FX Daily Strategy: N America, January 26th

EUR weakness on Thursday to be sustained

Decline in US yields looks unjustified by US GDP data

Upside risks for NOK/SEK

EUR/GBP shifting to looking at longer term yields?

EUR weakness on Thursday to be sustained

Decline in US yields looks unjustified by US GDP data

Upside risks for NOK/SEK

EUR/GBP shifting to looking at longer term yields?

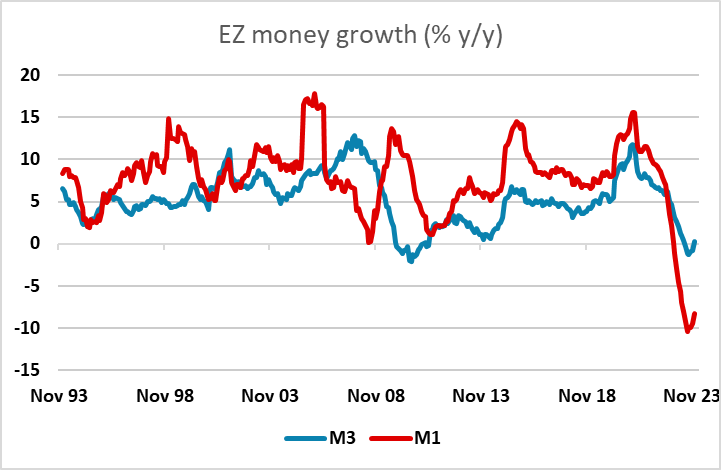

Friday doesn’t have a great deal on the calendar, so the focus may be on the aftermath of Thursday ECB meeting and US GDP data. Eurozone money data this morning was mixed, showing some recovery in M3 growth but more weaknes sin household credit, and money growth remans at very weak levels. While Lagarde et al. were not prepared to start talking earlier rate cuts, their admission that inflation has been soft in recent months, and their continued highlighting of downside risks to growth, helped put the EUR on the back foot on Thursday. The money data highlight the fact that the hike in rates has had a big impact on money and credit, which has yet to be fully felt in the real economy. The weakness in money data is well established and will lead the weakness in the real economy, and should be a reminder that there is no quick recovery coming, and the risks are on the downside for the economy. So the EUR is unlikely to see much recovery, and some further declines may be seen.

