FX Daily Strategy: Asia, January 22nd

Australia Headline Employment Chops

U.S. Q3 GDP still Marginally stronger

U.S. Personal Income and Spending Heading for gains

New Zealand CPI Remain Above Target Range

The Australian labor market has tilted to the downside in recent releases. However, the overall integrity remain sounded. It is expected we will be seeing a positive headline figure on Thursday but participation and unemployment will likely remain at similar level. If we see another miss, market participants will likely be concerned about the health of labor market. Though we do not see such to happen persistently. The RBA could be reading more into the employment figure as they begin to look past only CPI to assess their forecast.

On the chart, the pair extending gains as break of strong resistance at the .6700/27 area opens up room for retest of the .6766 current year high. Positive daily and weekly studies suggest scope for break here to extend the broader gains from the April low. Clearance will see room for extension to target the .6800/25 resistance. Meanwhile, support is raised to the .6700 level which extend to the .6660 congestion. Would take break here to fade the upside pressure and open up room for deeper pullback to retrace gains from the November low.

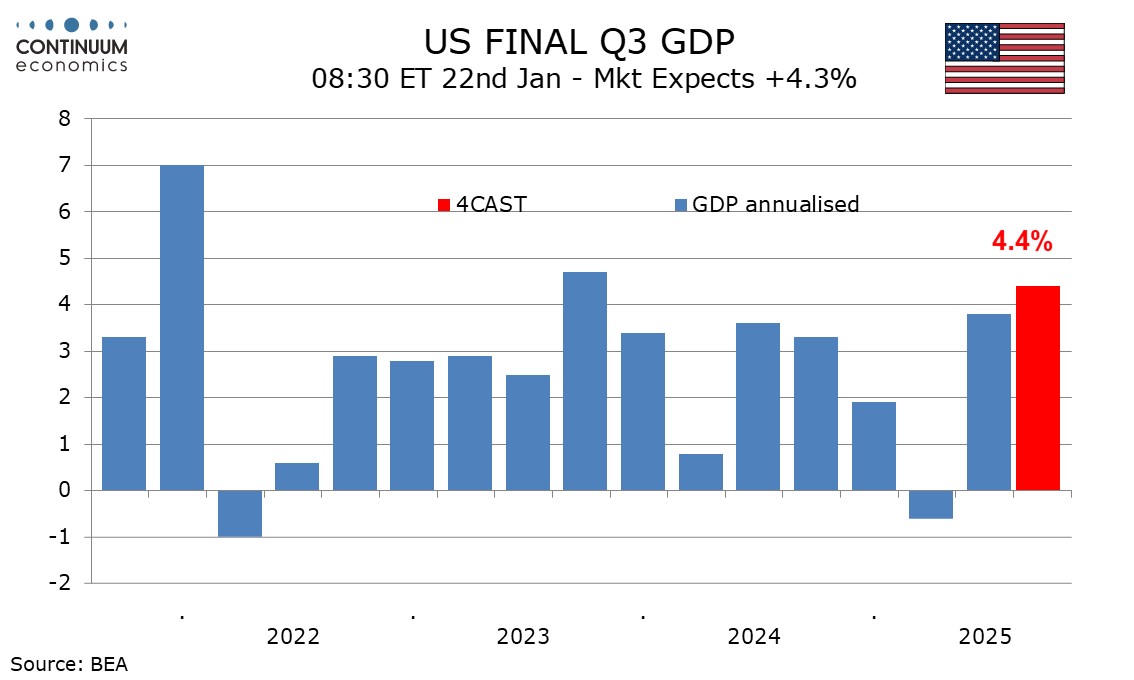

We expect a marginal upward revision to Q3 GDP to 4.4% from an already strong 4.3%. The only component we are expecting a revision to is inventories, on an upward revision to September retail inventories led by autos. Most components will not see significant revisions with the first estimate having come later than usual due to the shutdown and thus less subject to revisions than usual. October’s trade data did see upward revisions to Q3 data led by services, but the data in the previous Q3 GDP report looks consistent with the revised trade data.

September construction spending data due on January 21 could still change the outcome. We do not expect any revisions to the price indices, of 2.9% for core PCE, 2.8% for overall PCE and a significantly higher 3.8% for GDP.

