FX Weekly Strategy: Asia, June 16th-20th

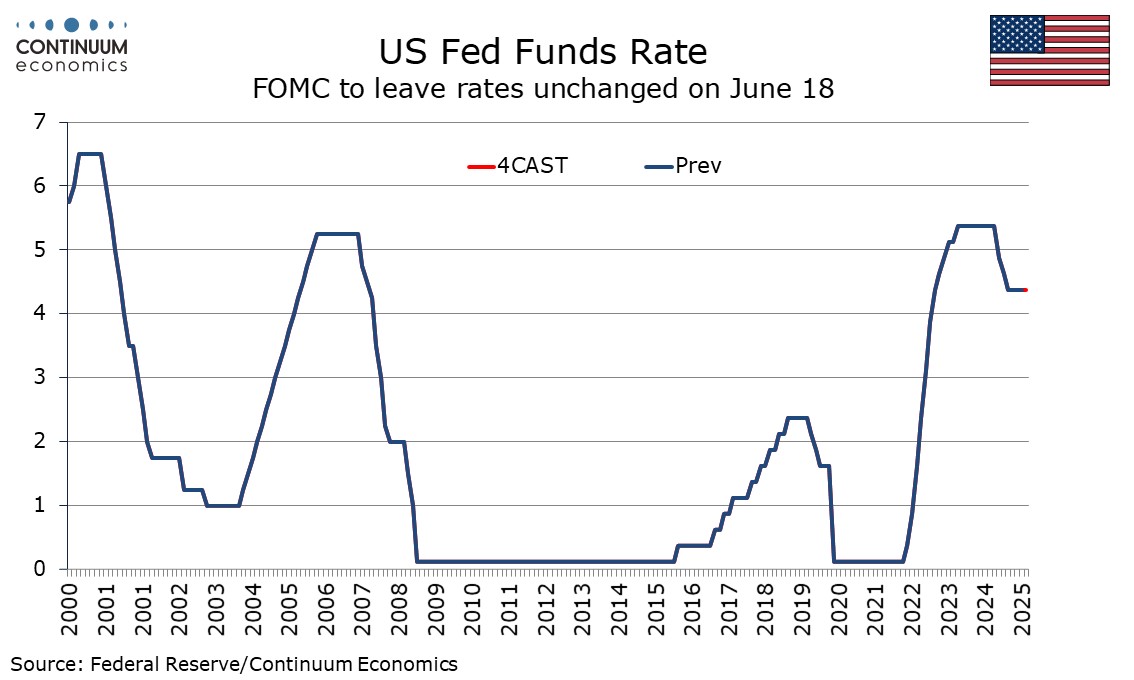

No change in rates or dots for FOMC

Splits to Continue within BoE

SNB Toying With Being Negative

Norges Bank Policy Easing Schedule Clearer

Riksbank to Cut and Reassess Policy Outlook

The June 18 FOMC meeting looks highly likely to leave rates unchanged at 4.25-4.5%. We expect only marginal changes to May’s statement and the Fed’s median forecasts from March, with no change at all in the median dots on rates. Chairman Powell at the press conference may welcome recent signals on inflation, but given uncertainty over tariffs, will state more information is needed before easing.

Core PCE prices produced soft 0.1% gains in March and April, and CPI data suggests a similar outcome for May. However, these followed strong gains of 0.3% in January and 0.5% in February. The Fed is likely to be pleasantly surprised by the lack of pass-through from tariffs so far, though this can be explained by a large Q1 inventory build up and uncertainty over the future tariff picture. With decisions on reciprocal tariffs due from both Trump and the courts in July, the case for waiting in June is strong. Resilient employment data for May suggests the economy is not at the cusp of recession. May’s meeting, and particularly minutes, saw the Fed downplay the significance of a marginal negative in Q1 GDP, that was due largely to a surge in imports which April trade data suggests is being reversed in Q2.

