FX Daily Strategy: Asia, November 13th

GBP has further downside risks on GDP data

AUD should remain well supported if employment data is solid

SEK still expensive against EUR and NOK

CHF strength on trade hopes shouldn’t lead to new highs

GBP has further downside risks on GDP data

AUD should remain well supported if employment data is solid

SEK still expensive against EUR and NOK

CHF strength on trade hopes shouldn’t lead to new highs

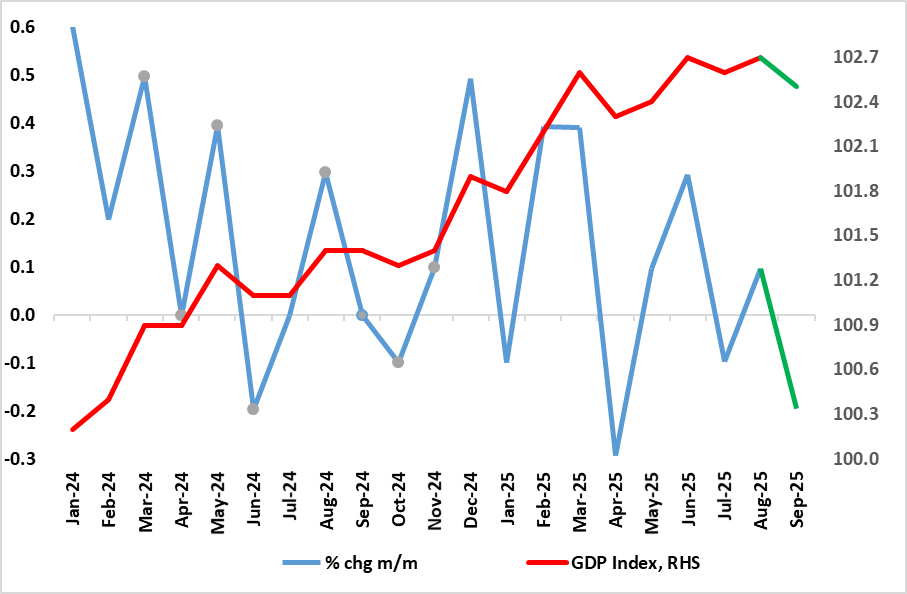

Solid UK GDP Growth Ebbing and Hit by Shock?

Source: ONS, CE

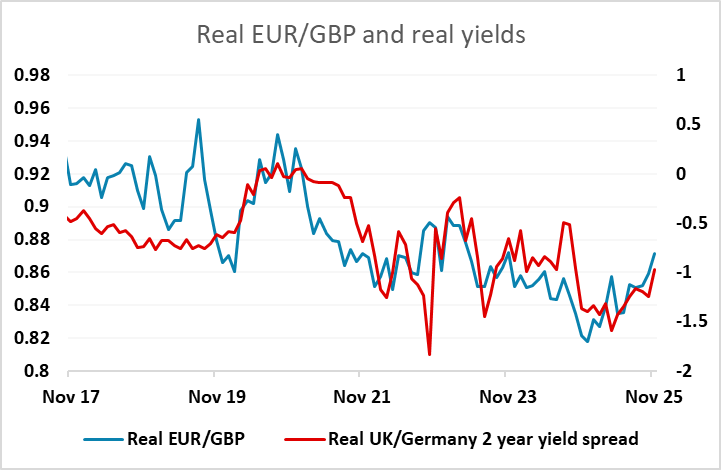

Thursday sees UK monthly and Q3 GDP data, and there is greater focus on GBP after weak labour market data this week as well as pressure from political uncertainty. There has been talk in the last couple of days of a challenge to PM Starmer’s leadership of the Labour Party, and although the rumours have been denied, they helped to push EUR/GBP to new highs for the year on Wednesday at 0.8838, while UK yields edged higher against a background of globally lower yields. We see downside risks on the UK GDP data as we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September GDP dropping 0.2% m/m and with downside risks. If so, this would mean Q3 GDP having slowed to 0.1% q/q despite a perkier consumer performance. The market consensus being for a flat September number so we would expect at least a knee-jerk negative GBP reaction, potentially sending EUR/GBP to 0.8850, although if it is attributed to the JLR problems the expectation of an October bound may mean the decline is short-lived.

In Australia, employment data is expected to show another 15k rise, and the recent domestic news has continued to be quite solid, suggesting there should be upside for the AUD if risk appetite remains positive. The AUD has underperformed yield spreads recently and it’s hard to make a case for weakness below 0.64 in AUD/USD if the domestic economy remains solid. So we tend to see AUD risks as being to the upside as long as any equity market weakness remains mild.

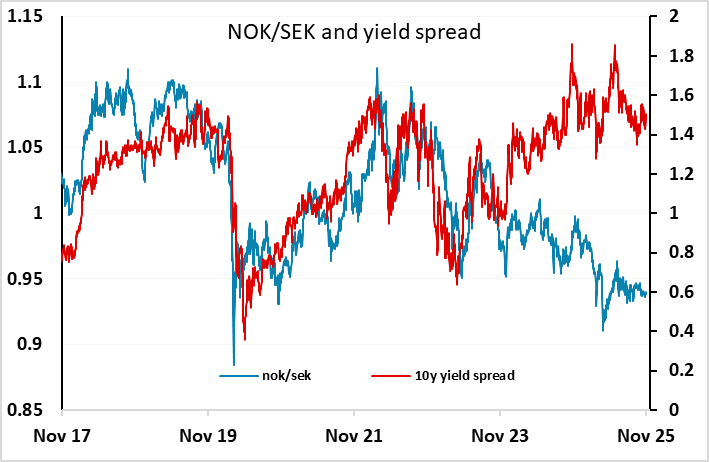

Final Swedish CPI data has often seen some significant revisions from the still quite new preliminary CPI release, so the final data isn’t quite a foregone conclusion, After the stronger numbers seen in Norway this week, the risks may be to the upside and a stronger SEK. Even though the SEK still looks to have outperformed the usual yield spread metrics this year, the gap has been narrowing, and there is still potential for SEK gains if we see any renewed speculation about potential Riksbank tightening. But in general we still see more scope for SEK weakness on neutral data, particularly against the NOK.

CHF strength on Wednesday related to expectations of a trade deal with the US which could see the tariff on Swiss goods reduced from 39% to 15%, according to chatter after Trump’s comments on Monday. The 0.92 level has been an effective floor for the CHF in the last year, despite being tested several times, and while there is no conclusive evidence of FX intervention, the mild pick up in sight deposits and FX reserves in recent months suggests there may be some modest SNB support going on. While a trade deal is good news for Switzerland, the CHF never weakened significantly on the rise in tariffs and remains close to all time highs against the EUR, and at extreme levels of valuation in general, so it’s hard to argue that such a deal would justify a break to new CHF highs, and we would expect support at 0.92 to hold.