FX Daily Strategy: Asia, March 13th

US PPI unlikely to have much FX impact, but USD risks may be slightly on the upside

USD’s negative correlation with equities fading

JPY still looks set to make general gains

AUD has potential to shake off concerns about equities and test higher

US PPI unlikely to have much FX impact, but USD risks may be slightly on the upside

USD’s negative correlation with equities fading

JPY still looks set to make general gains

AUD has potential to shake off concerns about equities and test higher

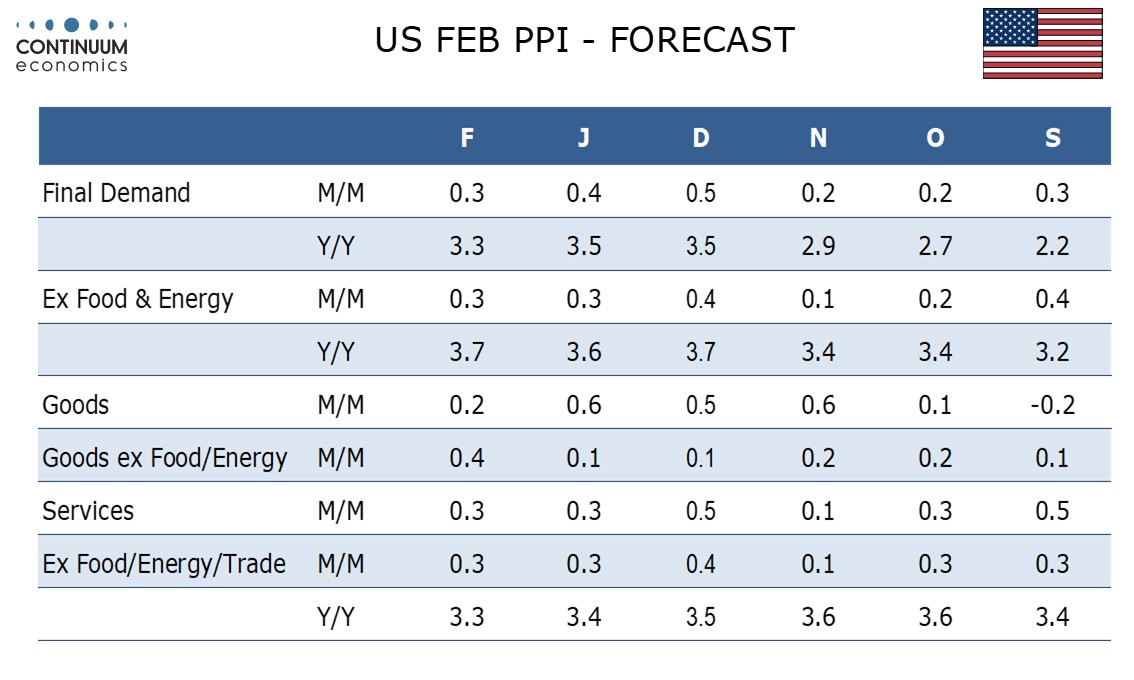

Following the softer than expected CPI data on Wednesday, Thursday sees US PPI data for February. We expect February PPI to increase by 0.3% overall, and in the core rates ex food and energy and ex food, energy and trade. This would be a slowing from a 0.4% January increase overall, but each core rate would match their January outcomes. Our forecast is in line with the market consensus, so we don’t anticipate much reaction, especially since the reaction to the softer than expected CPI was quite muted. If anything, the reaction to CPI suggests that there would be more impact from a stronger than a weaker PPI number, with the market concerned about the potential for higher US inflation as tariffs are imposed. The USD risks may therefore be marginally to the upside.

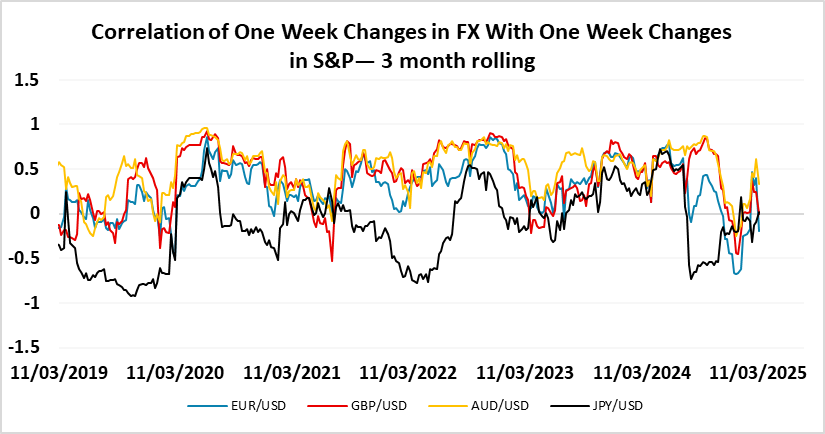

However, after showing initial resilience following the weaker than expected CPI data, the USD slipped back in subsequent trading on Wednesday, broadly mirroring the decline in the equity market. There was even a USD decline against the AUD and CAD, currencies that would typically suffer from weaker equities. The positive correlation of the USD with equities is unusual in recent times, at least against the riskier currencies, but suggests the USD is being driven by sentiment towards the US economy more than it has been in the past, and also by the perceived vulnerability of US equities. Meanwhile the European equity market is looking more resilient because of expectations of increased European fiscal spending. From here, it’s still hard to see much upside for US equities given current valuations, so we would continue to favour the USD downside.