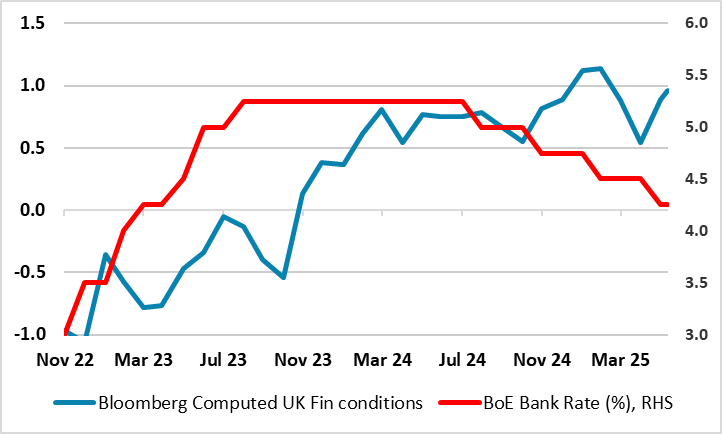

Figure: BoE Rate Cuts Not Stopping Financial Conditions Tightening

A stable BoE policy decision next Thursday is most likely (Bank Rate staying at 4.25%) as the MPC discusses various scenarios still, possibly with any hawks diluting what were previous concerns about a ‘tight’ labor market. In fact, we see two dissents in favor of a 25 bp rate cut albeit where the statement is likely to repeat the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long. But the issue of what constitutes restriction is important (Figure shows the policy rate diverging from financial conditions) as it should help determine how much further and when the BoE eases. We think that with the BoE regarding neutral policy rate as being well above 3%, two further 25 bp moves this year will be followed by another 50 bp in H1 2026. But we think the risks are for deeper and possibly faster cuts as we think the BoE is both over optimistic about growth prospects and over-estimating policy neutrality.

As for recent policy, early May saw the widely expected 25 bp Bank Rate cut (to a 2-year low of 4.25%) but which came amid a less dovish rather than a more hawkish assessment than was envisaged beforehand. While the updated Monetary Policy Report MPR) envisaged inflation falling below target almost a year earlier than seen three months earlier, this largely reflects weaker energy price assumptions alongside only a modestly larger negative output gap. Instead, a friendlier interest rate picture helped limit any damage to the BoE’s GDP outlook, this in turn meaning that the envisaged drop in inflation while earlier, does not intensify further out. Partly this reflects a BoE overall view which places much more emphasis on a possibly weaker supply side of the economy (both at home and globally) than perhaps markets have discounted, this explaining the lack of a clearer disinflationary outlook.

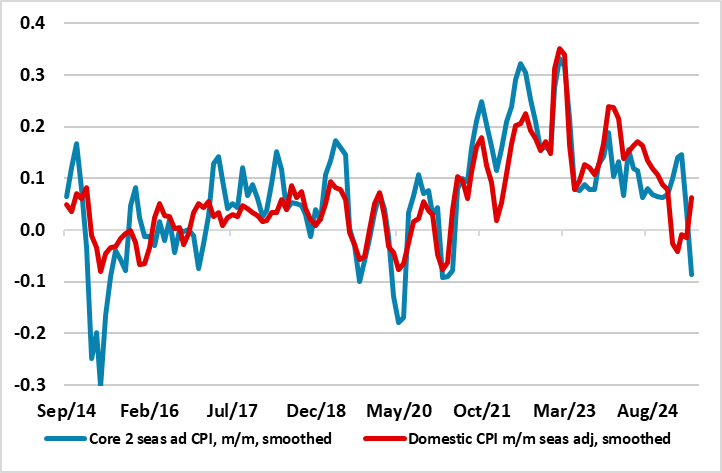

Figure: Swiss Disinflation Now Encompassing Domestic Price Weakness Too

A further 25 bp cut (to zero) in the SNB policy rate on Jun 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX intervention on aby major scale could provoke US retaliation against alleged currency manipulators. Both these factors suggest such a further SNB rate cut is likely, especially with zero CPI inflation undershooting even the SNB’s timid expectations. But going under the radar is the fact that the SNB may be judging the inflation undershoot in an even more worrying light as opposed to merely being a part-currency induced fall in import prices. Indeed, domestic inflation has fallen and is running near zero too more recently, suggesting that should further tariffs bring the global disinflation many anticipate then Switzerland may see persistent negative inflation rates. With this in mind the SNB is seemingly justified in not ruling out a return to negative policy rates.

