EUR, JPY flows: Weak German orders may cap EUR

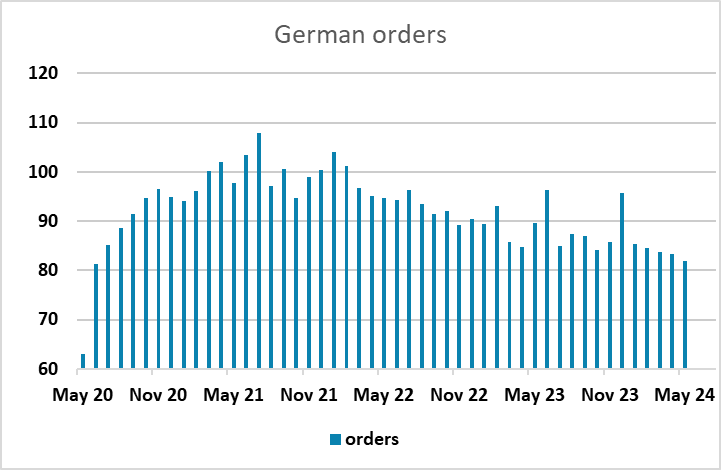

German orders weakest since pandemic

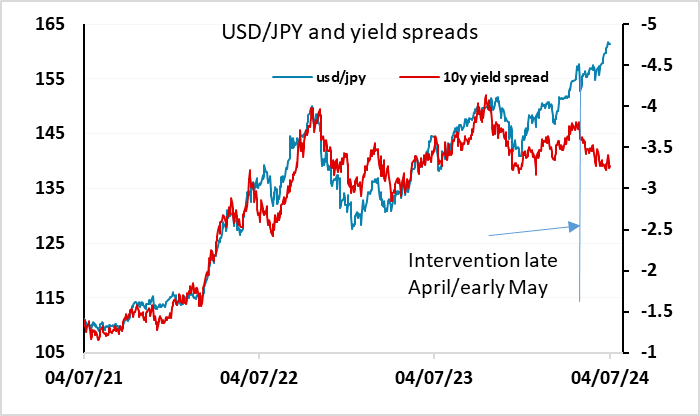

We are likely to have a quiet day ahead with the US holiday restricting activity. There is also not a great deal on the European calendar, but German manufacturing orders for May have been released this morning, and are something of a disappointment, showing a 1.6% m/m decline. These numbers are volatile, so one month’s data is not necessarily significant, but this is the fifth consecutive monthly decline, and the level of orders is the lowest since the pandemic (June 2020), suggesting that there is little evidence of recovery in the German manufacturing sector. The EUR dipped slightly on the data, but reaction was muted in these quiet markets. Nevertheless, the data should be enough to keep EUR/USD below 1.08 ahead of tomorrow’s US employment report. Combined with the softer US data yesterday, this ought to support some JPY recovery, but the JPY bears remain very much in control as long as the Japanese authorities refrain from intervention.