FX Weekly Strategy: Asia, Sep 15-19th

25bps Easing on Increased Labor Market Risk for FOMC

Bank of Canada justifies resumption of easing with Weak data

BoE Guilty on Gilts

BoJ will be on Hold

For the week ahead

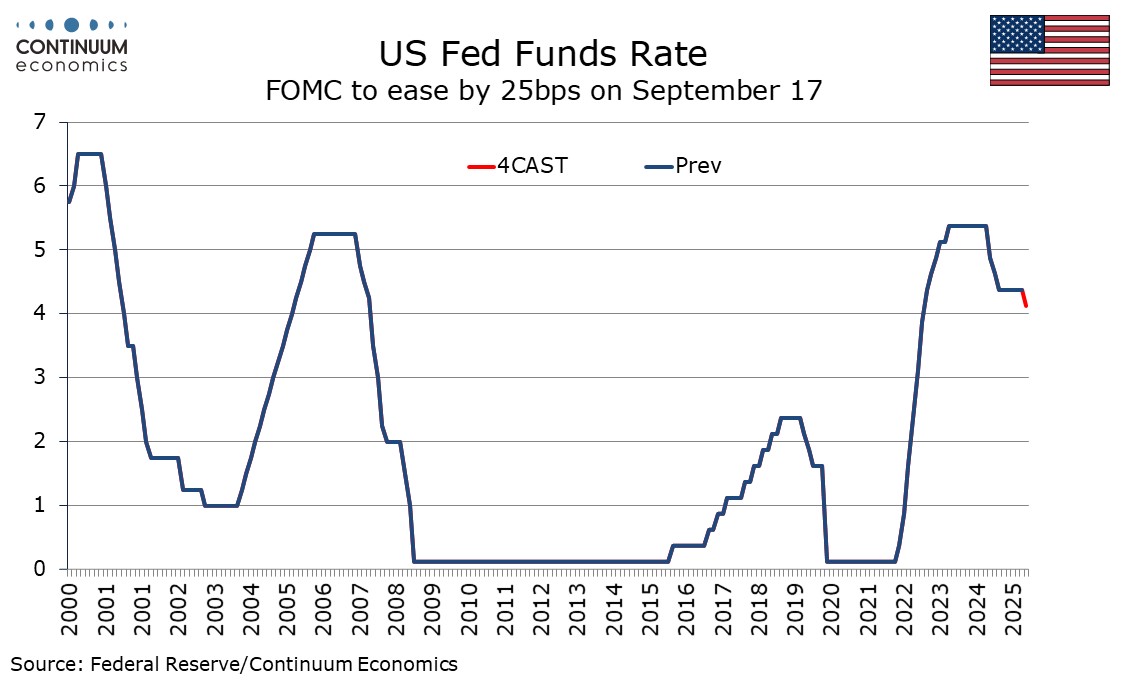

The FOMC meets on September 17 and we expect a 25bps easing to a 4.0-4.25% Fed Funds target range. The FOMC will continue to see similar upside risks to inflation but increased downside risks to the Labor Market. The dots are likely to continue to expect only one more move in 2025, but three moves in 2026 rather than one, which would take the rate close to neutral. September data showed a second straight core CPI increase that was above 0.3% before rounding, and yr/yr core CPI has moved back above 3.0% after falling below in March. Yr/yr core PCE prices stood at 2.9% in July, well above the Fed’s 2.0% target. There is likely to be more feed through from tariffs to come. While doves are willing to look through that as a one-time impact some FOMC officials noted that July’s CPI also saw disappointment in services, which are less sensitive to tariffs. The FOMC statement is likely to continue to see inflation as elevated while the SEP is unlikely to alter its inflation forecasts significantly. These saw core PCE prices ending 2025 at 3.1%, 2026 at 2.4% and 2027 at 2.1%. Forecasts for 2028 will also be seen at this meeting, A return to the 2.0% target is likely to be projected.