The Swiss economy is very exposed to global trade with exports representing some 68% of GDP and goods exports alone some 48% and where some 2%-plus of Swiss GDP comes from exports to the U.S. Thus the 10% tariff the US has imposed is a clear risk, as is that from the threat of a 25% levy on pharmaceuticals. The latter sector represents some 7% of Swiss GDP (ie a larger share than the infamous financial sector) and where the bulk of pharmaceutical exports are to the U.S. Admittedly, given the clear competitiveness of its exporters (often on matters beyond price), Switzerland’s high value-added exports are likely to be redirected toward other new and existing trading partners, offsetting part of the drop in U.S. exports. As a result, we feel at this juncture that our semi-consensus and below-trend GDP outlook of 1.3% and 1.2% growth this year and next respectively remains valid, albeit with activity suspect to a correction back in the near-term to the huge export surges that have boosted growth in the last two quarters reverse. Even so, Swiss resilience as seen of late will continue in the face of both a tariff threat and tariff reality.

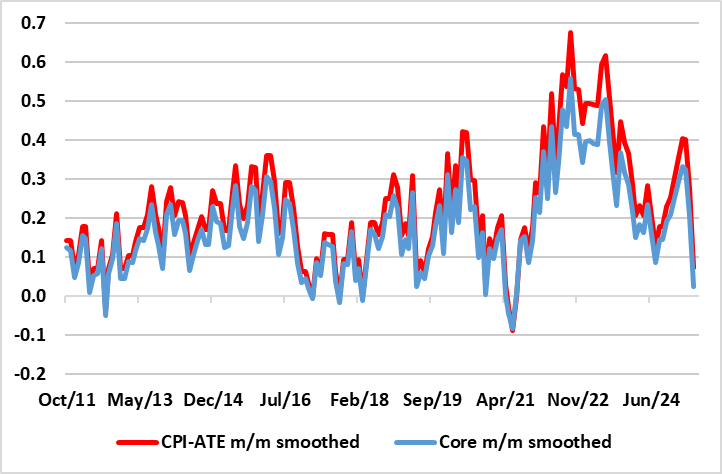

Figure: Core Inflation Pressures Back Towards Zero?

It is very unlikely that the Norges Bank will do anything at this month’s Board meeting other than to suggest the easing cycle will start later in the year and that the policy rate will thus remain at 4.5% - for the time being. In fact, it will have to be more explicit about any such a timetable given that an updated Monetary Policy Report will update an array of forecast, including that for the policy rate. In fact, we think that armed with much softer CPI outcomes of late (Figure), it will (still) point to a cut as soon as at the next meeting (Aug 14) and retain an outlook that brings rates down to around 3.25% by end-2026. We still see faster easing, both this year and next!

The hawkish line of thinking from the Norges Bank only helps bring inflation in its view back towards target but only 2-3 years hence. We think that the circa 4% rate projected in March for year end is too high against and that a rate somewhat under 4% is more likely, not least as we see a larger and earlier output gap. Indeed, we think the latter is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, May data shows that core inflation (CPI-ATE) fell 0.2 ppt to 2.8%, well below (again) Norges Bank thinking (it expected 3.1%). Looking at the details some of this softening may be calendar related but over the past couple of months, CPI inflation has been two to three tenths lower than Norges Bank’s expectations. And as Figure 1 shows CPIF and core inflation (ie CPIF ex food) are running nearer zero on an adjusted and smoothed m/m basis.

