FX Weekly Strategy: June 2nd-6th

Tariff issues still the main focus

EUR may suffer from any new US tariff measures

ECB rate cut and lower inflation forecast may also be EUR negative

CAD to gain modest support from BoC

JPY can gain in risk negative secanrio but should in any case be well supported

The focus for the next week is still going to be on tariffs and how the Trump administration react to the International trade court’s ruling that the president didn’t have the power to impose reciprocal tariffs. While the markets’ initial reaction was positive, as a removal of these tariffs would be seen as good news for the US and global economy, it’s still unclear whether the court’s decision will be effective in reducing tariffs. First of all, the White House is appealing, and the court’s decision could be overturned. However, this may take some time, and there is only a 10 day grace period before the reciprocal tariffs need to be unwound. More concerning for those expecting tariffs to be removed is the potential for the administration to raise tariffs by other means. Product tariffs are seen to be legal, and there are also other legal avenues whereby surplus countries can have a 15% tariff imposed. We would expect more product tariffs to be announced fairly shortly, with pharma the most obvious target, and that could trigger a negative market reaction, more than reversing the positive impact of the initial court decision.

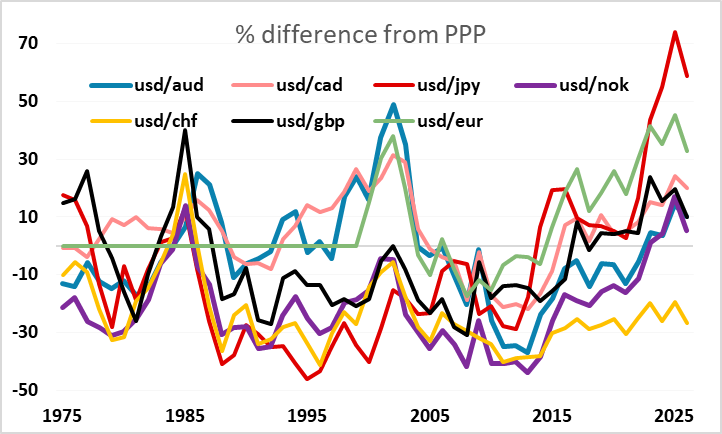

This suggests to us that the risks have shifted towards a danger of risk negative news. This is also against a background of a less positive economic picture after the Q1 GDP revision revealed a weaker than expected rise of 1.2% in consumer spending in Q1. But risk negative news might not be as clearly USD negative across the board as reciprocal tariffs. For instance, product tariffs on pharma are likely to be particularly negative for the EU and Switzerland, and while the resultant higher prices will still be contractionary for the US economy, the market may also see their imposition as negative for the EUR and the CHF. While the CHF is rarely much affected by Swiss economic news, the CHF is starting at such a high level that it is less likely to benefit from any risk negative news if the Swiss economy is being particularly impacted by tariffs. Both Switzerland and the EU could also suffer from tariffs focused on countries with large trade surpluses.

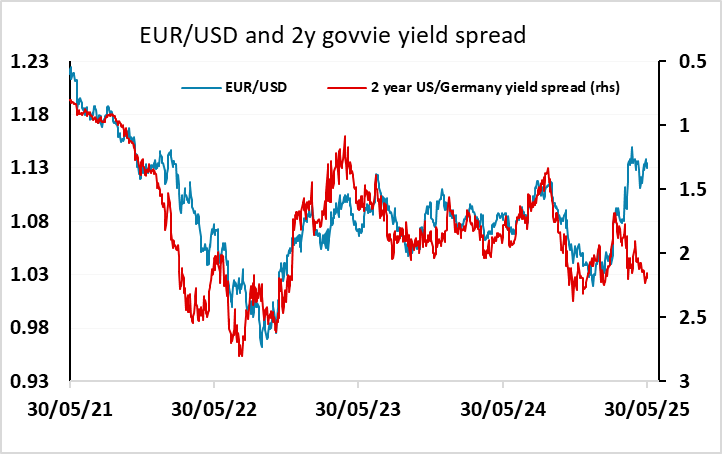

This week also sees significant US data releases, in the shape of the US employment report and the ISM survey, but these look less likely to have a major market impact. While we do see a somewhat softer US employment report, there isn’t much in the claims data to suggest we are seeing any major slowdown. EUR/USD in particular is in any case now largely disconnected from moves in US yields, and looks more likely to be affected by general sentiment towards the US economy and US asset markets. A solid employment report might consequently be mildly USD positive, with some scope for the bottom of the recent 1.12-1.14 EUR/USD range to be tested. The bar may be a little higher for a break above the recent highs above 1.15, given the risks to the European economy from tariffs and the fact that we have already seen the EUR move much higher than suggested by yield spreads.

