EUR, USD, GBP flows: Eurozone CPI unlikely to have much impact - focus on Fed and BoE

French and German CPI broadly in line with consensus, but EUR moves against the USD and GBP likely to be driven more by the Fed and BoE

French and German preliminary CPI are coming in broadly in line with expectations. The French HICP fell 0.2% in January as expected, while the German state CPI are seeing declines of between 0.5% and 0.8% in the y/y rates, which is in line with the market consensus of a 0.6% decline in the y/y rate in the national HICP (0.7% in the CPI). However, the NRW CPI number has shown the smallest fall in the y/y rate – to 3.0% from 3.5% - and with NRW being the largest state, this may suggest a mild upside risk for German inflation.

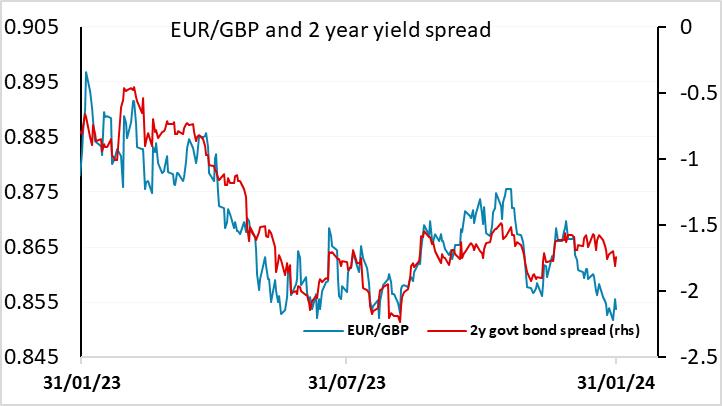

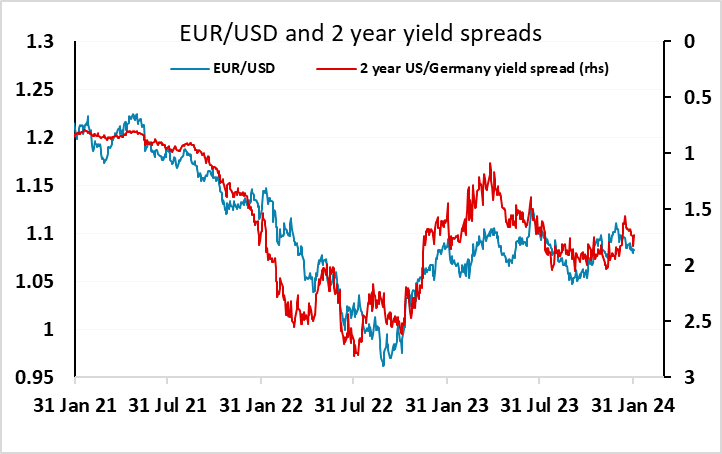

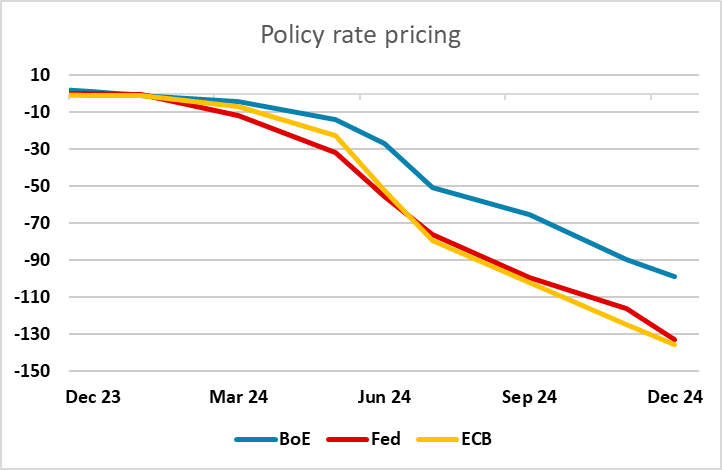

In any case, EUR/USD is slightly firmer, but as we have discussed before, an April rate cut is already fully priced, so there is little downside for EUR yields, and the picture for EUR/USD looks more likely to be determined by moves in US yields after the FOMC tonight. Similarly, EUR/GBP, which has dipped at the beginning of the year without much support from yield spreads, but reflecting some optimism about the UK economy, looks more likely to be influenced by tomorrow’s BoE MPC decision. In the case of EUR/USD, the risks should be on the upside for US yields and the USD given recent strong US data. For the UK, the risks should be on the downside for GBP, as the market continues to price in a hawkish BoE which looks hard to justify if, as seems likely, UK inflation falls sub 2% by the spring. This is especially the case since, even with this pricing, GBP has outperformed spreads.