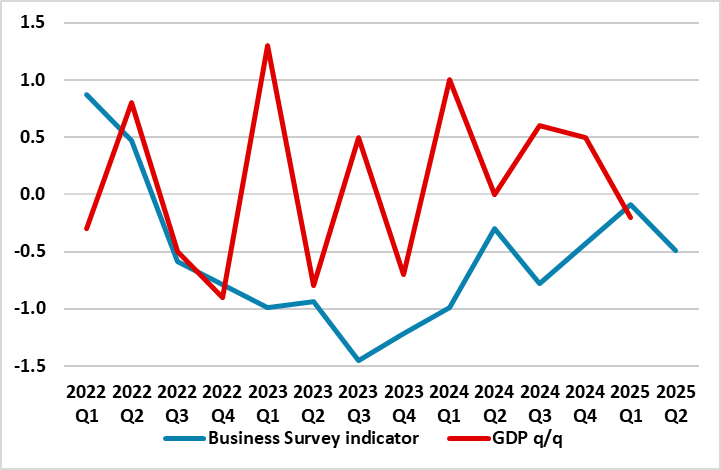

Figure: Riksbank Survey Suggest Weakness Intensified

We are even more convinced that the Riksbank will cut further and as soon as the next Board verdict on Jun 18. Moreover, the Board may even then suggest that further moves are possible. This may seem stretched given that the Riksbank has virtually called a halt to the easing cycle, albeit most recently (May 8) suggesting downside risks to its inflation outlook might warrant a slight easing going forward. Our thinking has hitherto reflected both below par survey data (suggesting difficulties in predicting future business conditions) and better inflation outcomes. Indeed, a Riksbank business survey now suggest that what green shoots had appeared have fizzled out (Figure) while the latest CPI numbers suggest an absence of inflation.

But this view has been bolstered by fresh GDP data that not only showed a surprise drop in Q1 but hefty downgrades to the 2024 backdrop and where even these may be overstating activity given the much weaker and persistent softer growth picture pained by the Riksbank’s own business survey (Figure 1). Indeed, the survey noted that ‘the economic situation has weakened during the spring, and companies’ view of the economic outlook for the coming months has become significantly gloomier’ .This is important as it does seem as if the Riksbank has dismissed the Q1 GDP data as not indicative of nay need to reassess the economy backdrop. Instead, we suggest that the Riksbank may have to halve what we have for some time suggested was an optimistic 2.2% 2025 growth forecast and, as a result, may have to double its estimate of an output gap, this adding to downside inflation risks.

Week Ahead

USA In the US Monday sees June’s Empire State manufacturing survey. Tuesday is a busy day for data. We expect May retail sales to fall by 0.7% with a 0.1% increase ex autos and then unchanged May industrial production with a 0.3% increase in manufacturing. June’s NAHB homebuilders’ index and April business inventoies, which existing data suggests will be unchanged, are also due.On Wednesday we expect May housing starts to fall by 0.8% to 1350k while permits fall by 1.5% to 1400k. Weekly initial claims are also due with Thursday seeing a holiday for Juneteenth. Wednesday is also likely to see the FOMC leaving rates unchanged at 4.25-4.5%. We expect no change in the median dots and only marginal changes to the statement and the Fed’s economic forecasts. Chairman Powell is however likely to cautiously welcome recent soft inflation data in the press conference. Friday sees June’s Philly Fed manufacturing survey and May’s leading indicator.

CANADA In Canada Monday sees May housing starts and existing home sales released. On Friday May’s IPPI and RPMI are due, as well as April retail sales. With March’s report a preliminary estimate for a 0.5% increase in April retail sales was made.

JP The BoJ interest rate will be announced on Tuesday, where we expect no changes to rate with BoJ’s hands being tied from the ongoing trade conflict with U.S.. However, there is a slim chance that BoJ could change forward guidance, acknowledging the high inflation figure and action once a trade deal is done. Any change will be critical and could see JPY significantly stronger. There is trade balance on the same day and National CPI on Thursday. The CPI figure will likely show inflationary pressure mounting with core-core inflation likely above 3%.

