AUD, EUR, JPY flows: Quiet day ahead, AUD looks undervalued

No major calendar events today. AUD weakness remains puzzling. USD/JPY likely approaching a top

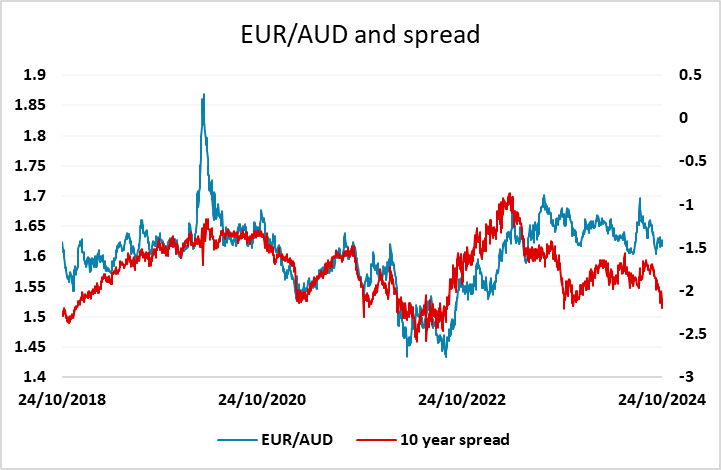

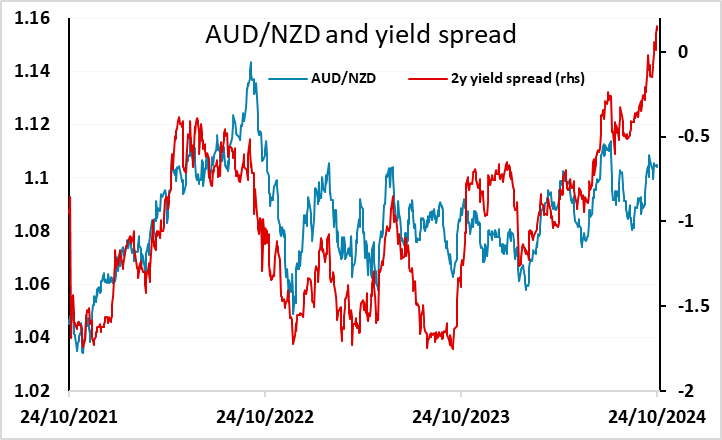

A quiet start to what looks likely to be a quiet day in FX. The USD is starting generally slightly firmer, although the AUD is managing a modest recovery after overnight losses. AUD weakness in recent weeks is a little puzzling. While there are clearly some concerns about the Chinese economy that are dragging it down, the domestic story remains quite positive and the RBA are among the more hawkish central banks. Yields are attractive and the current account remains in solid surplus. The economy has been among the best growth performers in the G10. While softness against the USD is to some extent understandable given the general USD strength and declining expectations of Fed easing, the underperformance against the EUR is harder to explain given the more dovish ECB, and AUD/NZD also looks ripe for gains given the much more dovish RBNZ stance.

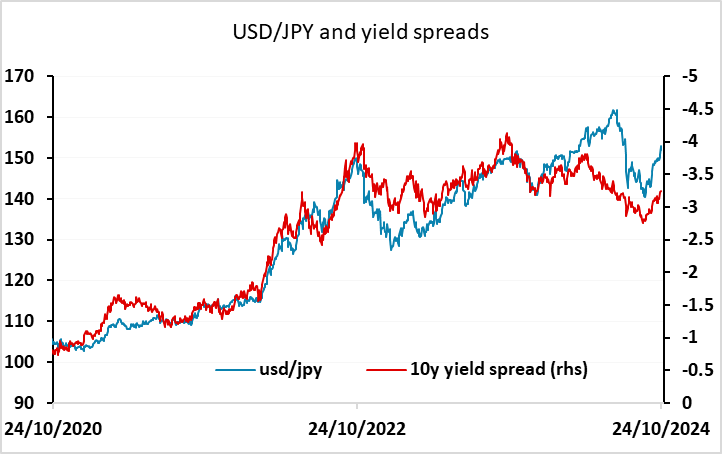

For today, there is little on the calendar that looks likely to move markets. October Tokyo CPI earlier showed declines in the y/y rates but slightly smaller declines than expected, so didn’t provide an argument against BoJ tightening. We still see next week’s meeting as live, but the market is only pricing 1.6bps of tightening (a 16% chance of a 10bp rate hike). USD/JPY may still have to trade up to the retracement level at 153.40 before a turn, and a turn will likely require a move lower in US/Japan yield spreads or weaker US equities, but the downside risks are much greater than the upside risks from here with the Japanese authorities increasingly concerned about JPY weakness.