SEK, CHF, JPY flows: SEK slips on CPI, CHF weak

SEK lower after softer CPI, NOK/SEK still has upside scope. CHF the favourite funding currency in current risk positive market

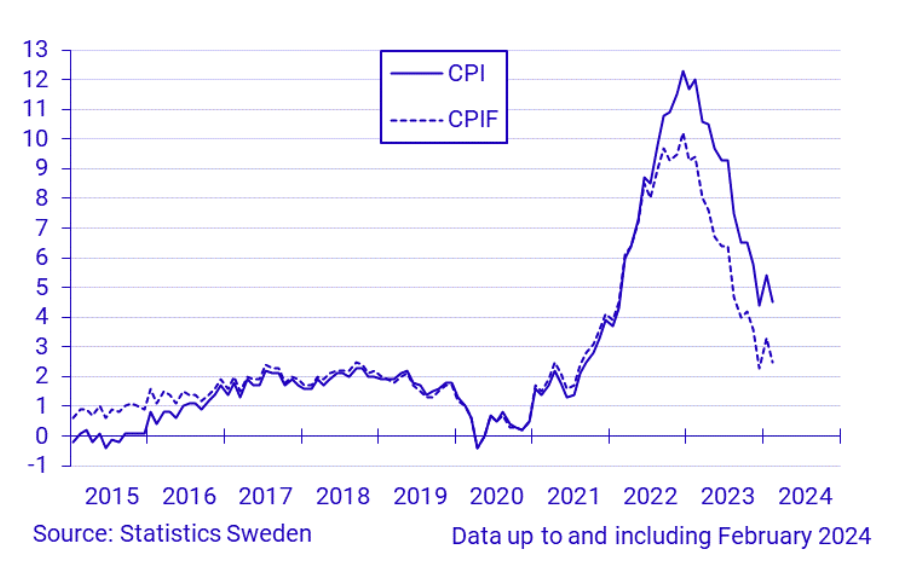

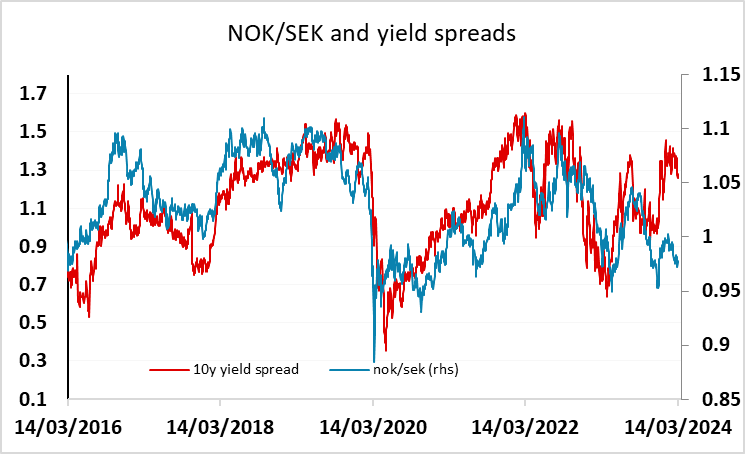

EUR/SEK has moved around 2 figures higher after Swedish February CPI came in weaker than expected, with the targeted CPIF measure down to 2.5% y/y from 3.3% in January, well below the 2.8% expected. NOK/SEK has moved a little further than EUR/SEK, with EUR/NOK dipping slightly, and there is more of a case for NOK/SEK gains based on the current yield spread picture than there is for EUR/SEK gains. However, this will obviously require EUR/NOK declines, which have not been facilitated by the weaker than expected Norwegian CPI data this week.

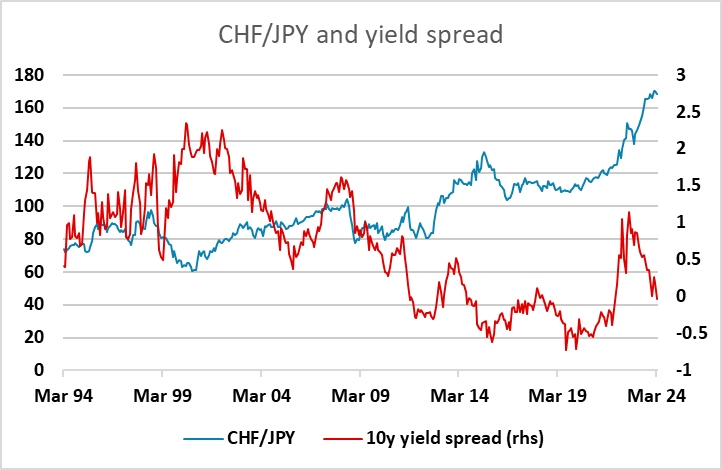

We have seen a fairly quiet overnight session, but the mild risk positive tone continues, with EUR/CHF notably edging higher, threatening last week’s 3 months highs at 0.9629. While we see the current equity market strength as a little fragile, it is hard to oppose, and the CHF looks the most vulnerable currency in this environment, given low yields, high valuation, and a central bank that is on the dovish side. In contrast, JPY valuation is very low and the market is gearing up for BoJ tightening. CHF/JPY therefore remains the clearest value play.