AU Rather clear calendar for Australia until Thursday. Labor data with be released where it should continue to show choppy but solid Australian labor market. Yet, it is unlikely to have a medium-term impact for RBA is not expected to cut in the coming months.

NZGDP is on Wednesday, Business PMI on Monday and Food Price index on Tuesday.

UK Wednesday sees the next set of CPI data. The April result was a notch higher than the BoE expected with a jump to 3.5%, albeit since revised back a notch to 3.4%, still a rise dominated by a pick-up in services, some of which (ie airfares) may be temporary. Indeed, the timing of Easter may have been a partial factor and this should unwind in the May CPI. But while we see a distinct drop back in services, the headline and core rates may drop a mere 0.1 ppt, albeit to a notch below BoE thinking. The May CPI data will be offered to the BoE in advance, but may have no bearing on Thursday’s MPC verdict.

A stable BoE policy decision is most likely (Bank Rate staying at 4.25%) as the MPC discusses various scenarios still, possibly with any hawks diluting what were previous concerns about a ‘tight’ labor market. In fact, we see two dissents in favor of a 25 bp rate cut albeit where the statement is likely to repeat the need for policy to be framed carefully as well as gradually also repeating that monetary policy will need to continue to remain restrictive for sufficiently long.

Otherwise, we expect a clear (circa 1% m/m) correction in Friday’s May retail sales with public borrowing data due the same day likely to show a further overshoot of OBR monthly projections.

EurozoneMore ECB updates arrive via an array of Council member speeches, many occurring at a banking conference in Milan (Mon-Thu), as well as the latest ECB Bulletin through the week.Datawise, after Wednesday’s final HICP numbers there is an important update on labor costs (Mon) as well as consumer confidence (Fri) and construction (Thu). Otherwise German ZEW data (Tue) may move sideways as may French INSEE survey results (Fri).

Rest of Western EuropeThere are key events in Sweden, including labor market numbers (Tue), but dominated by the Riksbank decision (Wed). We are even more convinced that the Riksbank will cut by a further 25 bp. Moreover, the Board may even then suggest that further moves are possible. Our thinking has hitherto reflected both below par survey data (suggesting difficulties in predicting future business conditions) and better inflation outcomes.

In Norway, on Thursday, it is very unlikely that the Norges Bank will do anything at this month’s Board meeting other than to suggest the easing cycle will start later in the year and that the policy rate will thus remain at 4.5% - for the time being. But it will have to be more explicit about any such a timetable given that an updated Monetary Policy Report will update an array of forecast, including that for the policy rate.

In Switzerland, on Thursday, a further 25 bp cut (to zero) in the SNB policy rate now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX intervention on aby major scale could provoke US retaliation against alleged currency manipulators. Both these factors suggest such a further SNB rate cut is likely, especially with zero CPI inflation undershooting even the SNB’s timid expectations.

Recap for the Week

Israel has launched multiple wave of air strikes and have killed at least one top level Iranian official, destroying a nuclear enrichment site too. Despite the U.S. officially released a statement of non-involvement, Iran already vowed to retaliate both the U.S. and Israel. There has been reports of Iranian ballistic missiles being launched. Iran confirms that the commander of the Khatam al-Anbiya Central Headquarters, Gholam Ali Rashid, alongside armed forces chief of staff Mohammad Bagheri and Revolutionary Guards chief Hossein Salami were killed by Israel's attacks. Subsequently, Iran also pulled out of their nuclear talk with the U.S.. There is no doubt Iran will retaliate and already seen Israel intercepting drones attack but market participants will be concerned about further retaliation, especially against U.S. personnel.

