USD, CAD flows: Employment data USD positive, CAD negative

USD up on a stornger than expected employment report, CAD down as Canadian data disappoints

A stronger than expected employment report, with payrolls 103k above expectations and the unemployment rate a little lower, but average earnings were in line at 0.3%. The numbers may not make a big difference to Fed thinking, given the average earnings numbers, with the y/y rate falling to 4.1% as expected in spite of an upward revision to last month’s m/m rise to 0.2%. But the data is certainly on the strong side of expectations, and has led to higher US yields and a stronger USD, with a negative impact on equities, as the market is pricing in 5bp less Fed easing by year end than before the data.

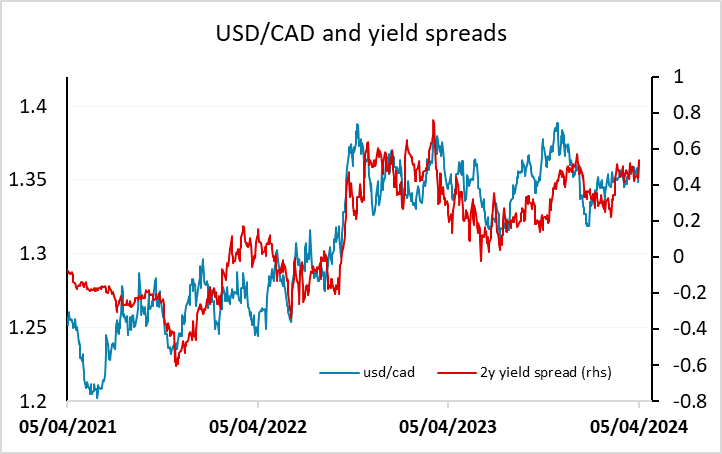

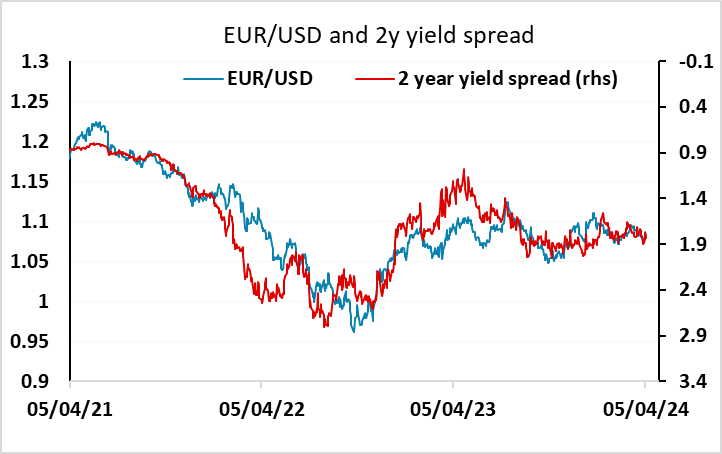

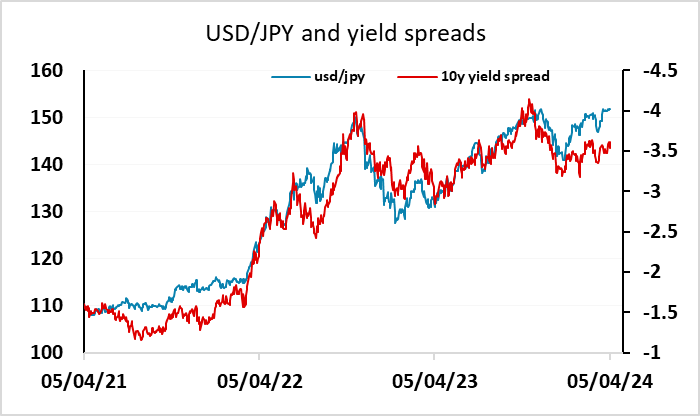

There is some scope for EUR/USD to test below 1.08, but front end spreads have only reversed the decline seen yesterday, so we wouldn’t see any significant EUR/USD break lower. Similarly, US/Japan yield spreads don’t support a break above 152. However, there may be more scope for a move in USD/CAD, as the Canadian employment numbers were clearly on the weak side of expectations, with a decline in employment and a rise in the unemployment rate. Even so, we doubt there is much scope beyond 1.3650 unless we see renewed Middle East concerns triggering a much more significant risk negative reaction.