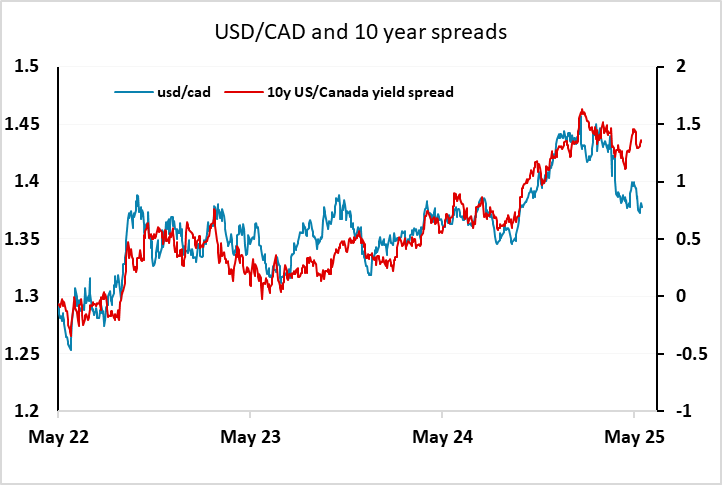

We also have the latest ECB and BoC meetings, with the rate cut fully expected from the ECB meeting providing another reason why the EUR may be capped in the near term. Although the ECB may suggest that the pace of easing might now slow, they also seem likely to revise down their inflation forecasts and this should ensure that EUR yields remain low, also limiting the EUR upside. In Canada, Wednesday’s Bank of Canada call is a close decision, though with Q1 GDP showing some resilience, April core inflation showing an acceleration and trade risks, while still large, having eased somewhat, we now lean to the Bank of Canada remaining on hold as it awaits further developments. The market is pricing around a 20% chance of a cut, so the CAD may enjoy a small boost from a no change decision. However, as with the EUR, the CAD has outperformed its yield spread relationship with the USD in recent weeks, so upside scope from higher yields may be quite limited.

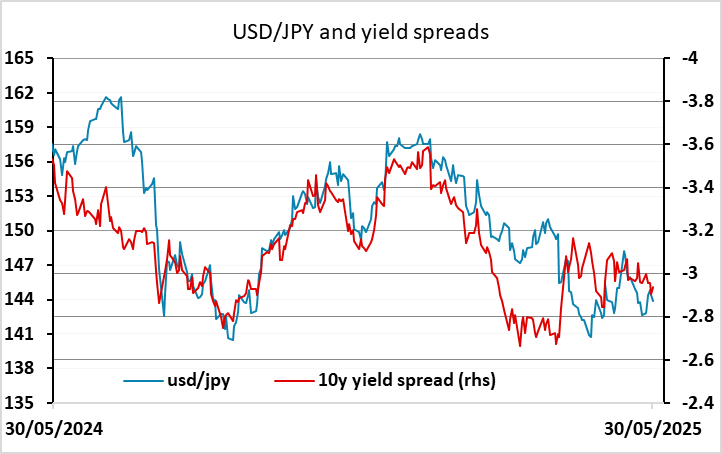

The JPY still looks like the currency most likely to benefit from any risk negative impact of further tariff announcements. This week also sees Ueda speaking and the latest wage data, which might reflect the early impact of the latest wage round. If we see a more risk positive picture, the JPY should still be well supported if the wage data and Ueda continue to suggest higher rates in the event of a positive economic performance.