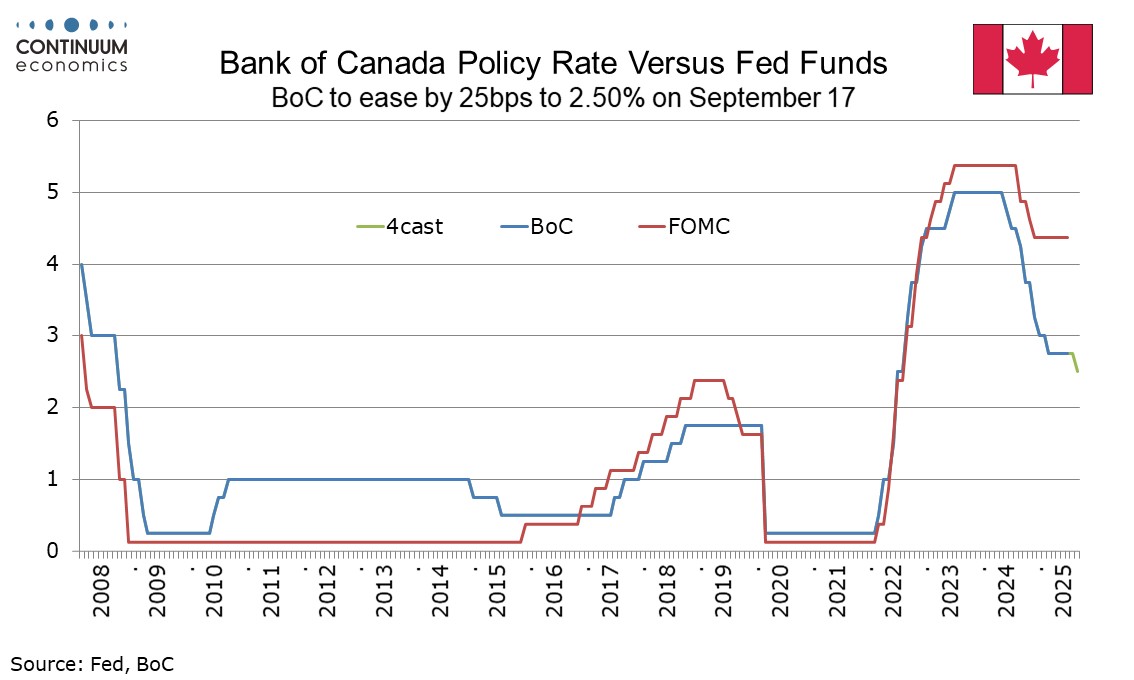

After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However with data since that meeting having been mostly weak, a 25bps easing, the first move since March, now looks likely at the September 17 meeting, to 2.5%. We expect two more easings from the BoC, in Q4 2025 and Q1 2026, which would take the rate down to 2.0%. After the July meeting BoC Governor Tiff Macklem stated that there was a clear consensus to leave rates steady. However minutes from the meeting showed a difference in opinion on the future outlook. Some felt the BoC may already have done enough and that further easing may only take effect as demand was recovering, boosting price pressures, while others felt that further support would be needed given persistent economic slack. The decision to hold at the meeting reflected three factors, uncertainty on US trade policy, resilience in the Canadian economy so far and that underlying price pressures remained.

