FX Daily Strategy: N America, January 12th

Chinese data may set the tone for risk assets

Low risk premia suggest scope for JPY recovery

UK GDP data supports GBP, but only short term

EUR could soften on Lane speech

Chinese data may set the tone for risk assets

Low risk premia suggest scope for JPY recovery

UK GDP data supports GBP, but only short term

EUR could soften on Lane speech

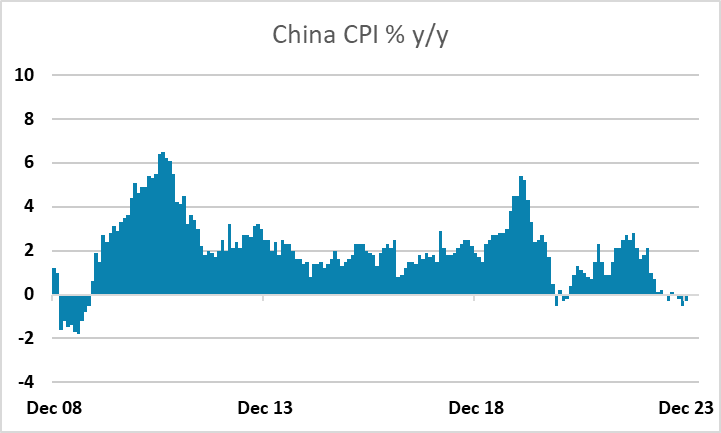

Friday kicked off with Chinese CPI and trade data, which may set the tone for risk sentiment for the day. Chinese CPI has been weak in recent months, and was still weak, although there was a modest rise in the y/y rate in December to -0.3%. The low level of inflation still suggests downward pressure on Chinese yields and easy PBOC policy. This might be seen as beneficial for the higher yielders, but only if the low level of Chinese inflation isn’t seen as a signal of a significant downturn. The focus in the trade data is usually the growth in exports and imports rather than the trade balance, although these are volatile month to month and shouldn’t really be seen as a good indicator of activity. However, strogner than expected exports helped support risk sentiment in spite of rising geopolitical concerns in the Middle East.

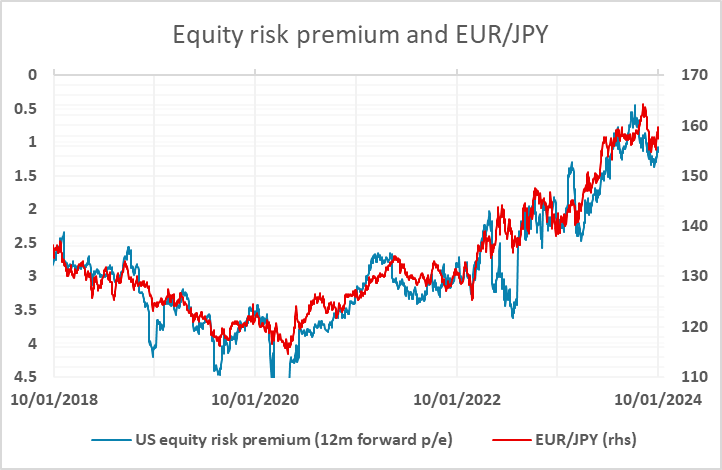

As it stands, US equity risk premia remain quite low, with the S&P500 briefly trading above 4800 on Thursday, getting close to the all time high of 4817 seen at the beginning of 2022. Risk premia have risen a little from the lows as yields have fallen back, but remain at historically low levels. The decline in risk premia has correlated with the decline in the JPY in recent years, and if we see a loss of confidence related to China slowdown the JPY is likely to be the main currency beneficiary. EUR/JPY and CHF/JPY in particular already look extended near 160 and 170 respectively. We did see some corrective JPY gains overnght, but risk appetite remains strong enough to limit JPY upside for now.

