April 2, but delay semiconductor and pharma tariffs. Finally, the threat of across the board secondary tariffs on any buyers of Venezuelan oil from April 2 has already prompted Indian companies to suspend purchases, as 25% across the board is penal. Trump tariff crusade remains in place for now, which is likely to do economic damage, but we also feel can extend the correction in the S&P500 to 5200.

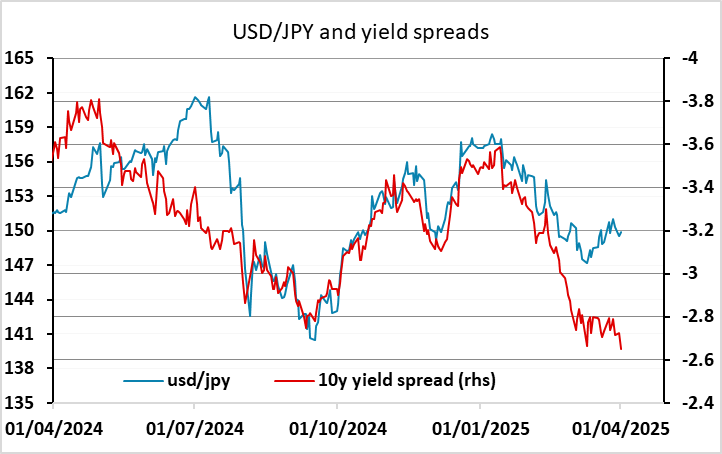

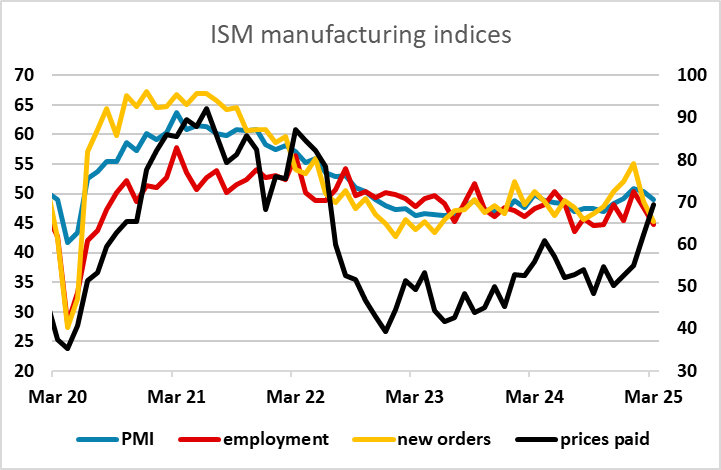

Tuesday saw a somewhat better equity market performance than Monday, although equities did take a hit from the weaker than expected ISM manufacturing survey. Equities got some support from the decline in US yields on the day, and by now the market has priced in some weakness in growth as a result of the tariffs, so we doubt there will be an enormous reaction, both because there is already an expectations of significant tariffs, and because there is uncertainty about whether whatever is announced will end up being negotiated away. Even so, the decline we have seen in US yields already justifies further substantial declines in USD/JPY, so we continue to favour JPY strength, but it is likely to be relatively modest unless equities see further declines.

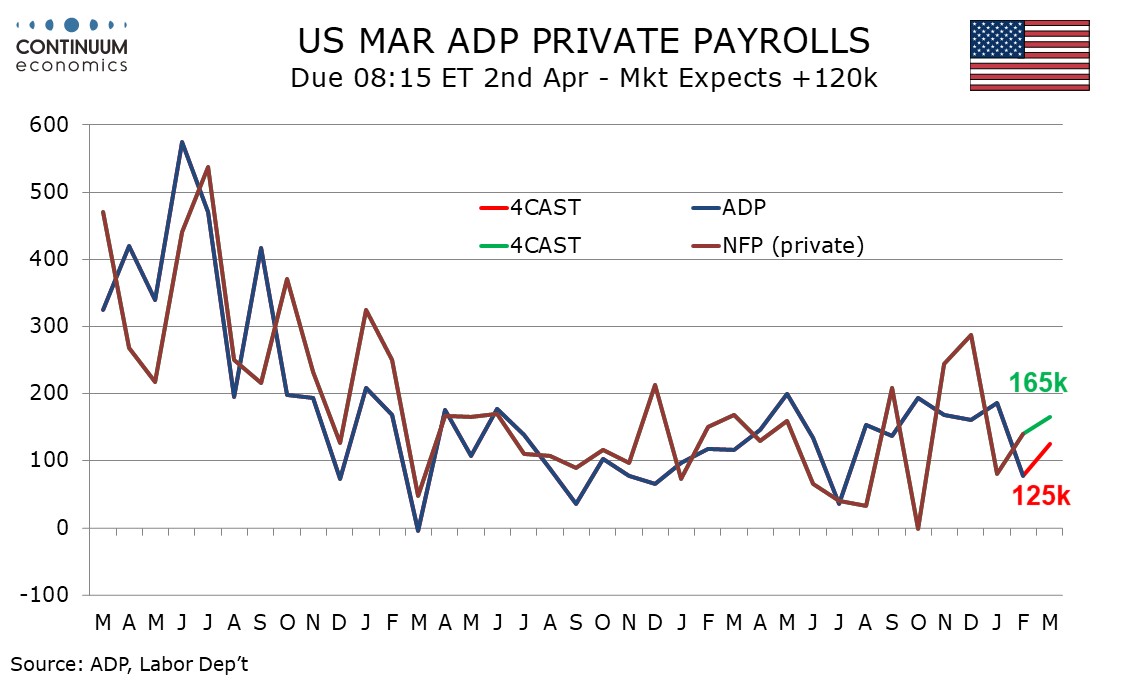

We expect a 125k increase in March’s ADP estimate for private sector employment growth, stronger than February’s weak 77k that significantly underperformed the non-farm payroll, but still below the pre-February trend. Initial claims suggest the labor market remains healthy. A 125k March increase would be weaker than the 165k increase we expect for March’s non-farm payroll, both in its private sector number and overall. Our forecast is close to consensus, and we doubt there will be much market reaction unless there is a dramatic miss.

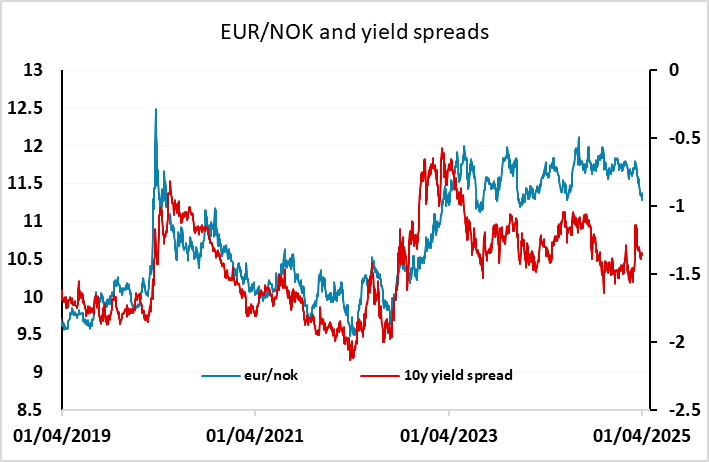

There isn’t anything of note due in Europe, and European currencies will also be focused on the US tariff announcement. In the last few months the scandis have performed well, and EUR/NOK hit its lowest for the year on Tuesday, with EUR/SEK not far off. We continue to prefer the NOK, with more attractive yields and a dramatic underperformance of yield spreads in the last year. But the SEK will tend to outperform as long as there is some optimism about the European economy.