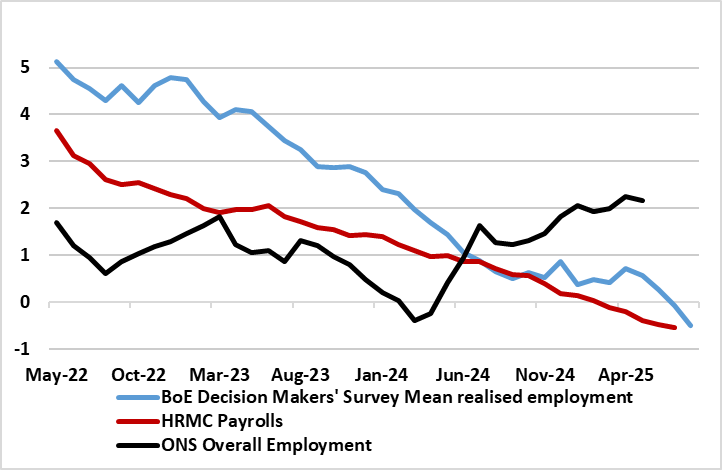

Figure: Employment Contracting Not Moving Sideways

That the BoE will keep Bank Rate at 4% after this month’s MPC meeting is all but certain. Indeed, the MPC majority has hinted that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s complacency regarding what we think is a rapidly deteriorating labor market (Figure 1) that warrants the further circa-75 bp of rate cuts we have pencilled in by mid-2026. But the other and perhaps more overt rational for no change in Bank Rate is that this month’s meeting is more to do with unconventional policy with the BoE carrying out its (now) annual update of its planned gilt rundown and sales as it continues to shrink its balance sheet. Along with the consensus, we see the annual rundown of gilts being slowed from GBP100bln pa to GBP75bln, but where the MPC may suggest both that it may shift the maturity of some gilt sales and also alter the rationale behind the decision too!

Last month, the widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relatively disparately. This partly reflects the alternative scenario building that now lies at the heart of policy thinking and which effectively demotes the baseline inflation projection’s importance. This very much complicates the policy outlook. Admittedly, familiar policy guidance (policy to be framed carefully as well as gradually) was offered but this surely masks similar divides that led to the dissents. More notably, the policy outlook is clouded even more than normal as the updated and somewhat higher CPI forecast it offered last month cannot encompass several likely downside risks, most notably a likely fiscal tightening that will impact over the next 1-3 years. Thus, the message from those BoE updated August projections, may be far from authoritative, if not outright misleading but what we consider to be (still) too optimistic on growth with the BoE very much underplaying what we think is fast emerging weakness and slack in the labor market.

