FX Daily Strategy: N America, March 19th

BoJ Exit Negative Interest Rate

A bigger JPY positive impact in a long run

Canadian CPI to weigh modestly on the CAD

GBP vulnerable as positions reached new highs

BoJ Exit Negative Interest Rate

A bigger JPY positive impact in a long run

Canadian CPI to weigh modestly on the CAD

GBP vulnerable as positions reached new highs

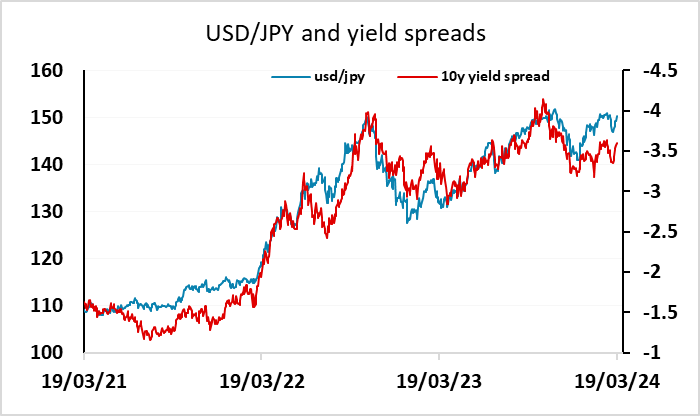

USD/JPY has moved higher overnight even though the BoJ hiked the policy rate and abolished YCC, which most didn’t expect to happen until April. However, the BoJ also said “Given the current outlook for economic activity and prices, it anticipates that accommodative financial conditions will be maintained for the time being." This suggests the BoJ is in no rush to tighten further. Additionally, while yield curve control has been officially removed, the BoJ announced they will be purchasing roughly the same amount of JGBs, and will intervene if yields spike. These moderating factors are being used to justify the JPY’s failure to rally on the rate hike, even though a hike was only a minority view. JGB yields are also marginally lower, supporting the softer JPY. Nevertheless, it is hard to understand why the JPY would be weaker considering the alternative outcomes. Few would have expected the BoJ to indicate substantial further tightening was coming when hiking rates for the first time. Would the JPY have been even weaker if they had not hiked?

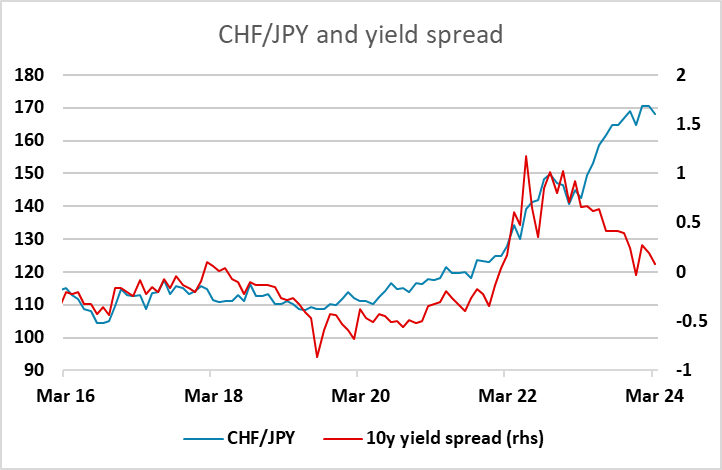

It seems most likely that the short term market was geared up for a BoJ move and the lack of any rise in JGB yields meant there was no impetus for any further JPY buying. But the decision to raise rates when central banks elsewhere are looking at cutting has to be seen as a JPY positive move in the longer run, and we would not expect JPY weakness to extend. While yield spreads have edged in the USD’S favour overnight, spreads are still at a level that suggests scope for JPY gains based on recent correlations. However, with the Fed quite likely to signal a slightly less dovish view at this week’s meeting, scope for JPY gains may be greatest against those currencies where easing is more possible near term. The CHF looks the best candidate, with the SNB the most likely central bank to ease this week. The market prices this as around a 30% chance of a 25bp cut, but in any case yield spreads and valuation point to huge scope for JPY gains against the CHF after the 50% rise in CHF/JPY in the last 4 years.

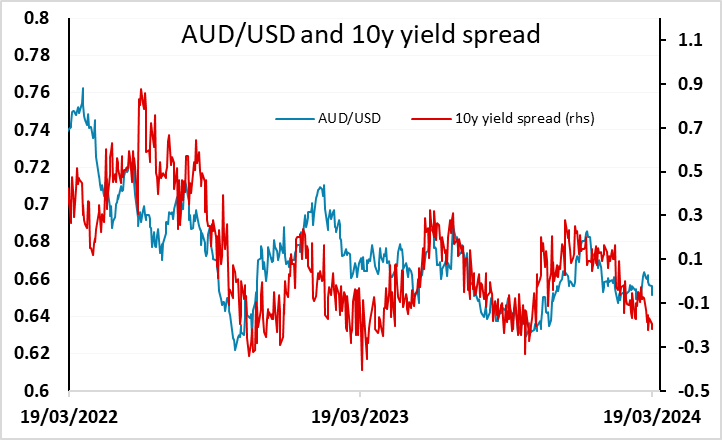

AUD/USD also fell back overnight after what was perceived as a dovish shift in forward guidance. The key forward guidance statement of "Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks." has been changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.". The wording effectively removes the bias to tighten, suggesting a hike or a cut are equally likely.

AUD yields are lower as a result, and spreads point to potential for some further losses against the USD. Softer equities, particularly regionally, are also not helpful for the AUD, and AUD/USD could now test support in the 0.6450-0.65 region.

