Enthusiastic Turkish Medium Term Program Towards 2026-2028 Aims to Find Solutions to Macroeconomic Issues… But Road is Bumpy

Bottom Line: According to the recently announced Medium-Term Program (MTP) for 2026-2028, the main goal of the program remained bringing inflation down to single digits and ensuring price stability soon. Despite GDP growth is forecasted to be 3.8% next year, 4.3% in 2027 and 5% in 2028, we think these are optimistic predictions due to tightening measures in place. We envisage getting inflation down to 16% in 2026 and 9% by 2027 will be (very) difficult as food and services inflation remain sticky. Our forecasts stand at 3.5% GDP growth, and 22.2% average headline inflation for 2026 since we think stubborn inflation and tighter fiscal stance will continue to dent GDP growth.

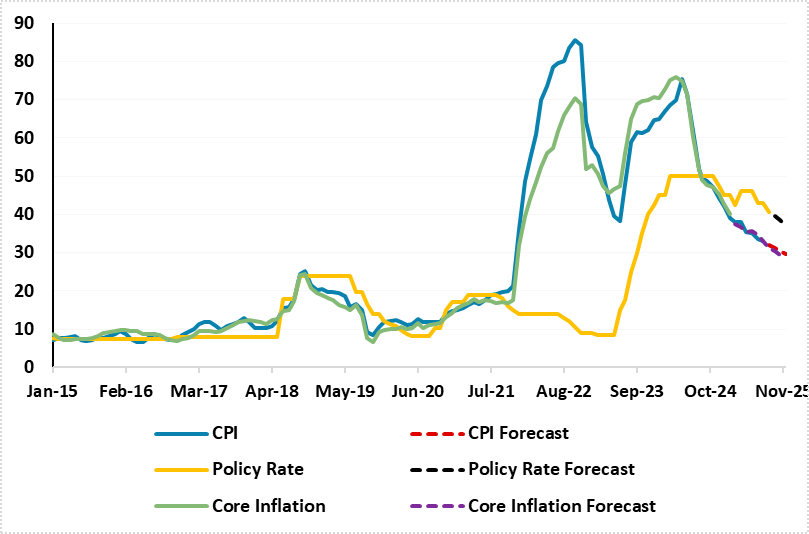

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

Despite recently announced MTP towards 2026-2028 estimates inflation to be 28.5% by the end of this year, we feel this remains unlikely due to sticky price pressures as inflation increased to 33.3% y/y in September from 32.9% y/y in August driven by higher education, housing and food prices. Central Bank of Turkiye (CBRT) also predicts end-year inflation to hit 24%, with an upper band of 29%, while we foresee the annual average headline inflation will be 34.5% in 2025 since inflation remains stickier than expected. We think upside risks such as stickiness in services inflation, volatile food and energy prices, deteriorated pricing behavior, and geopolitical risks will continue to keep inflation pressures alive in the rest of 2025 and 2026. It will be difficult to grind sticky inflation from 30%s to 10%s rapidly requiring high interest to remain for some time.

MTP expects Turkiye's economy to expand by 3.3% this year, 3.8% in 2026, and 4.3% in 2027. We think the forecast of 3.8% GDP growth in 2026 is likely too high, as too much improvement is required in macroeconomic imbalances and also structural policy. We expect GDP growth to edge down to 3.1% in 2025 as previous aggressive monetary policy, stubborn inflation and tighter fiscal stance continue to moderate household consumption, lending and investments. Growth will remain under pressure in Q4 2025/Q1 2026 due to high interest rates and adverse global outlook.

We envisage 2026 growth will be likely be higher than 2025, hitting 3.5% YoY in 2026, supported by positive impacts of the rate cuts and increasing business confidence assuming no dramatic impact from weaker external demand. We think a drop in the inflation rate and rate cuts could boost confidence, coupled with accelerated structural reforms, and stable global conditions could lift growth back toward potential of 3.5%-4% after 2027. (Note: There is still a downside risk that growth can be lower than expected, particularly considering all tightening measures in place).

We are of the view that the MTP program is significant as it serves a guide for the midterm framework for upcoming monetary and financial policies, given forward guidance by the CBRT with disinflation process is ongoing despite slower-than-expected, which was confirmed by the CBRT governor Karahan who said on October 7 that the disinflationary process has recently decelerated.

We believe MTP seems determined, while a strong determination in monetary tightening supported by accurate fiscal and income policies is required until the expected inflation outlook is achieved and twin deficits are fully controlled. 2026 will be significant for the Turkish economy from every angle as setting prices, wages, and other contracts according to forward-looking inflation will be key to resetting expectations and protecting competitiveness.