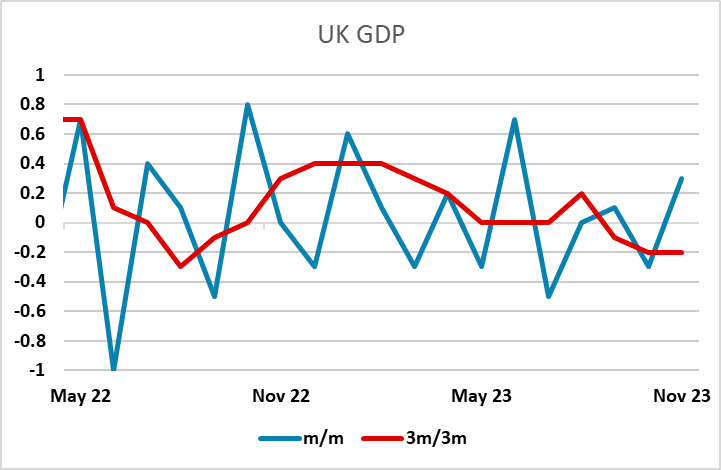

GBP is initially slightly firmer after November GDP came in at 0.3% - slightly above the 0.2% expected. However, the 3m/3m trend is still weak after October’s 0.3% decline, and while a flat quarter is likely, a flat December would only mean a flat quarter because of rounding. The trend appears to be declining, and while the market has seen some encouraging signs from stronger than expected UK services PMI in the last couple of months, we fear this may be a false dawn as the impact of higher interest rates will be increasingly negative in the coming months.

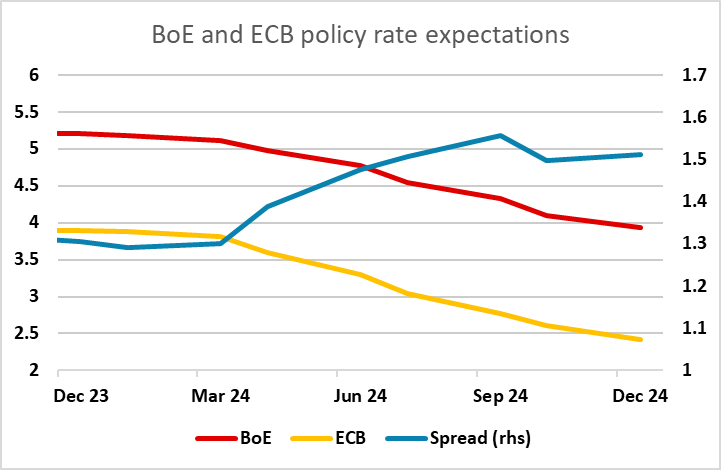

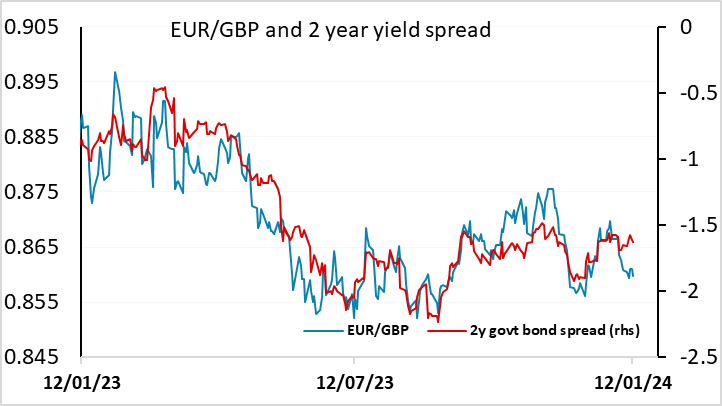

For GBP, we see little upside scope, as EUR/GBP is starting from a position that looks low relative to current short term yield spreads, and we also see more scope for UK yields to decline as UK data weakens, both because of the higher starting point and because the market currently prices a slower pace of BoE rate cuts. The stronger than expected monthly number will mean some initial GBP strength, but expect EUR/GBP to hold above 0.8550.