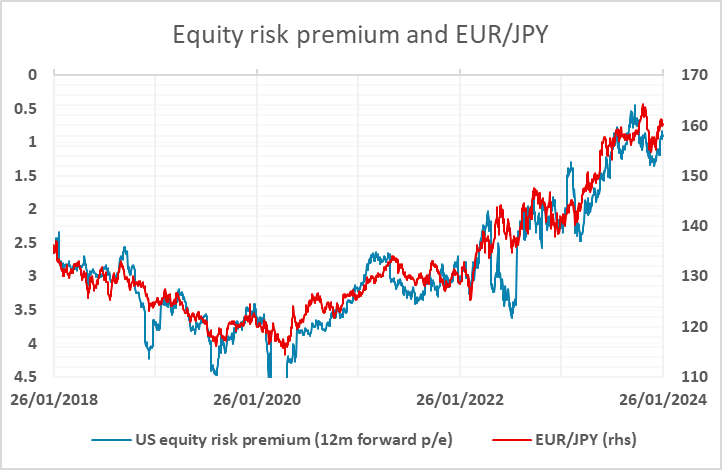

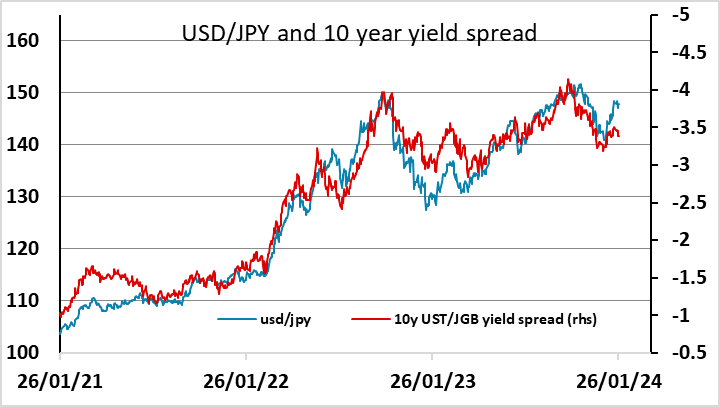

The decline in US yields in the wake of the US GDP data is less easy to justify. The Q4 GDP rise of 3.3% annualised was clearly stronger than expected, and followed the strong 4.9% Q3 rise. It’s consequently hard to justify the decline in US yields that followed the data. Admittedly, the GDP deflator was well below expectations at 1.7%, but the core PCE deflator – the Fed’s main inflation reference – was in line with expectations at 2.0%. The modest rise in jobless claims still left them at low levels consistent with solid employment growth. So we don’t see the decline in US yields extending, and it may well reverse, putting some upward pressure on the USD. This still looks most likely to have a positive USD impact against the EUR and some of the other riskier currencies, both because higher US yields might undermine equity confidence, and because USD/JPY remains well above levels that look consistent with current yield spreads. EUR/JPY consequently still looks vulnerable.

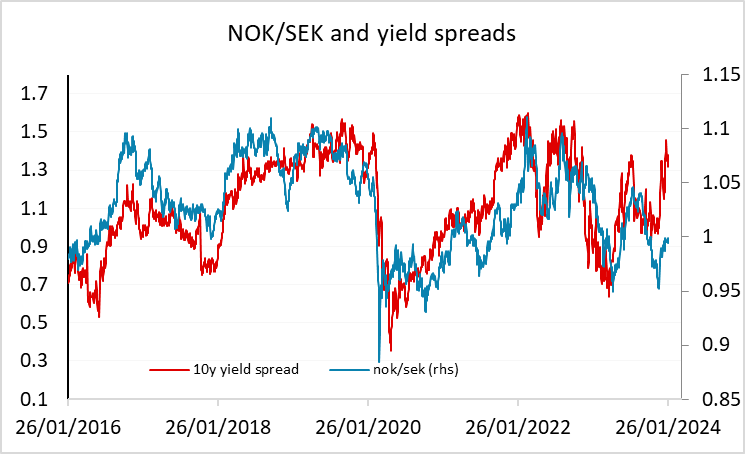

The scandis were both firmer against the EUR following the ECB meeting, but we continue to prefer the NOK to the SEK, with yield spreads suggesting scope for a NOK/SEK move well above parity. The Swedish economy y is also more likely to be highly correlated with the Eurozone. There has been a variety of Swedish data due on Friday, but it hasn't had much impact. Nevertheless, any signs of weakness going forward may be a justification for a rise in NOK/SEK.

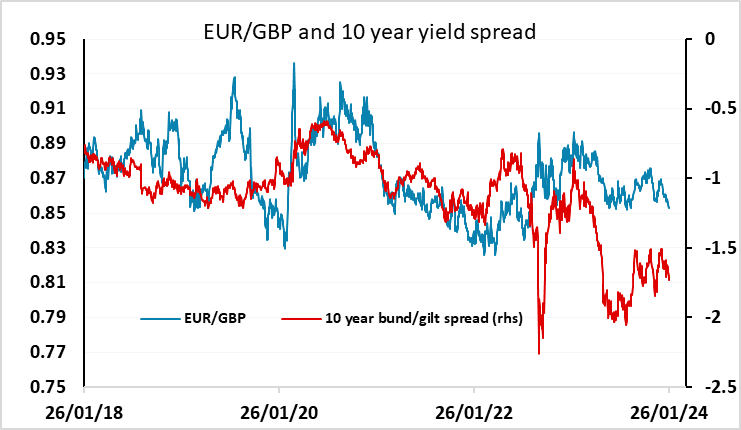

EUR/GBP also declined with the general EUR weakness on Thursday, and looks to have conclusively broken away from the short term yield spread relationship that held through last year. Longer term, the 10 year yield spread has been a better guide, and on that basis there may still be further downside scope. But we remain a little sceptical about GBP bullishness as the PMI strength we have seen has often not been a good guide to GDP growth, and the BoE may well turn out to cut just as aggressively as the ECB despite current pricing. Still, for down momentum remains clearly in the downside.