USD flows: USD firms slightly after ADP but focus on ISM and FOMC

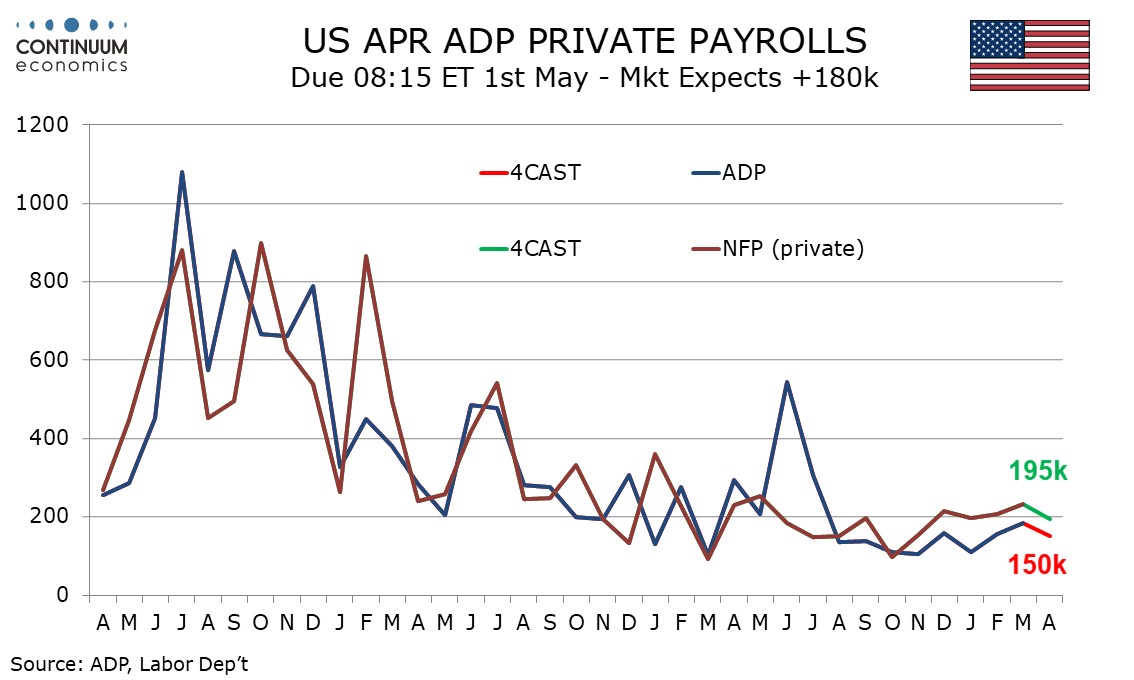

Marginally stronger than expected ADP employment won't change expectations for Friday's employment report. More scope for movement on ISM, but in practice a fairly steady market likely before the FOMC.

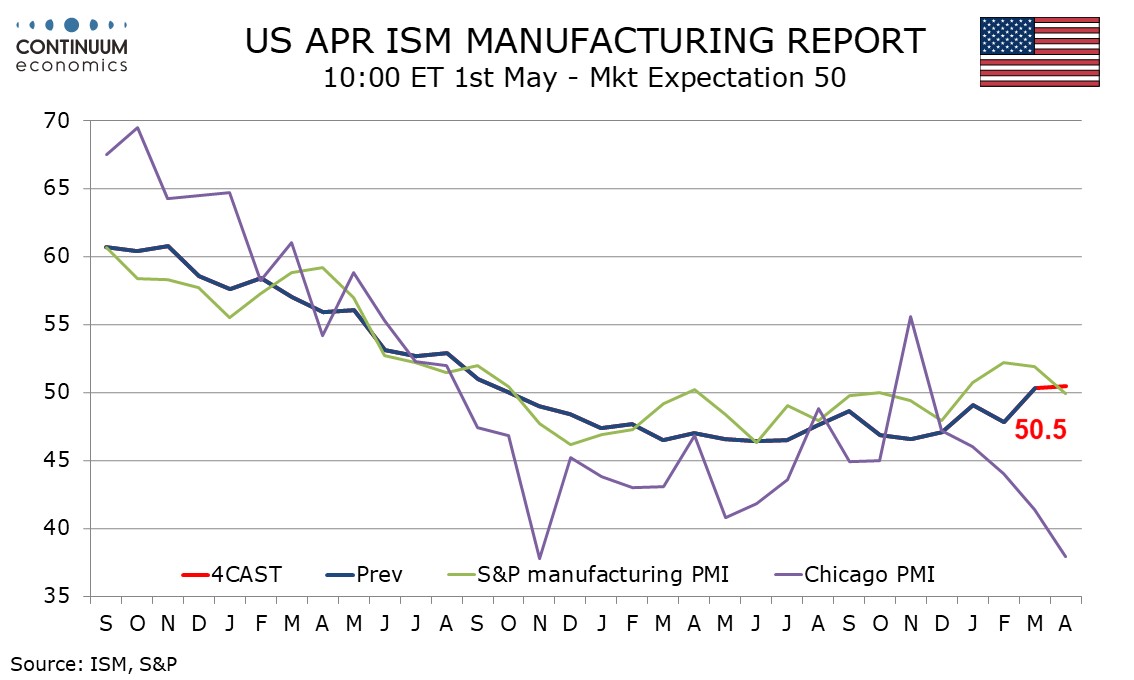

ADP employment comes in modestly above consensus, but not enough to change market expectations of Friday’s employment report given the inconsistent relationship between the ADP data and the payroll numbers. The USD has edged a few pips higher, but it’s hard to see much movement now ahead of the ISM data later. This will be of greater interest than usual, given the weakness of the US S&P PMIs, which will also see the final data released ahead of the ISM. The market has effectively ignored the PMIs, assuming they were a glitch among other solid data, but if weakness were to be supported by the ISM numbers, a significant USD negative impact could be expected. However, it was the services weakness in the PMIs that was more notable, so in practice we doubt there will be much movement ahead of the FOMC.