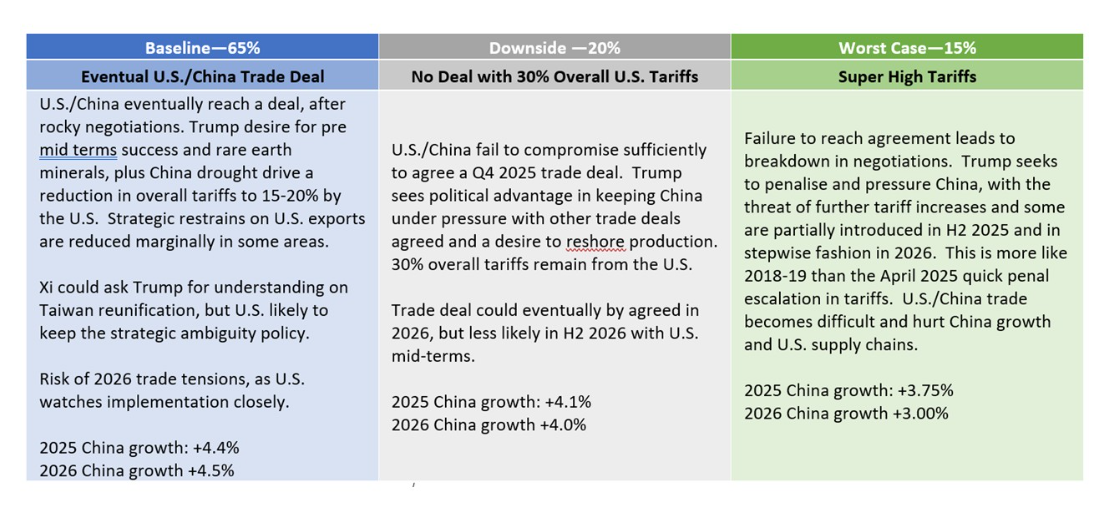

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Figure). Meanwhile, the Trump administration sending out post July 9 reciprocal tariff rates is more than a negotiating tactic before a further 90-day delay. The delay could be less than 90 days or the EU could be singled out with a 20% reciprocal tariff after July 9 to pressure the EU and other countries.

President Donald Trump is proclaiming a trade deal with China, whereas it a trade truce before difficult negotiations in the next 6 months on a phase 2 trade deal. Meanwhile, Trump on Wednesday threatened higher reciprocal tariffs after July 9 if trade deals are not done.

