FX Daily Strategy: N America, December 19th

BoJ and BoE both deliver rate decisions

No surprise from the BoJ...

…but BoE may suggest larger rate cuts next year than is currently priced in

US initial claims may be the US data that grabs the most attention

BoJ and BoE both deliver rate decisions

Still a risk of a BoJ hike…

…while BoE may suggest larger rate cuts next year than is currently priced in

US initial claims may be the US data that grabs the most attention

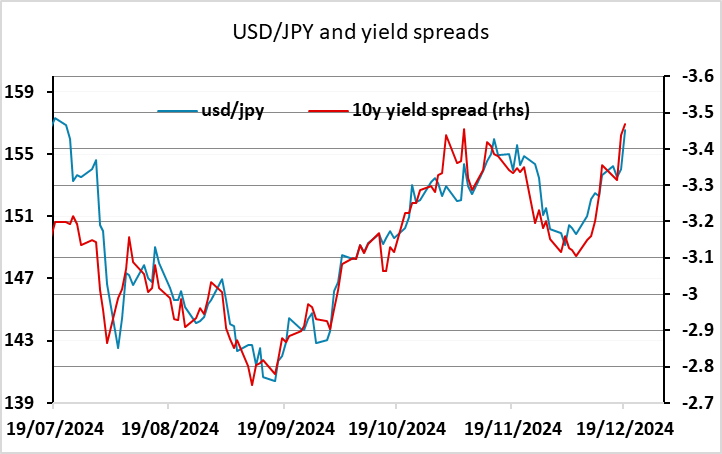

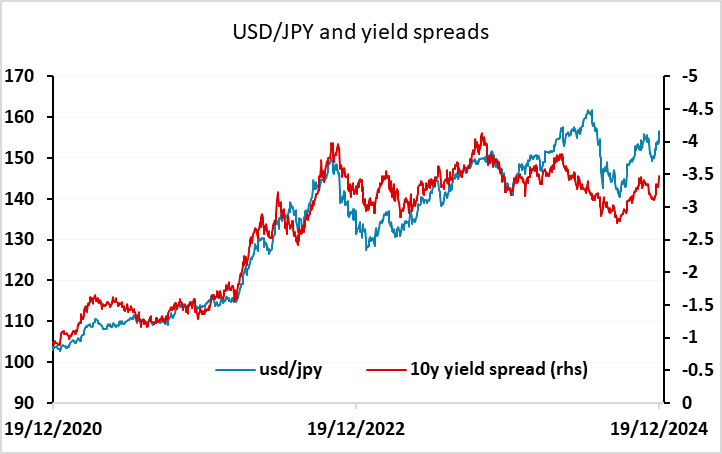

USD/JPY has been the biggest mover overnight, helped by the BoJ’s decision to leave rates unchanged at the December meeting as well as the more hawkish Fed tone. This was largely priced in ahead of the meeting after last week’s less hawkish BoJ comments, so there was little immediate reaction to the BoJ decision. But USD/JPY has moved sharply higher in late Asia/early Europe, gaining another big figure. This looks like a realignment with the higher US yields seen after the Fed. USD/JPY continues to map moves in the 10 year spread since August, and with JGB yields failing to follow the rise in US yields, USD/JPY at 156.50 is in line with the current spread. However, a bigger picture view still suggests this is too high based on the historic relationship with spreads.

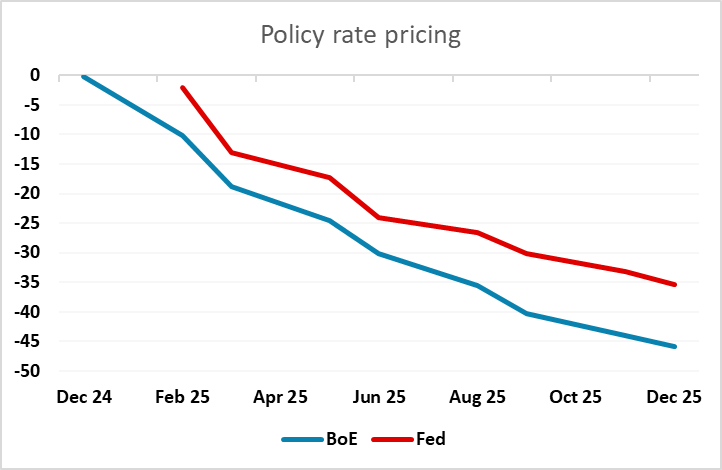

There is less uncertainty about the BoE decision, with the stronger than expected average earnings data this week supporting the hawkish case for only very gradual easing. Even though we saw the labour market data as somewhat more mixed than the market reaction suggested, most of the committee are likely to vote for no change, with only one possible vote for a rate cut. But while we see no cut this time around, it still looks like the UK curve underprices the risk of cuts next year, with just two priced in. The statement may challenge this view so we would see most of the GBP risk as being on the downside.

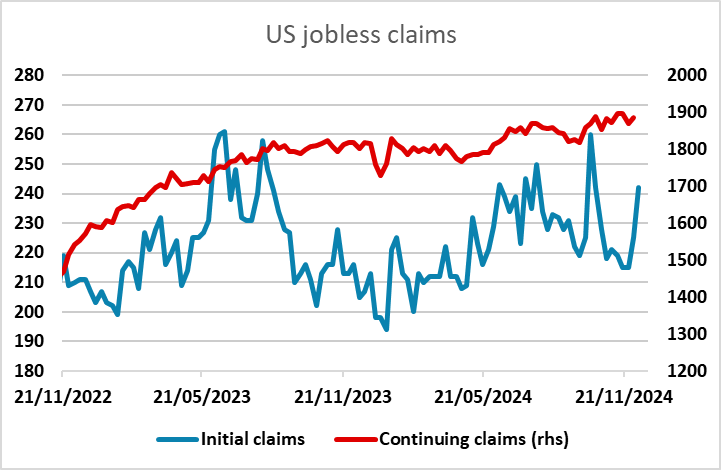

US jobless claims may attract the most attention of Thursday’s batch of US data. The GDP revision is unlikely to be significant, and the Philadelphia Fed survey has been choppy, but after last week’s higher than expected initial claims figure, there is potential for the market to take a more dovish Fed view if we see further evidence of an increase in labour market slack.