FX Daily Strategy: Asia, Oct 16

The Australian Employment Report May Not Move the Aussie

JPY Continue to be Affected by Political Tilt

Conflicting Signs To Veer Toward Weakness in UK GDP

Slate of U.S. Data if Released

The Australian employment data will be released in the Asia session on Wednesday. The Australian labor market has chopped to the downside in recent months, indicating a worsening labor market. However, the overall labor market remain healthy and should continue to see healthy unemployment and participation rate with headline employment changes fluctuate. Yet, the latest move in the Aussie seems to be not only correlated with RBA rate anticipation, but also the changes in global risk sentiment. Comment regarding the U.S.-China trade front is going to have a huge impact towards the Aussie.

On the chart, the break of the .6470 low of last week has seen losses to reach .6440. Bounce here see prices unwinding oversold intraday studies but consolidation here is expected to give way to fresh selling pressure later. Below the .6440 low will see room for deeper pullback to retrace the April/September rally and see extension to strong support at the .6415/00, August low and 38.2% Fibonacci level. Meanwhile, resistance is lowered to .6500/20 area. Above here will open up room for stronger bounce to .6550 congestion.

Political uncertainty regarding the Japan governance persists, Komeito seems to have broken their coalition with LDP. More importantly, the opposition seems to be in discussion of narrowing policy difference. If successfully, they may joint hands and become the majority of houses to push their own candidate for coming PM. LDP may lose their leadership after decades of in control. While it is still a distant potential, the speculation is enough to turn the sentiment in monetary policy with LDP's Takaichi may not be on the seat.

On the chart, the pair is leaning lower in consolidation and below the 152.00 level see room for retest of the 151.10, Friday's low. Overbought daily studies suggest scope for break here to open up room to the 151.00 congestion then 150.92, August high. Break here will see room for deeper pullback to strong support at 150.00 level and september high. Meanwhile, resistance is lowered to the 152.00/152.50 congestion area now expected to cap and sustain pullback from the 153.27 high. Clearance, but not expected, will further extend April gains.

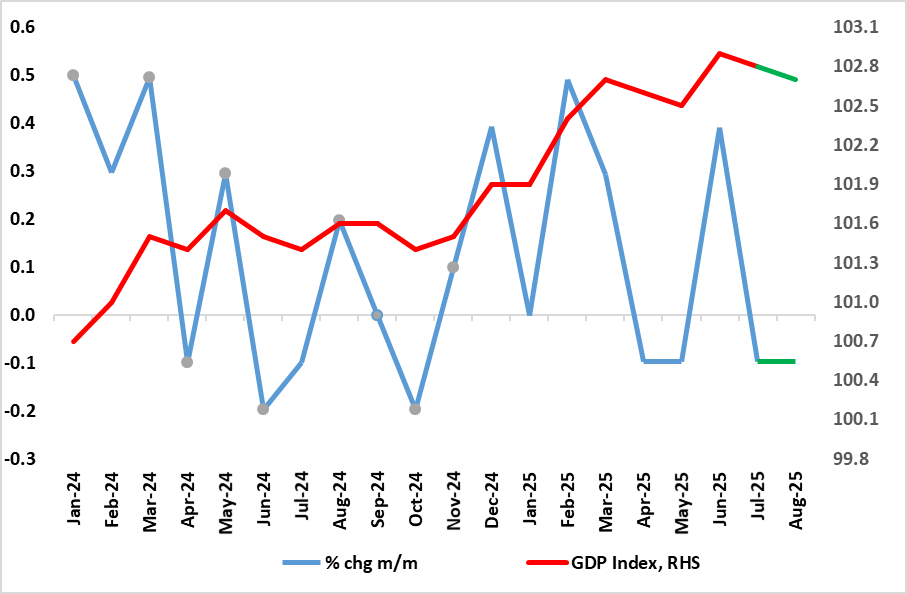

Figure: Solid GDP Growth Ebbing?

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). We see this being repeated in the August numbers with a 0.1% drop (Figure). This would leave the less volatile three-month rate at 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data, especially one construction weakness is incorporated. Even so, at this juncture, the strong June outcome of 0.4% has created a solid backdrop for the last quarter GDP to support the BoE’s 0.3% Q3 forecast – even successive 0.1% m/m declines would still leave the quarter up 0.1% in q/q terms, that is without what may still be likely revisions but this remains our projection.

To what extent better weather in July helped prevent a more discernible fall in the month’s GDP. But gauging the economy is all the more difficult given both conflicting signals and the extent to which the public sector has supported growth of late. The question is whether this latter factor will go in to reverse, sooner but probably later. As for conflicting signals this is best highlighted by recent headline regarding service sector surveys. Indeed, according to the CBI, activity across the services sector continues to weaken while August's PMI sees 'Steepest upturn in service sector output since April 2024'. Notably, the September PMI data more corroborates the CBI findings suggesting that UK service providers achieved only a marginal expansion of business activity as the rate of growth eased sharply since August amid sluggish demand conditions.