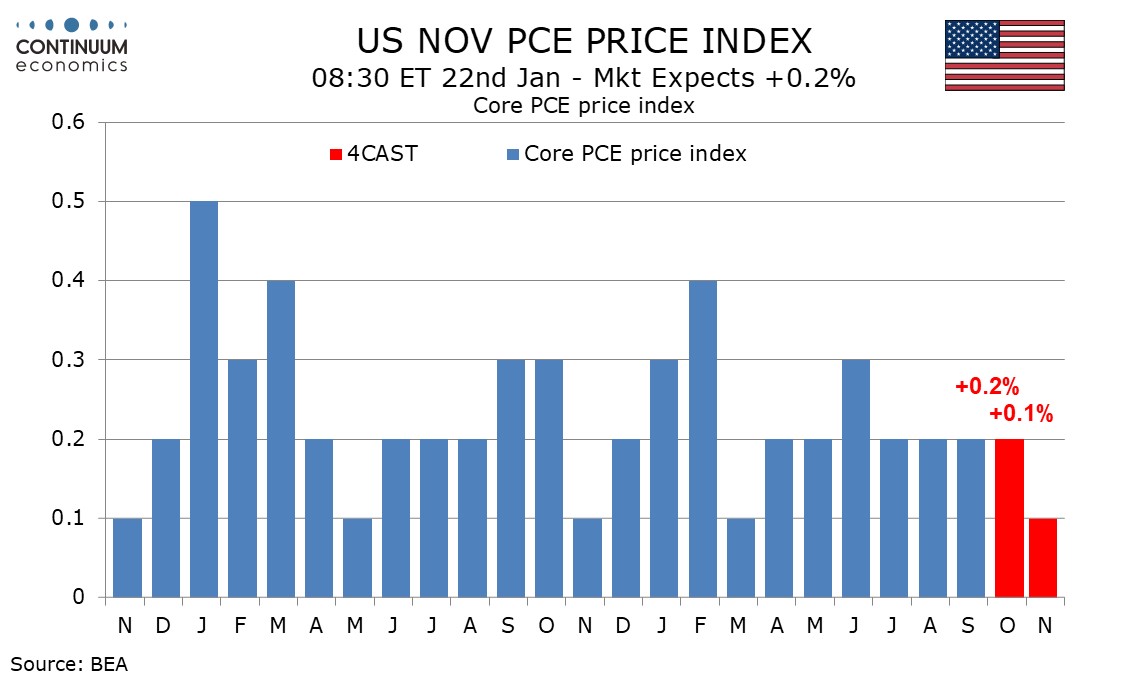

January 22 will see a personal income and spending report for both October and November. We expect personal income to rise by 0.4% in October and 0.5% in November and personal spending to rise by 0.2% in October and 0.5% in November. For core PCE prices, we expect gains of 0.2% in October and 0.1% in November. For Q4, gains slightly above 2.0% for real disposable income, real personal spending and core PCE prices all look likely.

CPI data was not collected for October but it is known that CPI, both overall and ex food and energy, rose by only 0.2% over the two months. We do not expect PCE prices to be quite as soft as that, each rising by 0.3% over the two months. The breakdown by month of the core rate is hard to predict but it is known that gasoline prices fell in October and rebounded in November. We thus expect a smaller 0.1% rise in overall PCE prices in October while the core rises by 0.2%, but November to see overall PCE prices up by 0.2% even with a slower 0.1% increase in the core. We see yr/yr growth in overall PCE prices at 2.7% in November, up from 2.6% in October but below September’s 2.8%, with core PCE prices at 2.7% yr/yr in both October and November, down from 2.8% in September.

Retail sales regained momentum in November after a subdued October, with autos recovering from a dip in October as did gasoline in response to prices. We expect services to rise by 0.4% in both October and November, slower than in each month 0f Q3. This would leave overall consumer spending up by 0.5% in November after a 0.2% increase in October.

The Q4 NZ CPI will be released in late Thursday. The inflationary pressure remains above target range for the past quarters and we expect Q4 to stay around 3%. The RBNZ has previewed higher short term CPI but eases regardless. They are seeing medium term spare capacity to be more important than short term inflation, which is forecasted to return below target range in 2027.

On the chart, the pair break above resistance at the .5800 level has seen sharp gains to tag the .5850 resistance. Prices has since settled back to consolidate strong gains this week from the .5755/35 area and unwind overbought intraday studies. The positive daily and weekly studies suggest this giving way to renewed buying interest later to further retrace the July/November losses. Clearance will see room for extension to the .5910, 61.8% Fibonacci level. Meanwhile, support is raised to the .5800 level which should now underpin and sustain gains from the .5710 low.