JPY, EUR, AUD flows: JPY reverses gains, AUD soft, EUR steady

JPY reverses the gains seen after the declaration of Martial Law in South Korea. AUD soft on weaker GDP, but has strong support near current levels. EUR awaits French confidence vote but bad news largely priced in

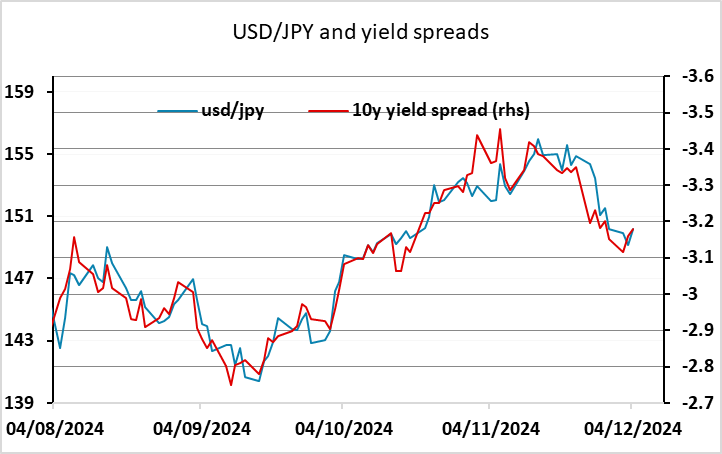

The main European focuses today will be in the afternoon, with US ADP and ISM services data and the French confidence vote, so this morning looks like being relatively quiet. Overnight we have seen some weakness in the JPY and AUD. The JPY has retraced yesterday’s gains that came after the South Korean declaration of Martial Law, with that declaration now having been lifted. US yields moved back up after dipping on the Korean announcement, and spreads are now consistent with USD/JPY near 150 based on the correlation of the last few months. We still see medium term downside risks, as longer term yield spread correlations and fundamental valuation both point a lot lower. But the risks on the US data today and this week may be to the upside.

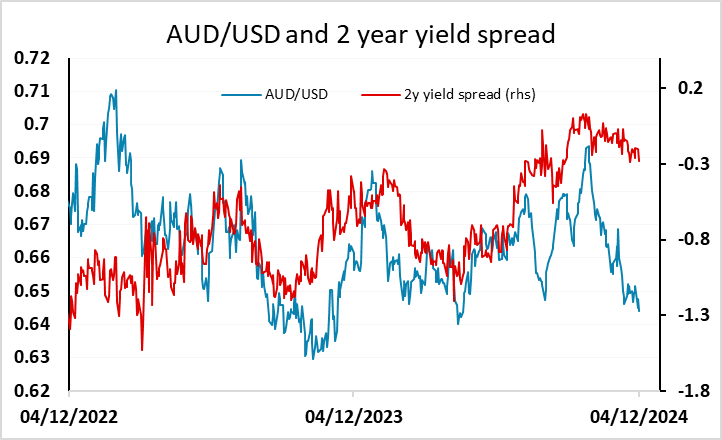

The weakness in the AUD related to the weaker than expected Q3 GDP data which led to a significant dip in AUD yields. Even so, the AUD continued to trade well below levels suggested by the yield spread correlation, and while there are still concerns about the potential impact of Trump policies on China in particular and world trade in general, the 0.6350-0.6450 area represents good support, and could provide a base for an AUD recovery.

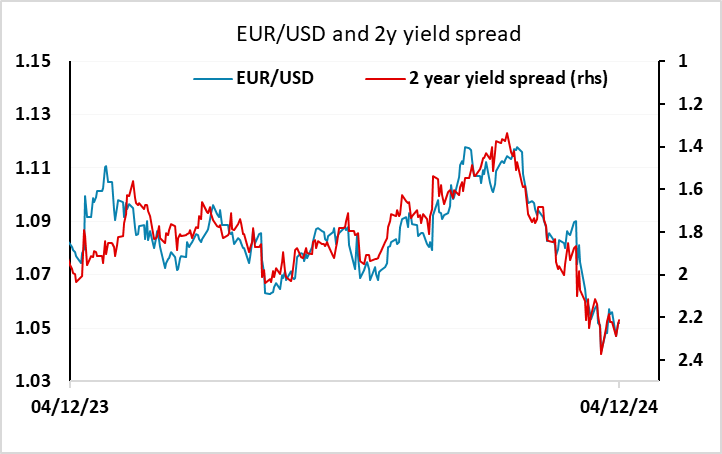

EUR/USD has bounced above 1.05, and while there must be nerves around the French confidence vote this afternoon, the likelihood is that a government defeat is near enough priced in. While we might see a knee jerk negative EUR reaction, it will probably require some increase in expectations of a 50bp ECB cut in December to general any renewed downside momentum, as current yield spreads still look consistent with EUR/USD holding near 1.05. There is still some potential for EUR/USD declines on strong US data, but it will take some Fed statement to trigger significant gains as recent comments have been on the dovish side.