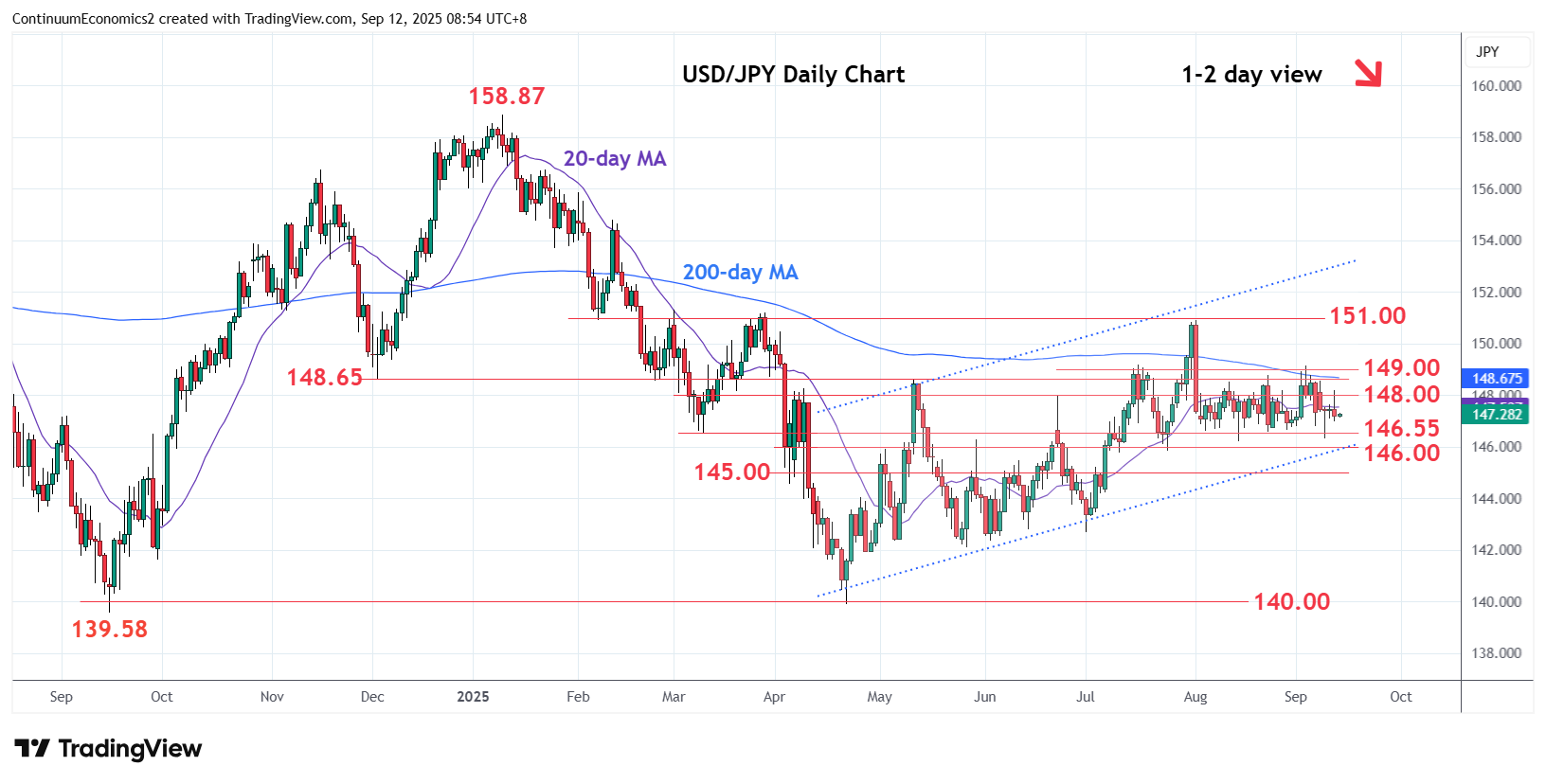

The higher inflation has been amping up pressure on the BoJ. The BoJ has been watering it down with transitory inflation factor but with ex-fresh food & energy CPI elevated above 3%, it is difficult for BoJ to keep holding. We continue to see a October hike from the BoJ with underlying inflation supportive and less uncertainty on U.S.-Japan trade. A September hike is mostly ruled out on a political shift and the lack of commitment from the BoJ sees little urgency for their next step.

The resignation of Japanese PM Ishiba creates more uncertainty. After Ishiba's initial resistance to step down for the failure in election, he finally bow down to the party pressure and resigned over the weekend. Originally, the Japan LDP has scheduled a vote to oust Ishiba and was expected to be receive approval from most LDP parliamentarians. It is anticipated the LDP party leadership election will be held in early October. Ishiba has stretched his term until the memorandum between U.S.-Japan has been signed. To be fair, the issue for LDP also existed before Ishiba took power in late 2024 and he will unlikely be the last one to have to deal with LDP's predicament.

UK The coming week sees several important economic updates looming. Most high profile, after the upside (and broad) July CPI surprise, we see the headline rising a notch to 3.9% in the August figure. The core rate is seen staying at 3.8%. Services inflation is seen easing, the rise in August still masking a clear slowing in services inflation in adjusted terms of late, with the recent rise in headline inflation driven more by goods. Friday sees public borrowing numbers which are already nearly £7 billion above the same period last year but in line with the monthly profile in OBR projections. Friday sees August retail sales data where a m/m correction is seen with it unclear how a very warm month may have affected spending. Perhaps most notably, Tuesday sees ever-more important labor market numbers where apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data) is likely to see little further clear drops in the official earnings data, at least in this release. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so, such data possibly taking greater precedence than CPI numbers for some MPC members.But the BoE decision on Thursday takes precedence. That the BoE will keep Bank Rate at 4% is all but certain. Indeed, the MPC majority has hinted that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s complacency regarding what we think is a rapidly deteriorating labor market (see above). But the other and perhaps more overt rational for no change in Bank Rate is that this month’s meeting is more to do with unconventional policy with the BoE likely to trim the annual rundown of gilts from GBP 100 bln pa to GBP 75 bln.

EurozoneWe see little change in what may be the fresh insight into how companies have actually reacted to the EU-U.S. trade ‘deal’ this coming via the German ZEW update Tue. Final HICP data (Wed) will offer little new as may Monday’s EZ trade figures and Thursday’s construction data. Tuesday sees EZ industrial production figures, probably showing some bounce in July after the June fall (which may be revised to smaller drop). Labor costs updates appear both via official data for Q2 (Tue) and then the ECB wage tracker (Wed)

Rest of Western EuropeThere are no key events in Sweden over and beyond what have been weaker labor market data (Wed), albeit very volatile of late. Norway sees the Norges Bank decision (Thu). Recognizing the stronger than expected data seen of late (real and price-wise), we still see the Norges Bank cutting a further 25 bp and flagging further likely moves even before year-end.