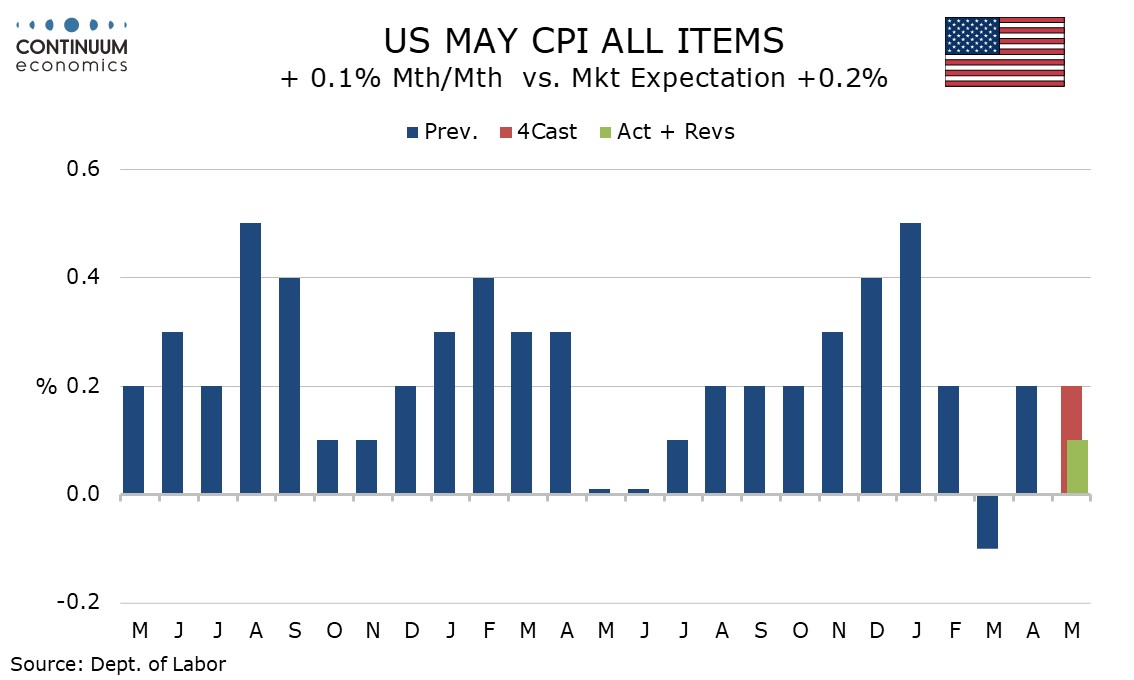

May CPI has surprised significantly to the downside, up only 0.1% both headline and core, with the respective gains before rounding being 0.08% and 0.13%. The data is subdued across the board, with commodities ex food and energy unchanged despite tariffs and services ex energy on the low side of trend at 0.2%.

Food was slightly above trend with a 0.3% increase after a 0.1% decline in April despite eggs continuing to move off recent highs, albeit less steeply than in April. However the gain in food was outweighed by a 1.0% fall in energy, ked by a 2.6% fall in gasoline. The components that restrained core commodities in April did so again in May. Apparel, despite being susceptible to tariffs, fell by 0.4% after a 0.2% fall in April. Used autos saw a third straight fall, by 0.5%, while new vehicles fell by 0.3%, the first fall since February. Transportation services fell by 0.2%, led by continued weakness in air fares at -2.7%. Lodging away from home fell by 0.1% for a second straight month to follow a 3.5% plunge in March. These sectors have taken a hit on reduced tourist arrivals from abroad. The heavily weighted owners’ equivalent rent rose by 0.3% after two straight gains of 0.4%.