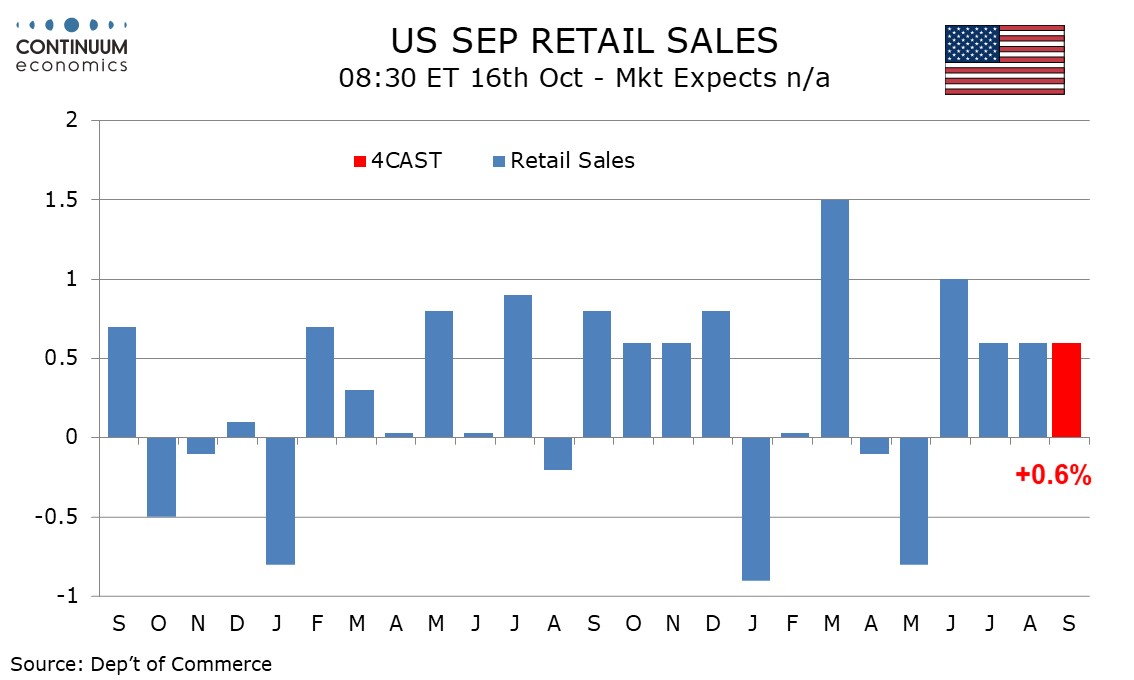

We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline. Industry data shows auto sales saw a modest bounce in September to reverse a modest decline in August. Retail auto data in contrast managed a modest increase in August so we do not expect a strong rise in September retail auto sales.

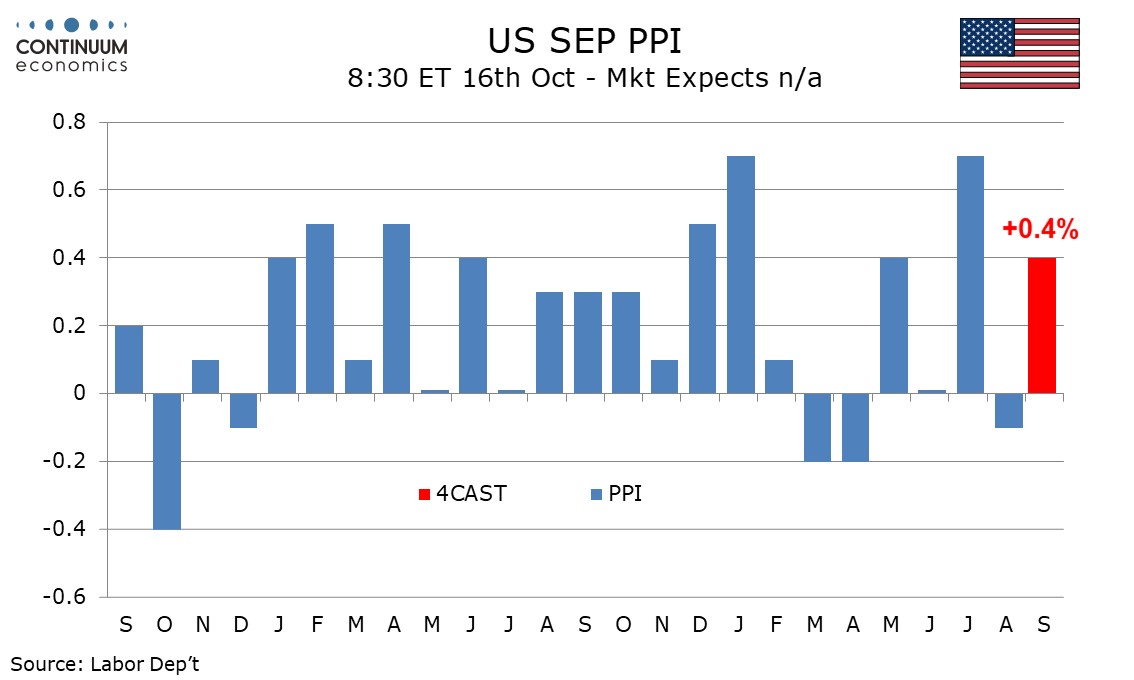

We expect September PPI to rise by 0.4% overall and 0.3% ex food and energy, with the latter gain coming near the average of a 0.7% bounce in July that was corrected by a 0.1% decline in August. Ex food, energy and trade we expect a moderate 0.2% increase after gains of 0.3% in August and 0.6% in July. The release date remains uncertain as long as the government shutdown persists. Higher gasoline prices are likely to lead a 2.5% increase in energy while we expect a 0.5% increase in food, supported by tariffs. Goods PPI ex food and energy has been trending around 0.3% per month through 2025 to date, compared with slightly less than 0.2% through 2024, and we expect that to continue.

Services have been recently volatile with strong gains of 0.5% in May and 0.7% in July, corrected by slippage of 0.1% in June and 0.2% in August. We expect a 0.3% increase in September, to be led by trade which fell by 1.7% in August, more than fully reversing a 1.0% increase in July. Excluding food, energy and trade we expect only a 0.2% increase in September PPI, slower than both August’s 0.3% and July’s 0.6%, which broke a string of subdued outcomes from March through June.