USA The highlight of the US calendar is the FOMC meeting on Wednesday, when we expect a 25bps easing in the Fed Funds target range to 4.0%-4.25%. Upside inflation risks persist but downside labor market risks have increased. We expect the dots to continue to show only one more easing after this one in 2025, but three 25bps moves in 2026, rather than one as was projected in June.The US data calendar sees September’s Empire State manufacturing survey on Monday. Tuesday sees August retail sales, which we expect to rise by 0.2%, with ex auto sales up by 0.4%. August import prices will be released at the same time. August industrial production follows, and we expect declines of 0.4% both overall and in manufacturing. Tuesday also sees July business inventories, where existing data implies a rise of 0.2%, and September’s NAHB homebuilders’ survey.Ahead of the FOMC, on Wednesday we expect August housing starts to fall by 6.2% to 1340k, while permits fall by a marginal 0.1% to 1360k. On Thursday weekly initial claims will be closely watched after a sharp preceding spike which we expect was related to the Labor Day holiday, suggesting a correction lower is likely. September’s Philly Fed manufacturing survey is also due. Friday sees no significant US data.

CANADA The Bank of Canada meets on Wednesday, and in a decision due ahead of the FOMC’s we expect a 25bps easing to 2.50%, given weak July CPI, Q3 GDP and most importantly August employment data released since the BoC last met. August CPI is due on Tuesday, and we expect a rise to 2.0% yr/yr from 1.7%, with little change in the BoC core rates, but we do not expect this to prevent an easing on Wednesday.There are several other Canadian data releases scheduled, with August existing home sales due on Monday followed by August housing starts on Tuesday. July data for manufacturing and wholesale sales are due on Monday, for which preliminary estimates are for gains of 1.8% and 1.3% respectively. July retail sales are scheduled for Friday and here the preliminary estimate was for a 0.8% decline.

JP National CPI on Friday continue to seize the spotlight. Headline CPI is expected to moderate further while ex fresh food & energy likely remain stubborn. It will only be a hawkish surprise if we see core-core above 4% and we do not see much dovish surprise. The BoJ interest rate decision will be announced later in the day and is expected to see no change. While we call for an October hike, we may not be hearing any changes to forwards guidance yet. There is also trade balance data on Wednesday.

AU Labors data on Thursday would be the only meaningful release for the week. The broader picture sees a choppy but solid Australian labor market, wage data would be more important in this regard.

NZWe have Q2 GDP on Thursday and trade balance on Friday. Preliminary data suggest there is likely little surprise.

