Published: 2024-09-25T13:10:38.000Z

Preview: Due September 26 - U.S. Final (Third) Estimate Q2 GDP - Historical revisions due

Senior Economist , North America

2

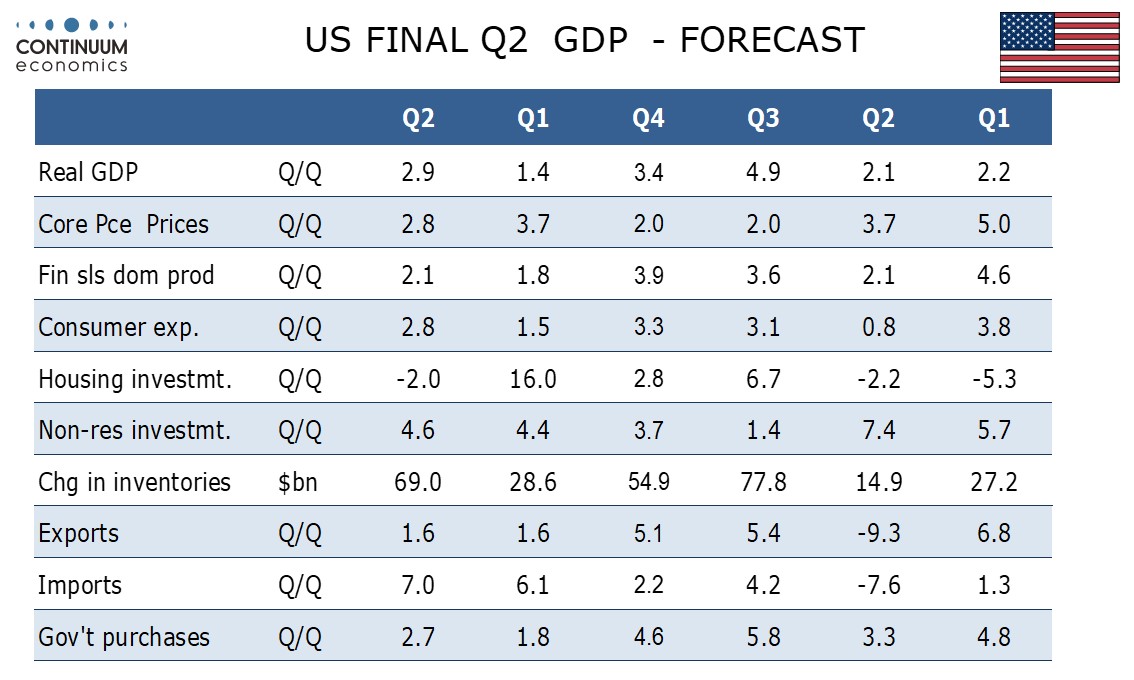

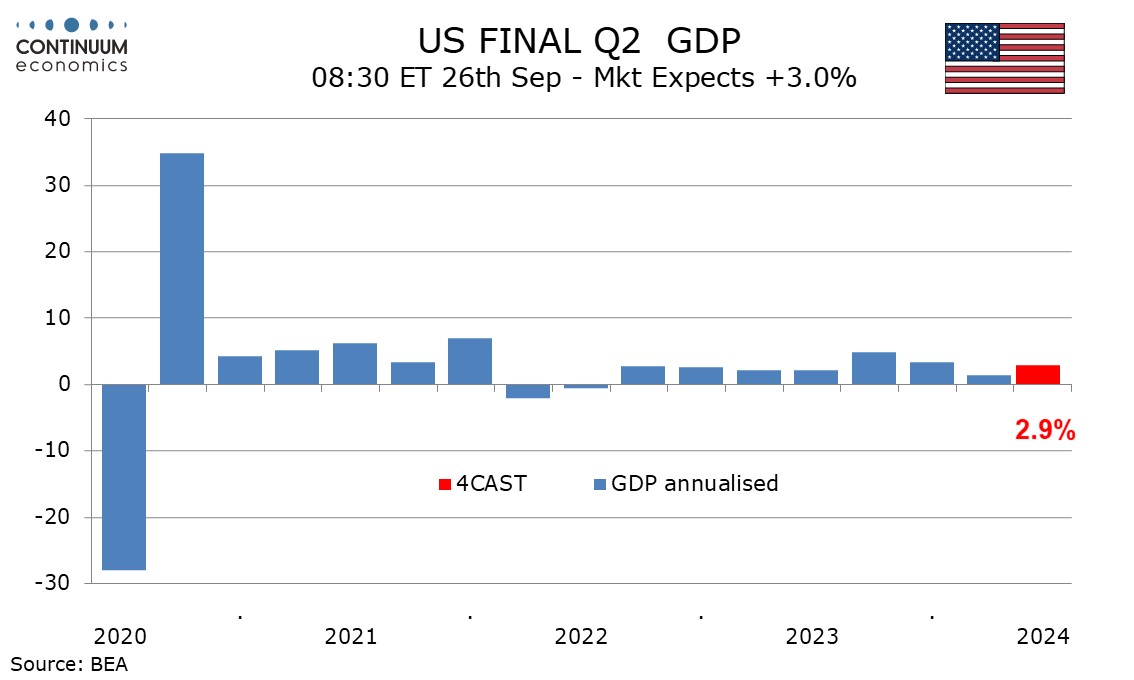

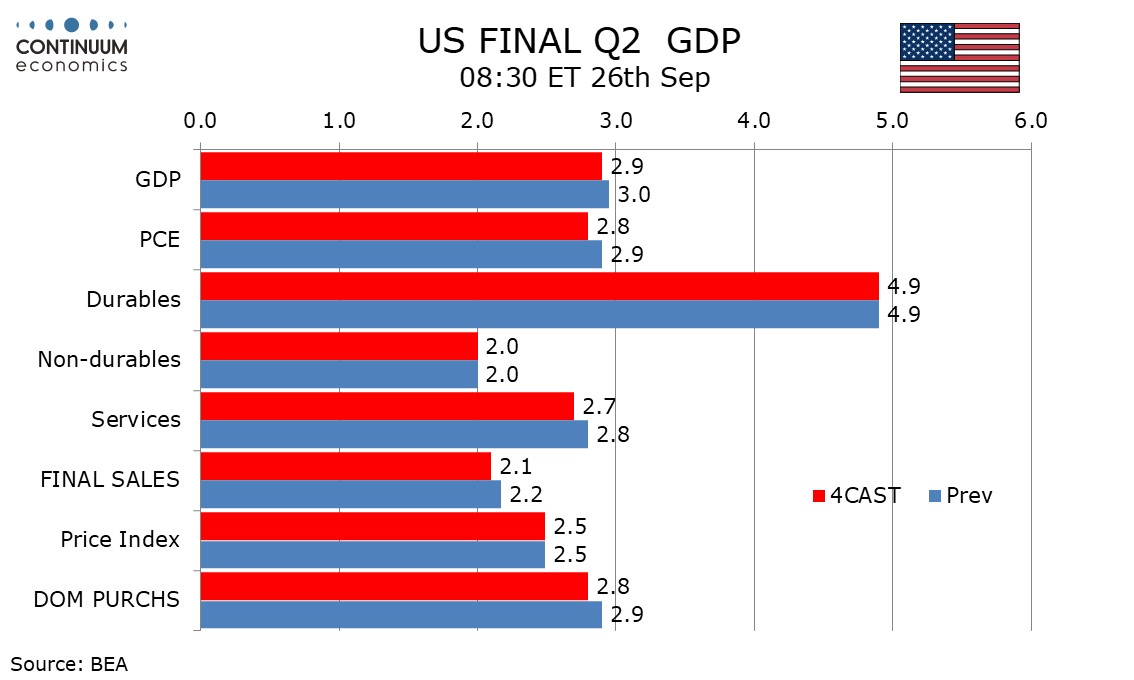

We expect only a marginal downward revision to 2.9% in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.0%. However the data will include historical revisions for the last five years, and they should be closely watched.

GDP in recent quarters has been outperforming Gross Domestic Income and that suggests risk that GDP could be revised down, particularly given a large downward revision to the March 2024 employment benchmark.

However recent monthly data do not hint at a large downward revision to Q2, though weak data from hospitals in the quarterly service survey suggests a downward revision to service spending. We do not look for any significant revisions elsewhere.

PCE price data will also be subject to historical revisions which would matter if significant, though we do not expect them to be. We expect Q2’s annualized gain to be unrevised at 2.8%.