Data and events for the week ahead

USA

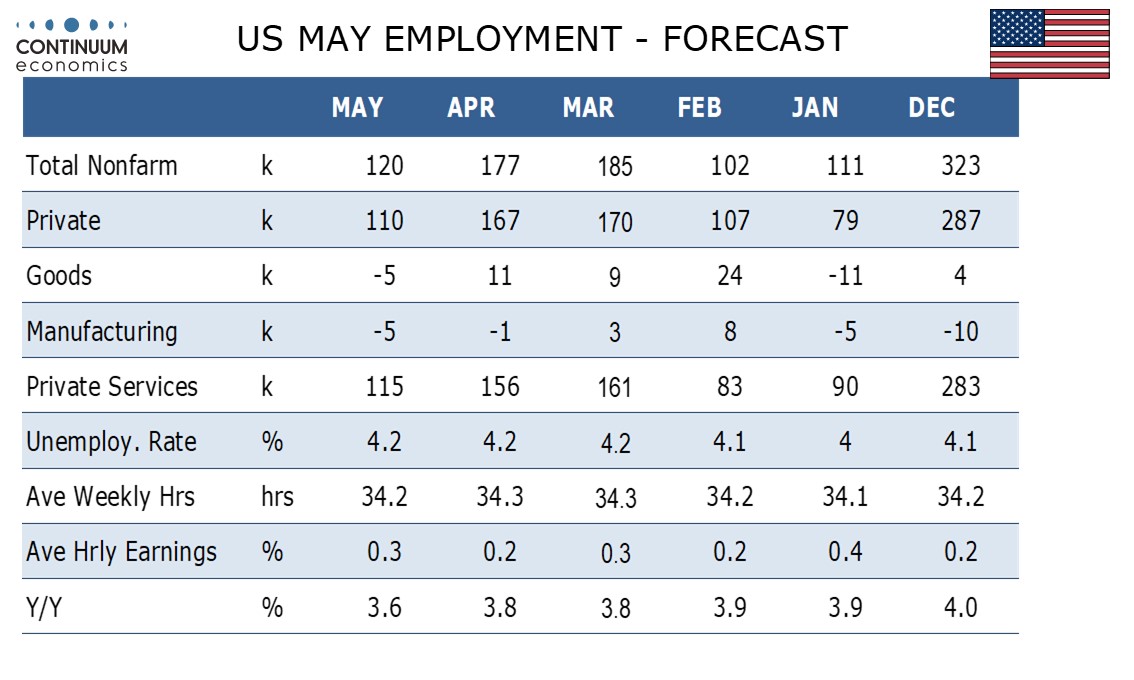

Initial US focus may be on how Trump fights the recent court ruling against his imposition of tariffs, though on Friday the May non-farm payroll will be seen as a crucial data release. We expect a slower 120k increase though this would not be weak enough to imply the economy is entering recession. We also expect an unchanged unemployment rate of 4.2% and a slightly stronger 0.3% increase in average hourly earnings. On Wednesday we expect May’s ADP estimate of private sector employment to rise by 85k, continuing a recent tendency to underperform the private sector non-farm payroll, for which we expect a rise of 110k. Other labor market signals due are April job openings on Tuesday, and weekly initial claims on Thursday. Thursday also sees revisions to Q1 productivity and costs data, which are likely to be minor.