Recap for the week

Japanese PM Ishiba Resigned Under Party Pressure

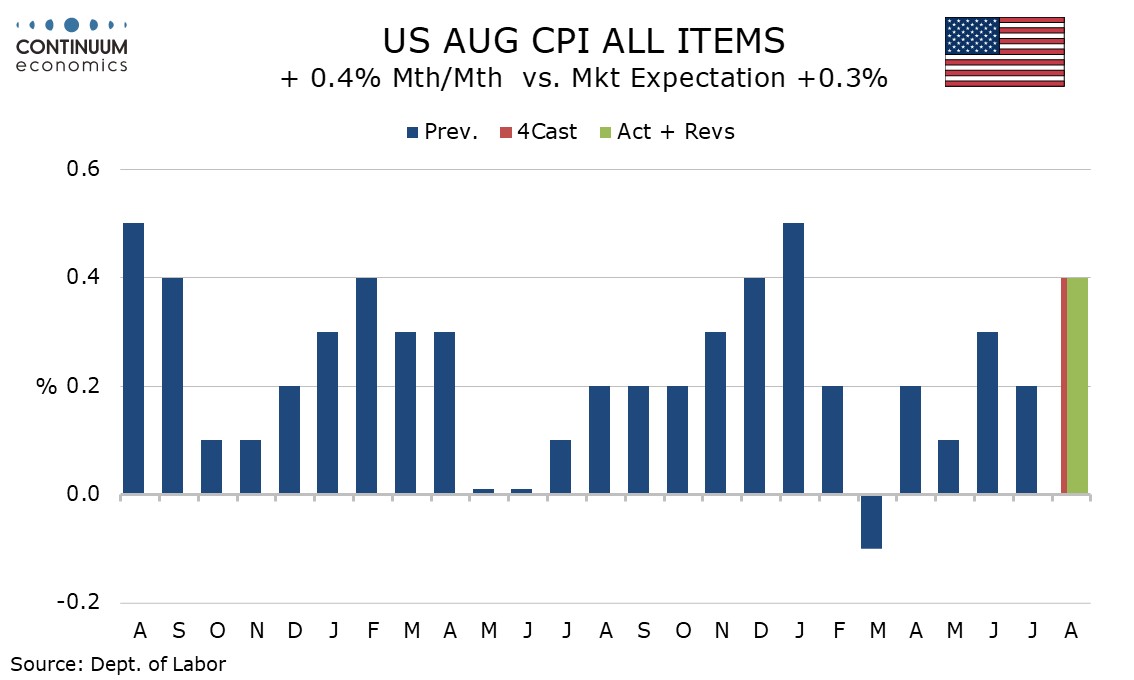

U.S. August CPI firmer than expected

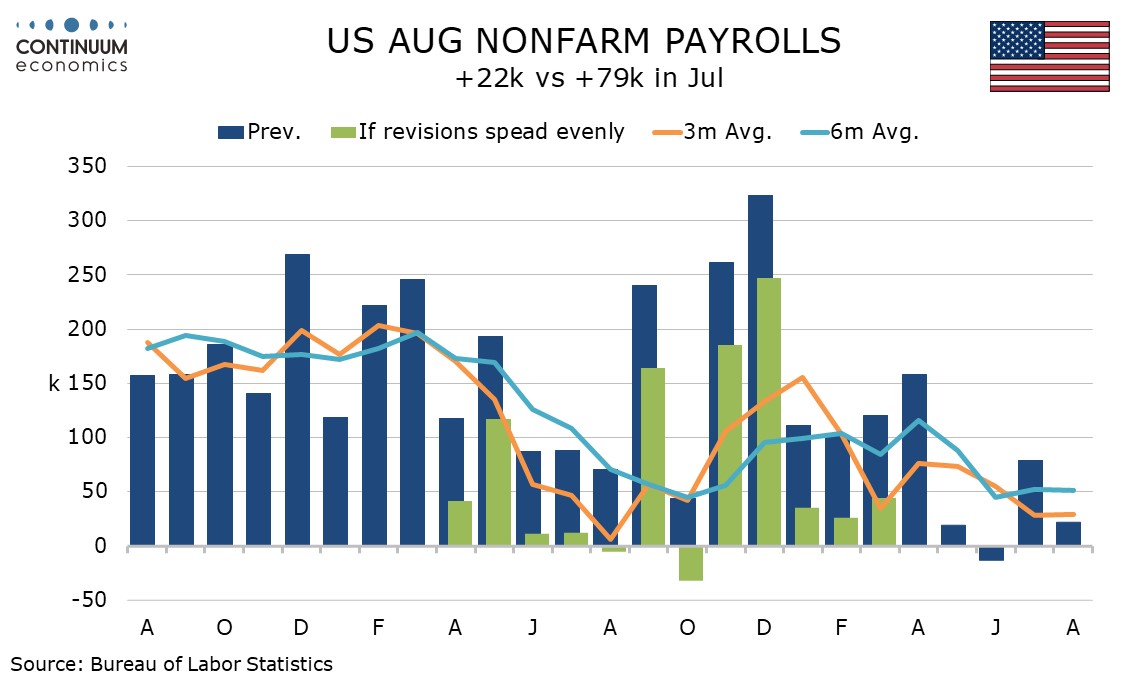

U.S. March 2025 Non-Farm Payroll Benchmark Revised Down

And more political uncertainty in the U.S.

Steady ECB Council Meeting

After Ishiba's initial resistance to step down for the failure in election, he finally bow down to the party pressure and resigned over the weekend. Originally, the Japan LDP has scheduled a vote to oust Ishiba and was expected to be receive approval from most LDP parliamentarians. It is anticipated the LDP party leadership election will be held in early October. Ishiba has stretched his term until the memorandum between U.S.-Japan has been signed. To be fair, the issue for LDP also existed before Ishiba took power in late 2024 and he will unlikely be the last one to have to deal with LDP's predicament.

