EUR, JPY flows: EUR may get support from confidence data, JPY weakness continues

Better German confidence data provides some support for EUR. JPY weak in spite of new high in JGB yields

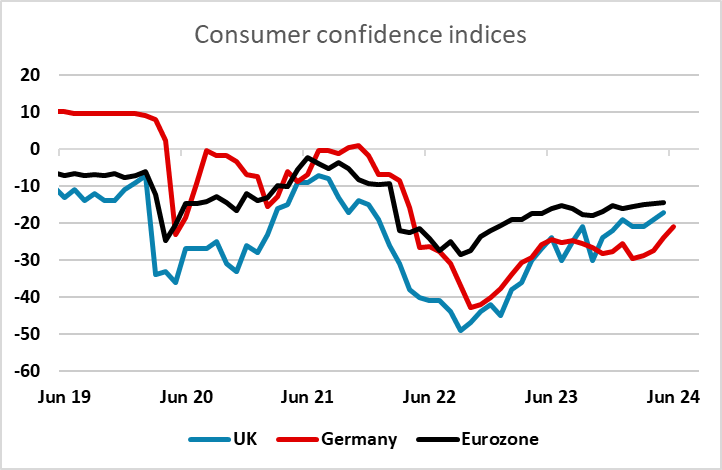

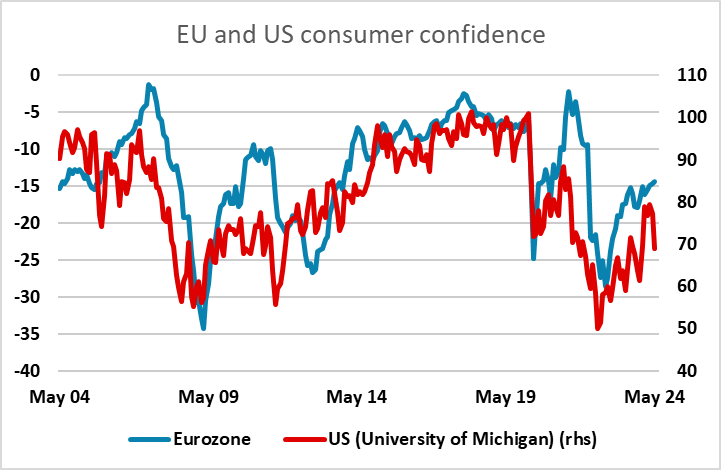

German CPIs will be the main focus this morning, but there are also consumer confidence numbers from Germany, France and Italy, and the German Gfk numbers just released provide more support for optimism about the Eurozone recovery. The index has hit its highest since April 2022, and suggests that the EUR will retain some support even if declining inflation leads to increased expectations of ECB rate cuts. Rising consumer confidence in Europe contrasts with declining confidence in the US, and models suggests that if European equities outperform because of a recovering relative growth picture, this will provide support for the EUR even if the yield spread doesn’t.

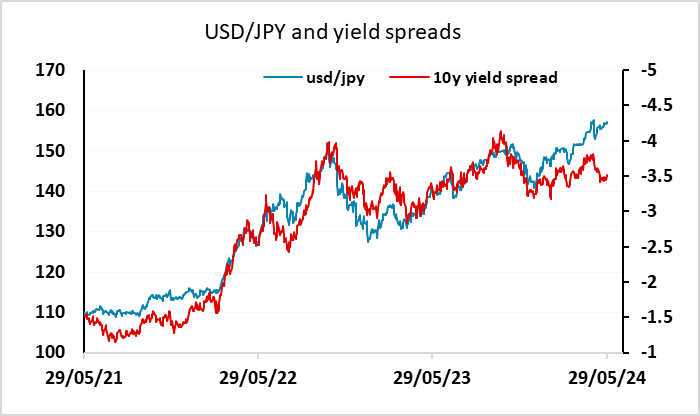

The USD has been generally a little firmer overnight helped by rising US yields, but it is notable that JGB yields have kept pace, hitting their highest (excluding an early year spike) since 2012. While the verbal intervention has subsided a little, it may be that he Japanese authorities are looking to control JPY weakness with higher yields rather than verbal or actual intervention. Certainly, yield spreads don’t suggest that there ought to be further upside for USD/JPY, but in quiet conditions the market is still favouring carry trades with the JPY the favoured funding currency. Nevertheless, it is hard to make a fundamental case for JPY weakness from here.