FX Daily Strategy: Europe, February 27th

Japan National CPI Beats Estimate

JPY to stay weak on the crosses, but downside limited

EUR to watch consumer confidence data

US data unlikely to have much impact

Japan National CPI Beats Estimate

JPY to stay weak on the crosses, but downside limited

EUR to watch consumer confidence data

US data unlikely to have much impact

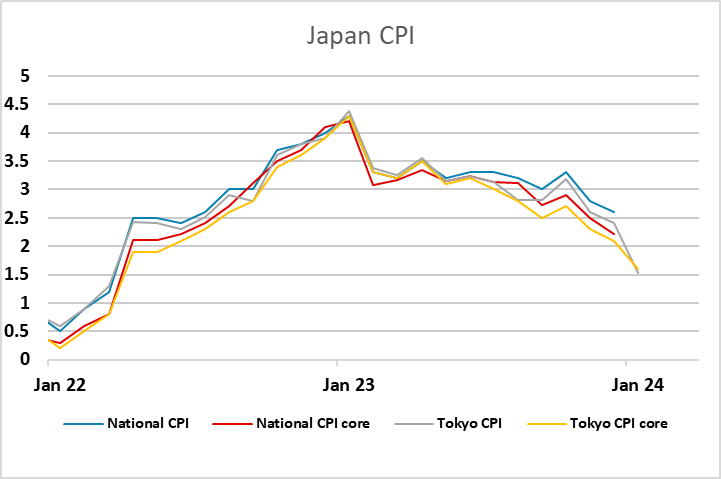

There isn’t a great deal of data on the calendar for Tuesday, but the initial market tone may be determined by the reaction in Asia to the Japanese national CPI data. The core CPI (ex-fresh food) is expected to fall from 2.3% to 1.8%, after the Tokyo CPI numbers already released showed a fall in the core from 2.1% to 1.6%. However, the risks are probably on the downside as there is not always a gap between the national and the Tokyo measures, and the risk is we seen some convergence.

However, the national CPI did beat estimate. The January National CPI, all three items, stays above 2% BoJ target. Headline y/y CPI coming in at 2.2% from 2.6% in December , ex fresh food 2.0% from 2.3% and ex fresh food & energy at 3.5% from 3.7%. The Japan inflation picture continue to moderate and move closer to BoJ target. However, ex fresh food and energy CPI remains a tough nut to crack and maybe on BoJ's mind for a while. Still, all eyes are on March wage negotiation as the result will have a higher impact than CPI currently.

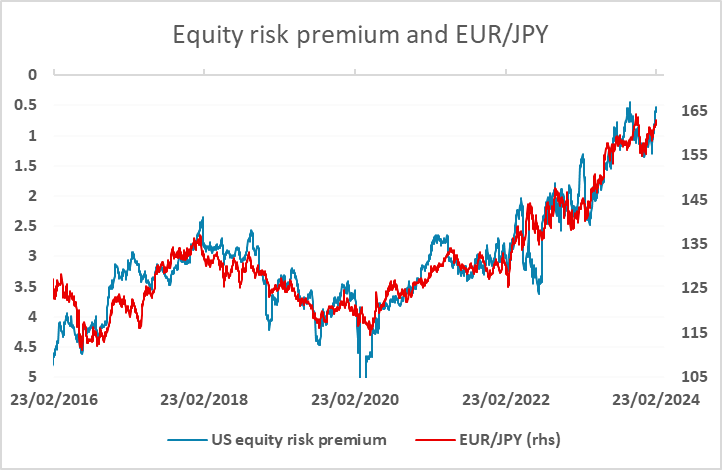

JPY weakness continued to be the theme on Monday, primarily against the European currencies, with GBP/JPY hitting a new post-2015 high and EUR/JPY hitting a new post-November high, the November high having been the highest seen since 2008. Of course, in real terms both pairs are even higher, with EUR/JPY at all time highs. Weaker Japanese CPI is unlikely to do anything to halt the JPY decline, with the November EUR/JPY high of 164.30 now a target. The driving force behind JPY weakness remains strong risk appetite, characterised by declining risk premia. JPY crosses continue to move in line with declining US equity risk premia, so unless we see equity weakness or a decline in yields that is not followed by equity gains, it will be hard for the JPY to recover. Even so, the levels here are very stretched form a valuation perspective, and Japanese inflation is expected to decline sharply, so even if EUR/JPY does trade to new post-2008 highs, we would expect the new highs to be marginal.