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. CPI detail shows commodities less food and energy and services ex energy both increased by 0.3%, with the former being an acceleration after two straight months at 0.2% and suggesting an increasing feed through from tariffs. Used autos rose by 1.0% after a 0.5% July rise, a second straight ruse after four straight declines, while new autos at 0.3% saw their first rise since March. Apparel, seen as tariff-sensitive but recently subdued, picked up by 0.5%.

The service detail showed air fares up by 5.9%, a second straight strong rise, while lodging away from home rose by 2.6% to correct two straight significant declines. Owners’ equivalent rent was on the firm side of trend with a 0.4% increase. Weighing against these strong increases was a 0.1% decline in medical care services to correct a 0.8% increase in July.

The preliminary estimate for the downward revision to the March 2025 non-farm payroll benchmark at -911k is steeper than generally than expected and exceeds even the unusually sharp 818k negative revision reported a year ago for the March 2024 benchmark. The data will be incorporated into the January non-farm payroll data due for release in early February. Exactly how the revision will be distributed by month is unclear. The quarterly Business Employment dynamics survey, which hinted at a large negative revision in line with what has just been released, suggests that Q2 2024 could see the largest revisions. However, we suspect that stronger Q4 2024 data is also vulnerable to large revisions.

The chart above shows how payrolls would look like if the revision was spread evenly from April 2024 through March 2025. Then growth in each month from April 2024 through March 2025 would be revised down by 76k. The recent slowdown in job growth would then look less pronounced with the 6-month average below 100k in most of the months from August 2024 assuming evenly distributed revisions.

And the political uncertainty increased when Trump's ally Charlie Kirk being assassinated in a public event in Utah. It has been a while since we see a high profile assassination, especially someone with close connection to the younger generation that are more susceptible to viral transmission of sentiment. Regardless of political tilt, Charlie Kirk has been a public yet close figure to youth and could spark more polarized response after his death. The conflict with the U.S. has been structural and lasted for years but such could trigger a broad base reaction in the coming days.

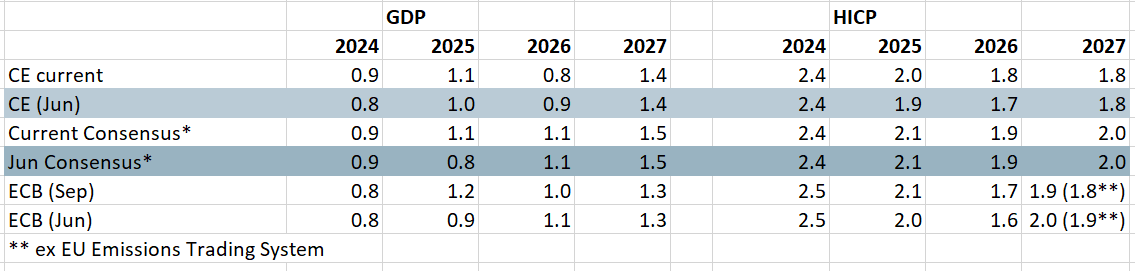

Figure: The EZ Economic Outlook – Alternative Perspectives

Source; ECB, Bloomberg, CE

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections (Figure) which only goes to show that an upward revision to the growth picture can be associated with a drop in underlying price pressures. All of which implies that even with growth risks seen as more balanced, this does not mean that disinflation cannot continue (irrespective of what President Lagarde suggested – possibly again speaking somewhat out of kilter compared to Council thinking). The ECB may now be in mode in which something will now have to trigger further easing, but we think this will occur given tariffs and what are still tight financial conditions likely to mean an undershoot of ECB growth thinking. Thus, data dependence will probably trigger two more 25 bp cuts, probably late this year and early next!

If there was guidance in the pre-prepared statement (as opposed to the Q&A) it was more implicit in suggesting an undershoot of core inflation into 2026 and (a slightly larger one) in 2027. This is not so much about the likelihood of further cuts over but, if policy easing has ended, it will be some time before hiking occurs – this possibly an implicit rebuke to markets which have started to price in rate increases from H2 next year.