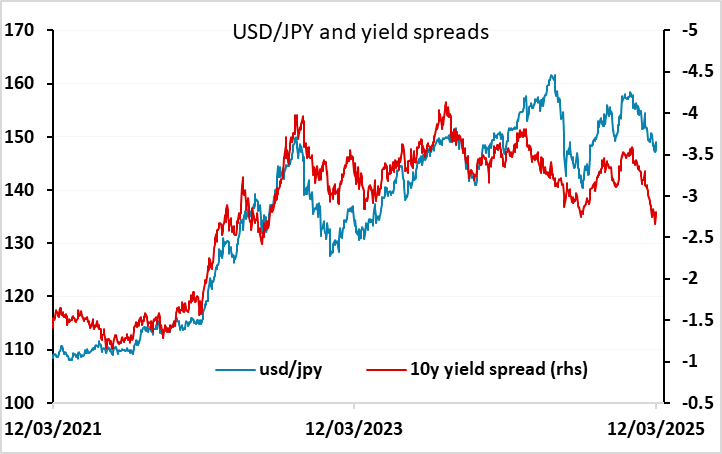

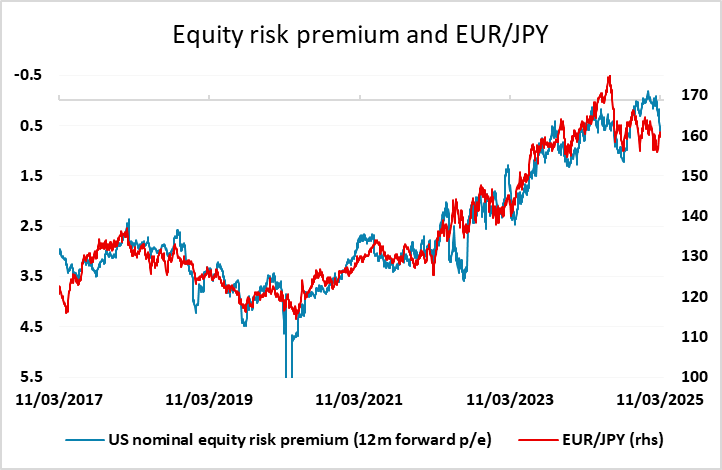

From a yield spread perspective the JPY still looks to have more scope for gains and is still likely to benefit from any rise in the US equity risk premium. EUR/JPY has recovered strongly in the last couple of weeks, but that has brought it back into line with the historic relationship with equity risk premia. From here, any further rise in risk premia, either due to equity weakness or lower yields, would tend to mean EUR/JPY reverses lower.

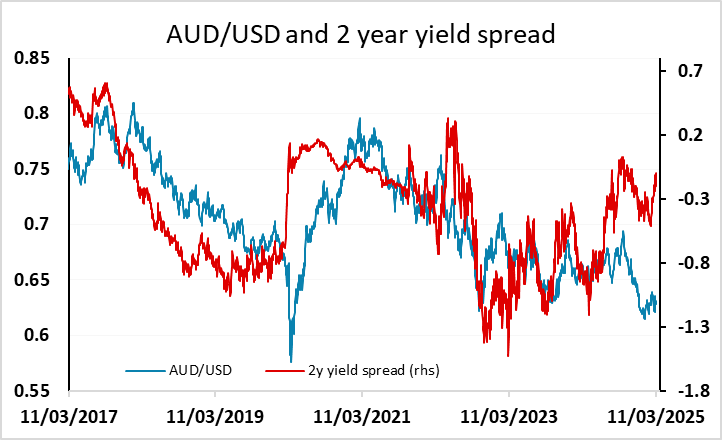

However, we also still see upside scope for the AUD. The concern for the AUD has usually been that it is vulnerable to any weakness in equities, particularly regional equities, but if that correlation is fading, there is less risk to long AUD positions. As it stands, the AUD still looks cheap relative to yield spreads, and Australia also looks at less direct risk from US tariffs, although it will also tend to suffer form any general decline in world trade. We see scope for another test up towards key resistance at 0.64 with potential to break substantially higher.