In Europe, we have consumer confidence data from France and Germany. The German data is nominally for March, while the French data is for February, but they likely reflect the same survey period. We have seen some recovery in French (and UK) confidence data in recent months, but the German data have been going in the other direction. Any strength in the German numbers would likely be seen as good news for the EUR, signalling some halt to the weakness in German growth. But the fate of the EUR is still more likely to depend in general risk appetite. We still slightly favour the upside against the USD as long as equities retain the recent firm tone.

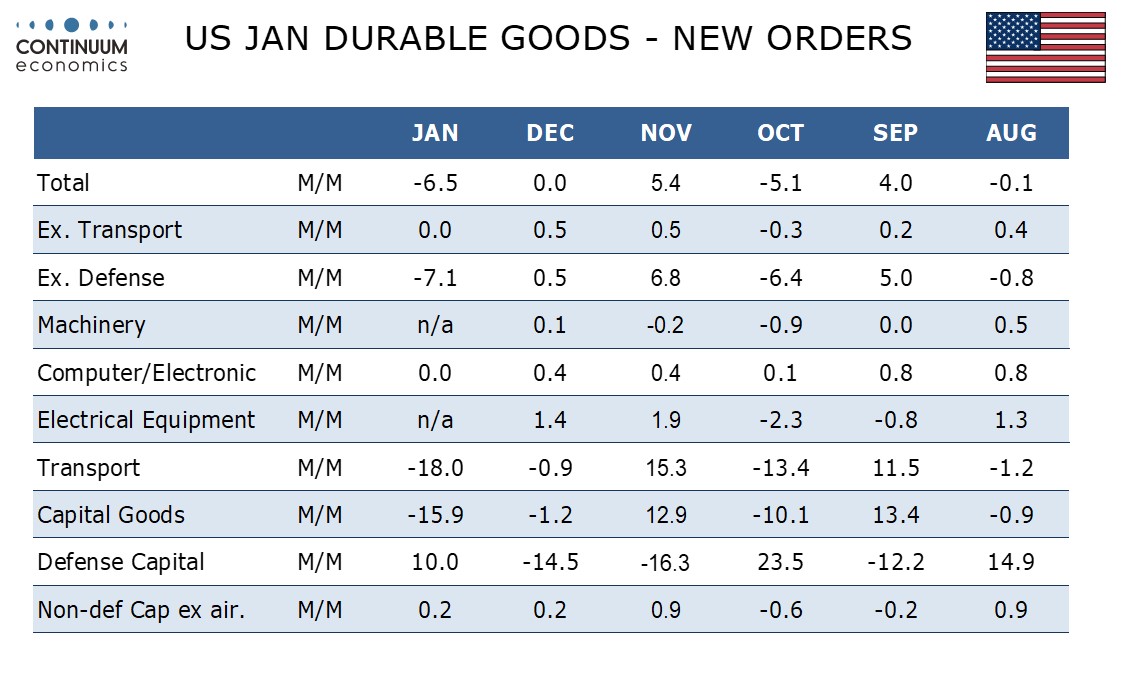

The second division US data on Tuesday looks unlikely to significantly change market sentiment. While we expect January durable goods orders to see a plunge of 6.5%, this is largely due to aircraft slipping sharply from two straight strong months. Ex-transport we expect an unchanged outcome in a pause after two straight gains of 0.5%. These are broadly in line with market consensus, and we doubt the Conference Board consumer confidence index or the Richmond and Dallas Fed surveys will have a significant impact. The market is now sensibly priced for three Fed cuts this year, with a slight risk of four, and we are unlikely to see this view change much ahead of the inflation data later in the week.