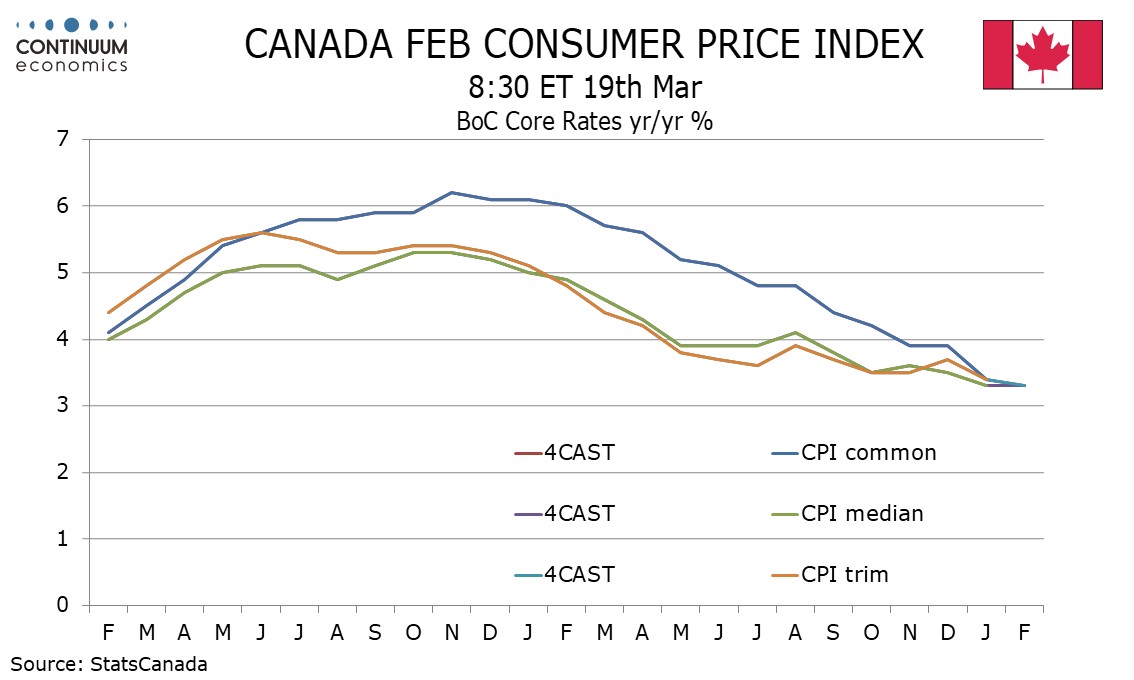

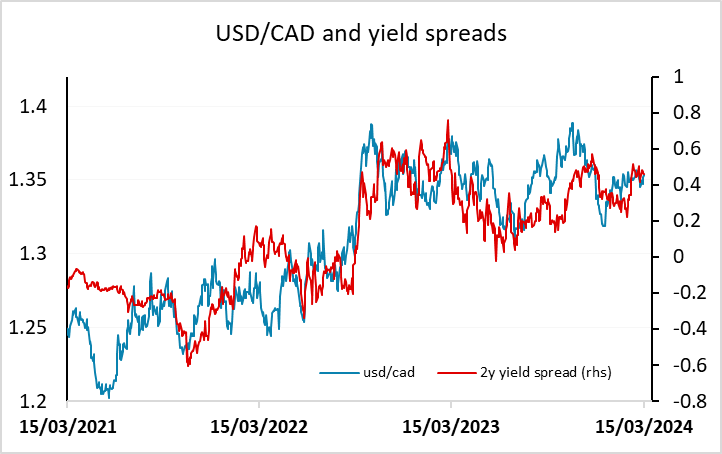

Canadian February CPI looks to be the only data of real significance on Tuesday, with the market consensus looking for a small rise in the headline y/y rate to 3.1%, but with all the core rates that the BoC watch expected to be unchanged from the January y/y rates. We see mild downside risks to inflation relative to the consensus, suggesting the CAD may have some downside risks, but we doubt they will be large.

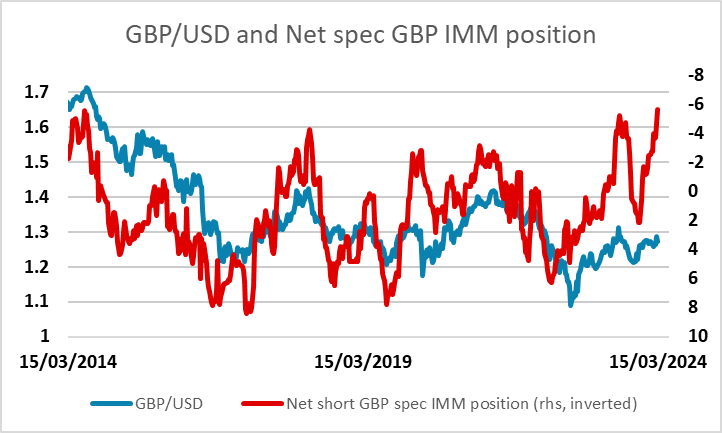

Monday saw relatively quiet trading, with the focus very much on central bank meetings this week. However, one thing to note ahead of the BoE meeting on Thursday is the CFTC data on net speculative GBP/USD positioning. This hit its highest level for at least 12 years last Tuesday, and suggests there may be some significant downside risks for the pound if the BoE turn more dovish this time around and open up the possibility of a rate cut as early as May, which is currently priced as very much an outside chance at around 12%.