Preview: Due July 16 - U.S. June Retail Sales - Trend losing momentum

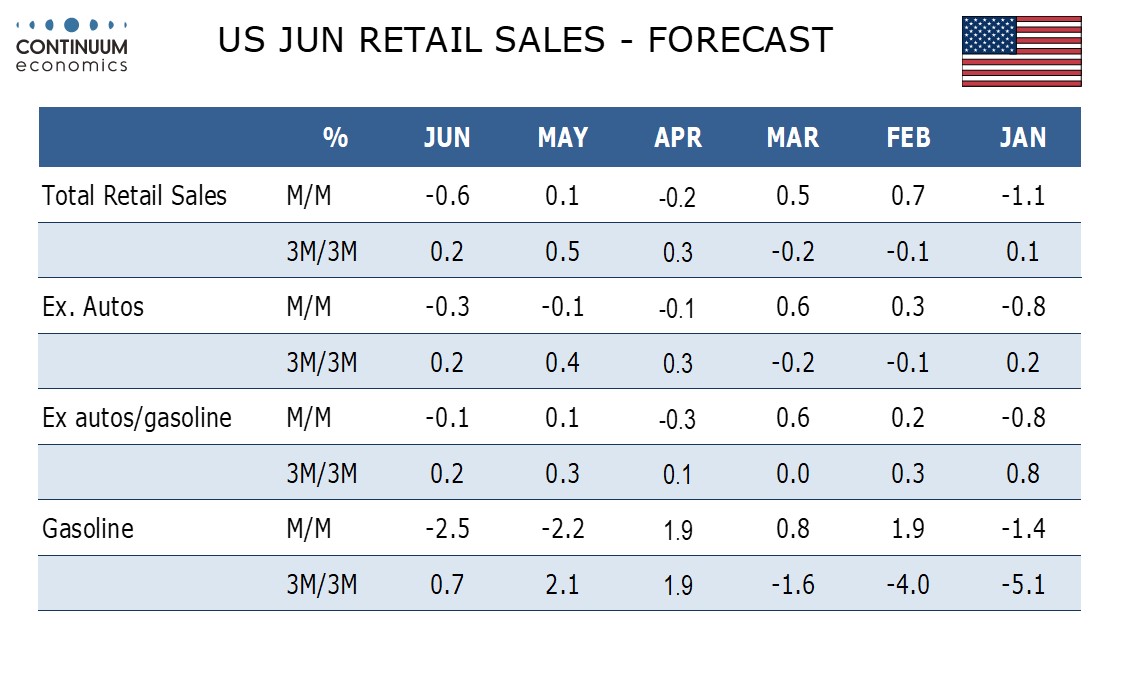

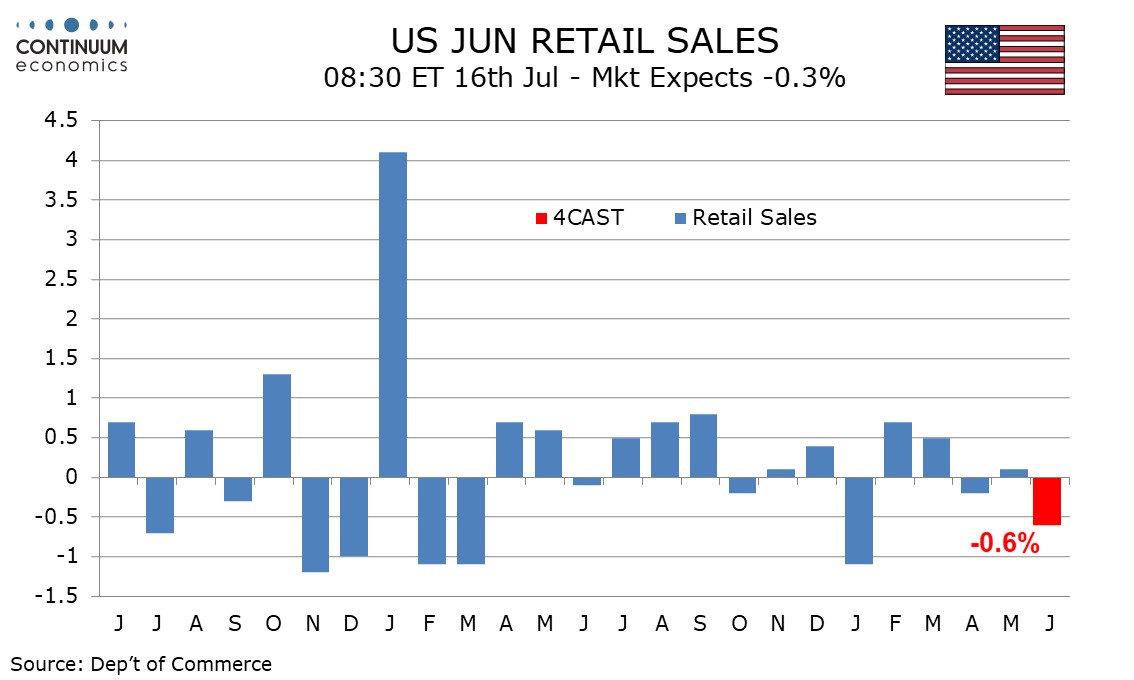

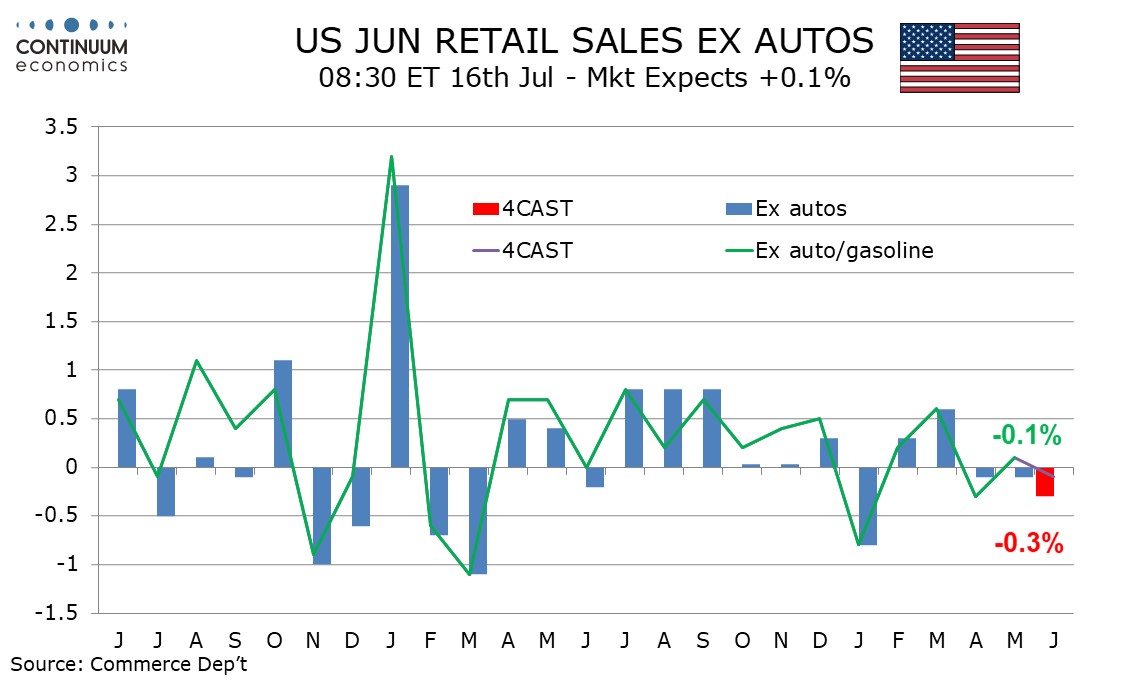

We expect a weak end to Q2 from US retail sales, with a 0.6% decline in June, and a 0.3% decline ex autos. While a weak month for autos and lower gasoline prices will lead the dip, we also expect a marginal 0.1% decline ex autos and gasoline.

Industry data suggests a significant dip in auto sales though trend in autos continues to have no clear direction. Gasoline prices look set to restrain sales values for a second straight month.

Ex-autos and gasoline a 0.1% decline would follow a 0.1% increase in May. Consumer spending appears to be losing momentum with savings built up during the pandemic now largely exhausted. After a strong second half of 2023 which outpaced real disposable income a weather-related dip in January was barely erased in February and March leaving Q1 negative.

Q2 is likely to be marginally positive only because of the depressing influence of January’s weather on Q1. A dip in April saw only a modest correction in May and a subdued June would confirm trend is now subdued. June’s payroll details were weaker for retail.