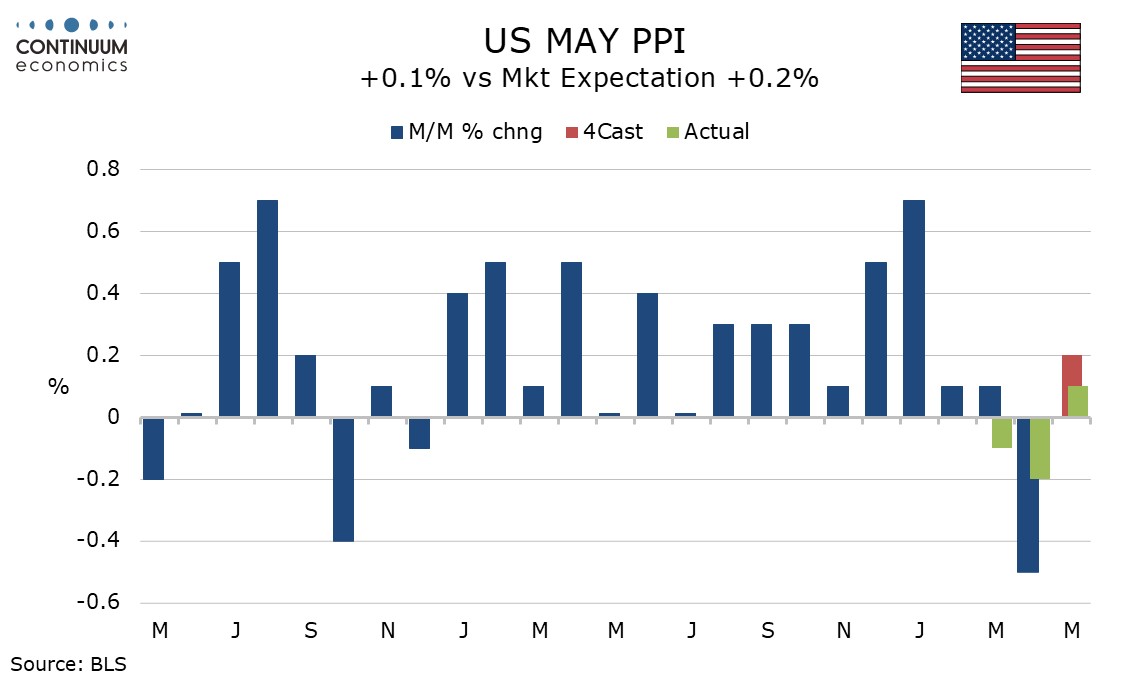

May’s PPI, matching May’s CPI, has come in softer than expected at 0.1% and in both the core rates, ex food and energy and ex food, energy and trade, though the downside surprise is partially offset by upward revisions to April, overall and ex food and energy both to -0.2% from -0.5% and -0.4% respectively, though ex food, energy and trade is unrevised at -0.1%. Initial claims are unchanged at 248k, but trend is showing signs of picking up as we enter June. June’s payroll may be less resilient than May’s.

Recent PPI data has been subject to significant revisions. The upward revision to April’s weakness follows an upward revision to a weak March in April’s report, from -0.4% to a 0.1% increase, though with May’s report March has been revised back down to -0.1%. Concern has been raised over staffing shortages reducing the accuracy of Labor Dep’t measurement, most vocally regarding CPI data, which is not subject to revisions. However large recent revisions to PPI data amplify these concerns. Recent PPI data has been on the firm side in goods ex food and energy, which rose by 0.2% in May after three straight gains of 0.3%. Services data, after a strong start to Q1, has been very soft in Q2 to date, unchanged in May after a 0.3% fall in April. Food rose by 0.1% and energy was unchanged.

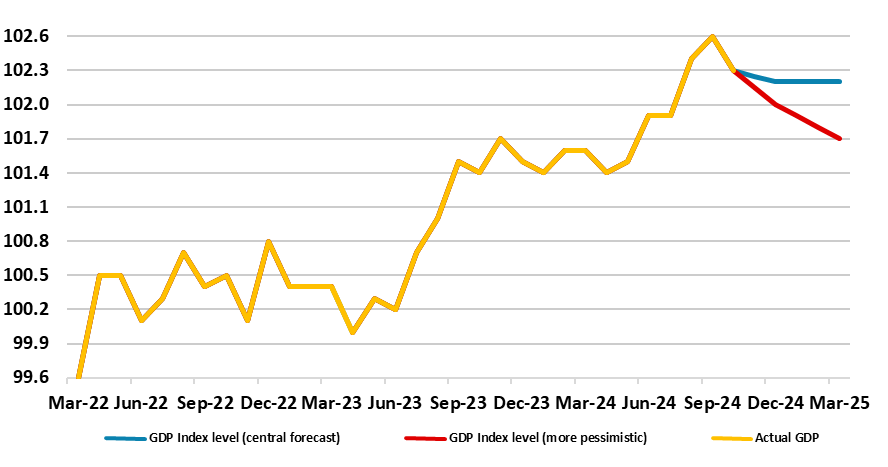

Figure: Actual GDP Outlook - Alternatives

After two successive upside surprises, a correction back in monthly GDP could be expected for the April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have dropped after the raising of effective stamp duty. But we already know that retail sales rose clearly in the month probably boosted by record sunshine and temperatures during April, although this probably caused the sharp fall in utility output. As a result, April GDP dropped 0.3% m/m, more than unwinding March’s 0.2% rise, thereby continuing the volatility of recent months. We think that GDP will be flat to down a notch in q/q terms this quarter and may be as weal in Q3, the former undershooting BoE thinking by a notch and even more so next quarter. Such weakness chimes with business surveys, payrolls and tax outcomes. If this pattern persists (let alone if it is even worse (Figure 1), then the BoE relative complacency regarding the economy is likely to shift.