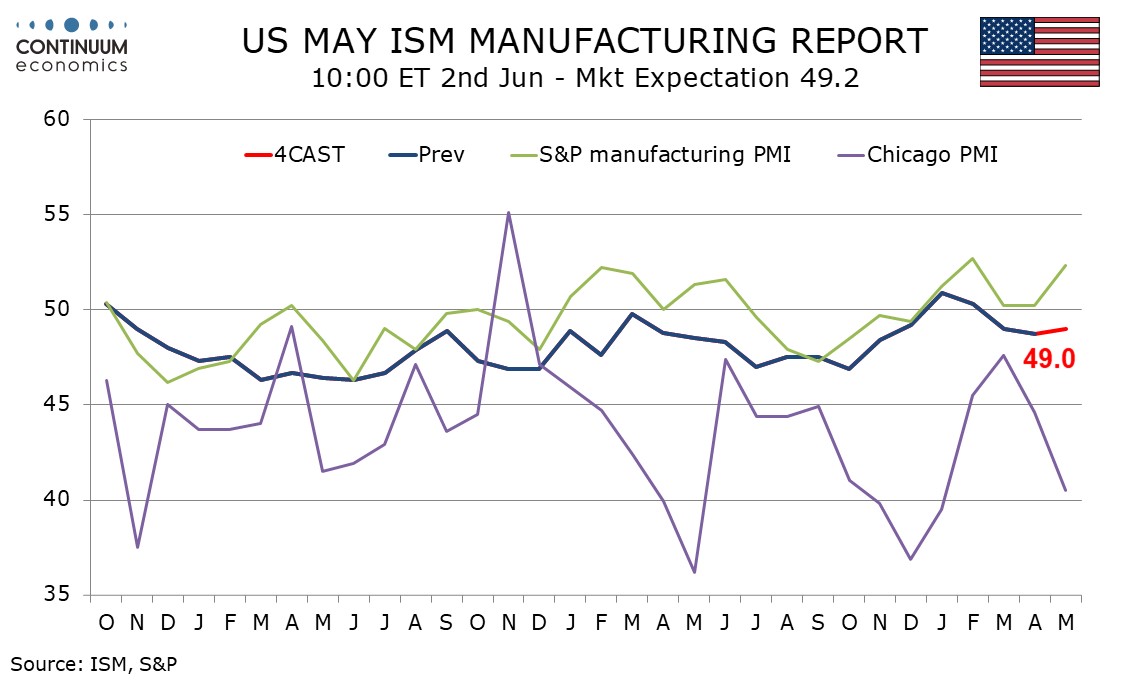

Also on the calendar are May’s ISM reports. We expect an increase in Monday’s manufacturing index to 49.0 from 48.7 but marginal slippage in Wednesday’s services index to 51.5 from 51.6. April data due during the week include construction spending on Monday, factory orders on Tuesday, the trade balance on Thursday and consumer credit on Friday. The Fed’s Beige Book is due on Wednesday. There are several Fed speakers scheduled. Monday sees Waller, Logan, Goolsbee and opening remarks from Powell. Tuesday sees Goolsbee again and Logan. Wednesday sees Bostic and Cook, and Thursday Kugler and Harker.

Canada

Canada’s key event is Wednesday’s Bank of Canada meeting. Expectations for a 25bps easing have been put in some doubt by acceleration in April’s core CPI measures and now fresh uncertainty over the extent of US tariffs. Friday’s May employment report should also be closely watched given recent signs of weakness. May PMI data from S and P on manufacturing is due on Monday, with services following on Wednesday. May’s Ivey manufacturing PMI is due in Thursday, which also sees April’s trade balance.

UK

Individual MPC updates are due from members Mann (Mon) and then both Breeden and Greene on Friday, with the BoE also offering information from its latest Decision Makers Survey (Thu), this adding to insights from final PMI numbers (Mon/Wed) as well as the Construction PMI (Thu). But the main hard data interest will be the BoE money and credit data where housing market volatility and distortions may be the order of the day.

Eurozone

Two key updates are due this week. The first on Tuesday with the flash HICP for May. The data is all the more important as HICP inflation failed to fall in April, instead staying at 2.2%. More notably, services inflation jumped 0.5 ppt to 4.0%, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. As already seen in flash French May numbers, and as was the case when this Easter effect last happened in 2019, services inflation is very likely to at least reverse that rise in May, this also likely to unwind the higher April flash core reading of 2.7%, ie which was up from 2.4%. Indeed, as a result, we see the headline rate dropping to a below-target and eight-month low of 1.9% helped by rounding and a further m/m fall in fuel prices.

Thursday sees the next ECB decision. What is widely seen as an eighth 25 bp deposit rate cut in the current cycle may be overshadowed by the ECB’s implicit if not explicit shift about the outlook thereafter. The door will be left open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs) due in the interim. But the impression may be given that a pause may be due after what have been seven successive cuts, this also reflecting what seem to be clearer Council divides over the extent and direction of inflation risks. But the main news may be reflecting much more disinflationary assumptions about interest rates, energy prices and the euro. As a result, the ECB’s updated forecast may show a much earlier (but still sustained) drop in HICP inflation to below targets than the H2 2026 timetable seen in the March forecasts. As this projection should encompass policy rate assumption to well below the 2% rate likely to be put in place in June, it would thus support such market thinking.

Regardless, the HICP data arrive alongside April labor market numbers which should see the jobless rate rise afresh. Notably, the still low jobless rate comes alongside a continued and above-trend increase in the workforce, this possibly being a major factor in the manner in EZ wage inflation has been falling.

Otherwise, a far from busy week data-wise sees PPI (Thu) and retail sales data (Fri), important to assess to what extent the consumer may be helping shore up recent solid EZ GDP numbers, details for later arrive on Friday. But cracks remain as may be seen in Construction PMI data (Thu) they coming a day after the revised composite figures. Germany sees April industrial data where production figures (Fri) which may see a reversal after the boost anticipating the US tariff imposition and where orders figures (Thu) may do likewise.

Rest of Western Europe

There are few key events in Sweden, most notably a Riksbank Governor Theeden speech (Mon). Thursday sees flash CPI data for May notable as April figures added to signs that the inflation pick-up early in the year may have been a blip. We see the downside surprise being consolidated with CPIF inflation steady at 2.3%, albeit with energy induced base effects offering an upside risk

Otherwise, in Switzerland, Tuesday sees CPI data which may turn slightly negative in y/y terns as the Easter effect unwinds. Monday sees fuller details on Q1 GDP.

Japan

Ueda will be speaking on Tuesday and likely repeat his usual rhetoric. The more important labor cash earning will be released on Wednesday. Followed by household spending on Thursday and both data will very likely disappoint as Japanese business under tariff pressure will hold on to wage hikes and consumers unlikely to spend when real wage chops around the positive and negative territory.

Australia

GDP on Wednesday and Trade balance on Thursday will be of higher priority. Followed by a slate of their two throughout the week. None of this data will be market moving as the focus remain on CPI so to determine the pace of RBA.

NZ

No important release on NZ next week.