JPY, EUR flows: USD looking expensive

The USD looks expensive based on current yield spreads

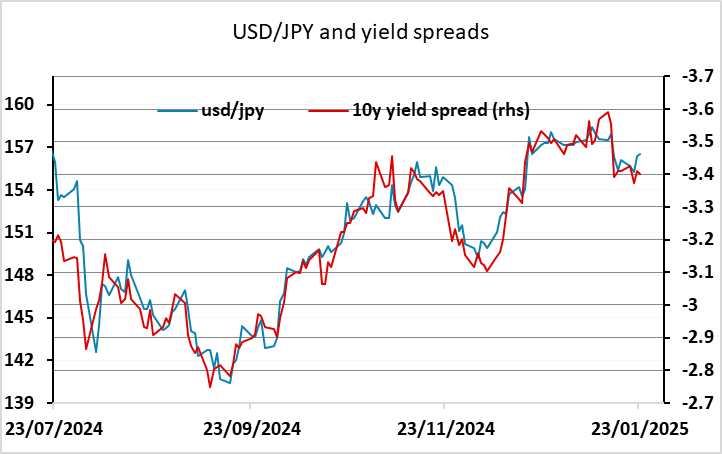

A quiet overnight session has seen the USD regain a little ground but it continues to look a little stretched based on yield spread correlations. USD/JPY, which has been sticking very closely to a yield spread metric for the last 6 months, looks a good figure too high at these levels based on current spreads. The market is pricing close to a 90% chance of a 25bp rate hike at tomorrow’s BoJ meeting, so the risks to USD/JPY are larger if we see no change, but current pricing suggests there is scope for JPY gains on the expected outcome.

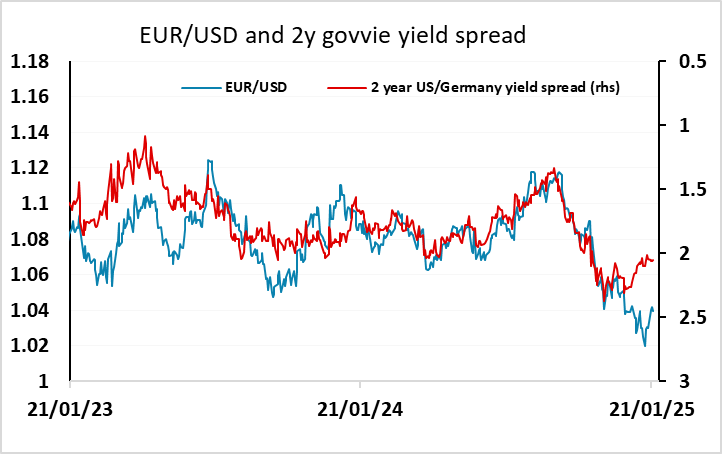

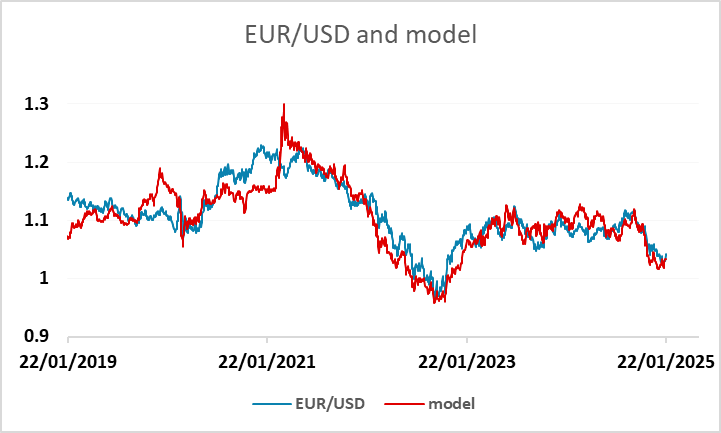

EUR/USD had broken away from the tight yield spread correlation around Christmas, but was very tight to this metric for the past year, and looks more than a figure cheap on this basis. However, our model which includes correlations with equities and relative equity performance has EUR/USD close to fair at current levels, although if European equities continue to outperform there will be potential for further EUR gains. We continue to be sceptical of the prospects of further US equity gains given the current extremely low equity risk premium, so we do favour the USD downside, although any severe equity weakness could be expected to result in some short term USD and particularly JPY strength.

For today, there is little on the calendar except for the Norges Bank meeting, which is previewed in our daily here.