USD, CHF, EUR, JPY flows: Risk negative tone overnight could extend

Risk sentiment turned negative overnight on talk of an Iranian attack on Israel. Some scope for extension, with such an attack a real possibility.

The overnight talk of a potential Iranian attack on Israel undermined risk sentiment and triggered some recovery in the safe havens, with the JPY, CHF and USD all making ground against the riskier currencies as equities and yields slipped lower. But the declines are still relatively modest, and EUR/USD, EUR/JPY and EUR/CHF are still all significantly higher on the week, and the same is true for the other risky currencies. While there is a significant possibility of an Iranian missile or drone attack on Israel, it seems unlikely to change the underlying situation in the Middle East, so while there would certainly be a further risk negative reaction if it occurred, we wouldn’t expect it to spell the end to the risk positive market tone.

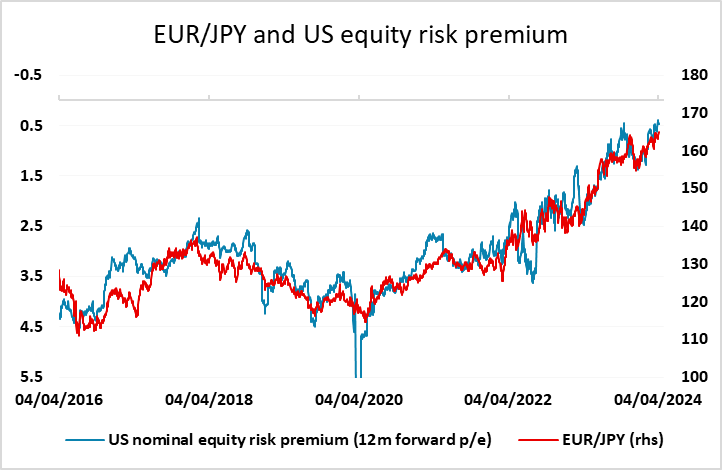

Nevertheless, while the main focus today will continue to be on the US employment numbers, the background feel will be more risk negative as few will want to hold risky positions into the weekend if there is an Iranian attack. Stronger numbers might therefore lead to clearer weakness in equities and limited rises in yields, while weaker numbers might see yields fall further than they might have previously. With the rise in JPY crosses this week lacking any real fundamental drivers and being motivated mainly by low volatility and carry strategies, there is more scope for these rises to be corrected, albeit only if we see a further decline in risk premia over the day.

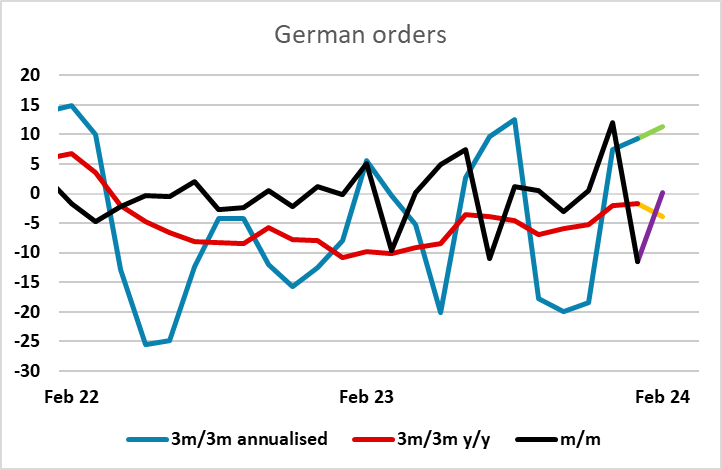

This morning could see a modest extension of the overnight risk negative tone, with little else to focus on ahead of the US employment report. The German factory orders data already released didn’t provide any real impetus one way or the other given the recent volatility of the series.