FX Daily Strategy: Asia, April 24th

PMIs expected to fall, but consensus is for the decline to be modest

USD might rally modestly on consensus data, but risk of bigger decline on weak numbers

Underlying USD negative tone remains hard to oppose given history of Trump’s first term

Equity market risks on the downside suggest JPY risks remain on the upside on the crosses.

Scope for USD recovery to extend on solid durable orders data

German IFO to dip, but may be less weak than feared

USD recovery still only likely to be short term

CHF can weaken further against the NOK

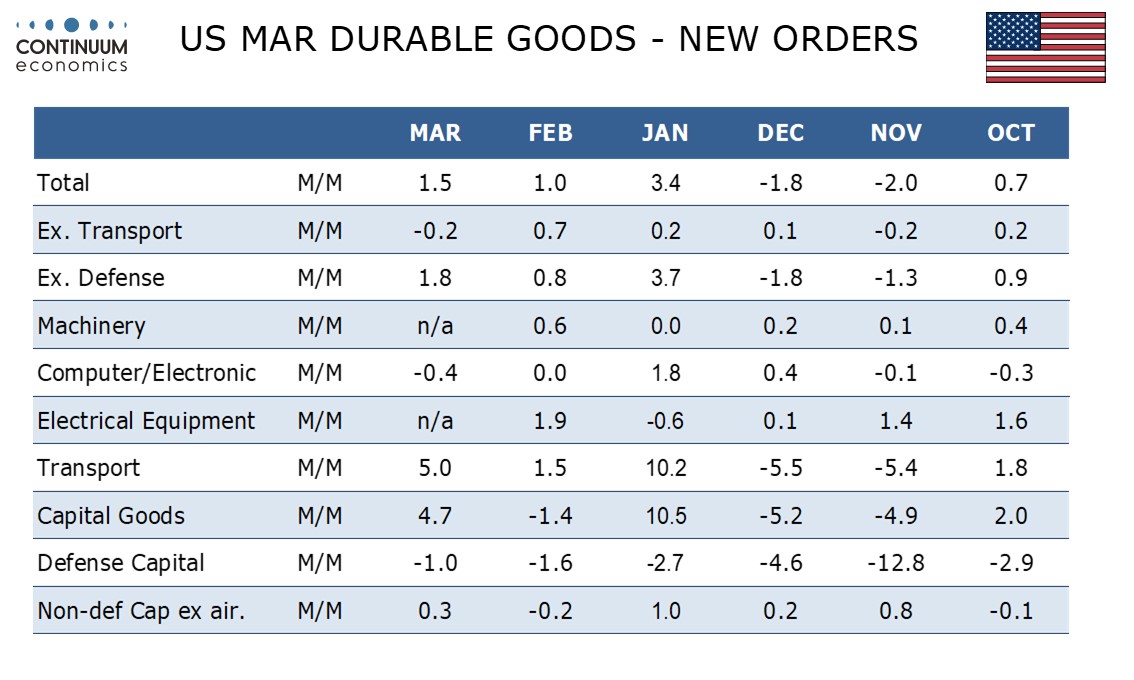

Thursday sees the German IFO survey and US durable goods orders. We expect March durable goods orders to increase by 1.5% overall led by a strong rise in aircraft but ex transport we expect a 0.2% decline to correct a 0.7% increase in February. Boeing reported a strong rise in orders in March and that is likely to lead a 5.0% increase in aircraft. Autos are also likely to contribute. We expect a negative contribution from defense after a positive in February. Ex defense we expect orders to rise by 1.8%. On the face of it, these forecasts look reasonably strong, but our numbers are slightly below consensus. But the data may be affected by tariffs in that firms might have been trying to stockpile before tariffs came into effect, so we wouldn’t put too much weight on these numbers. But the USD is in recovery mode, so strongish numbers may help that extend, although we see 1.1250 in EUR/USD and 144 in USD/JPY as levels that USD bears are likely to see as selling areas.

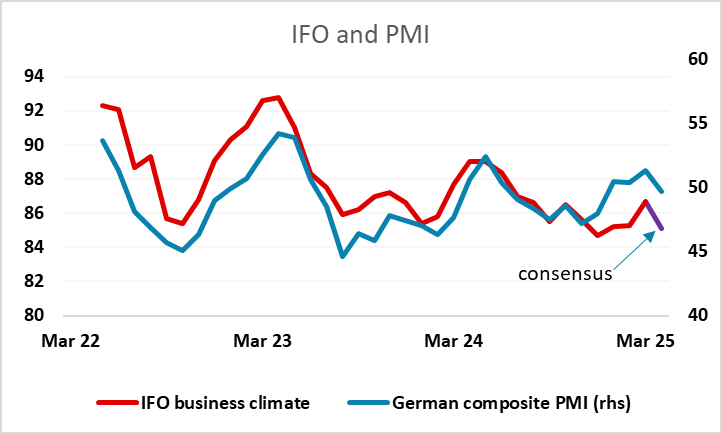

The German IFO survey has been on a slightly more negative trend than the German PMI survey in recent months, and the market consensus is for another decline this month, following the PMI decline reported on Wednesday. There may be some potential for the IFO to perform a little better than the PMI due to the previous underperformance and possibly a greater influence from manufacturing, so if anything we favour a modestly positive EUR reaction.

In general, the market showed a much more positive risk tone on Wednesday as the threat to fire Fed chair Powell was removed, but from a big picture perspective, equities are still marking time, with the S&P 500 in the middle of a 4800-5800 range. Although the PMIs were perhaps less weak than feared, the main tariff impact is yet to be felt, and it will be hard to take a properly positive risk view until ither tariffs are cut dramatically or there is evidence that the economy has been able to absorb the shock without derailing growth. In truth, unless the 10% universal tariff is removed, the impact of this on prices and consequently real consumption in the coming months will need to be seen before there is much chance of a positive risk tone emerging. We would therefore still see most of the medium term risks to the USD being to the downside, with the safe havens preferred. However, there is still some scope for a further short term USD correction higher.

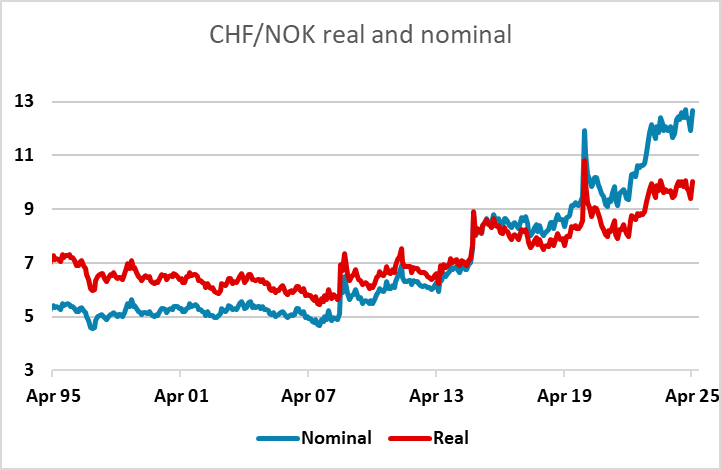

Wednesday did see quite substantial recovery in EUR/CHF, and there may be further scope for this to move higher ahead of the SNB annual meeting of shareholders on Friday where the central bank’s president, Martin Schlegel, will be speaking. There is a possibility that he will express some displeasure at the strength if the CHF, given that inflation was below target and close to zero even before the latest CHF rally. While the CHF is only modestly higher against the EUR in real terms, we see the NOK as having a lot of potential to recover versus the CHF after CHF/NOK made a new all time high last week.