FX Daily Strategy: Europe, June 19th

Focus on UK CPI with BoE MPC meeting on Thursday

EUR/GBP may bounce a little if CPI doesn’t come in strong

JPY weakness getting even more extreme

CHF strength looking excessive

Focus on UK CPI with BoE MPC meeting on Thursday

EUR/GBP may bounce a little if CPI doesn’t come in strong

JPY weakness getting even more extreme

CHF strength looking excessive

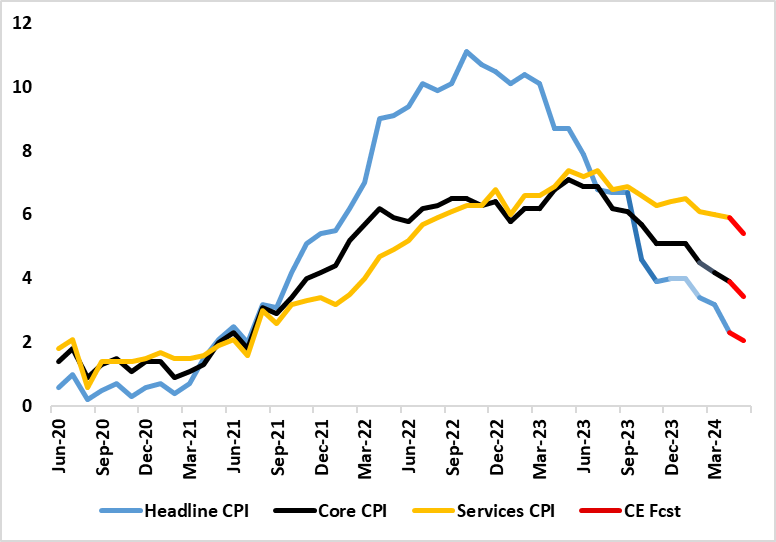

UK Headline and Core Inflation Drop to Continue and Services Less Resilient?

Source: ONS, Continuum Economics

UK CPI data is the highlight on Wednesday, providing the last piece of important data ahead of the BoE MPC meeting on Thursday. It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. But perhaps the CPI data is the most crucial especially with April’s signs of resilient services. Markets think there is no chance of a cut, but such a move cannot be completely ruled out after more soft labor market numbers. What the bar of acceptability is for the MPC in terms of the CPI picture is unclear; do they just have to hit the forecasts laid out in the recent Monetary Policy Report, or undershoot? The May numbers will be helped by favourable base effects and a belated drop back in services, and we see the headline down 0.2-0.3 ppt to 2.0-2.1% (the lowest since July 2021). Such an outcome would still be a notch above existing BoE forecasts, however, so are unlikely to be enough to convince the MPC to cut in June.

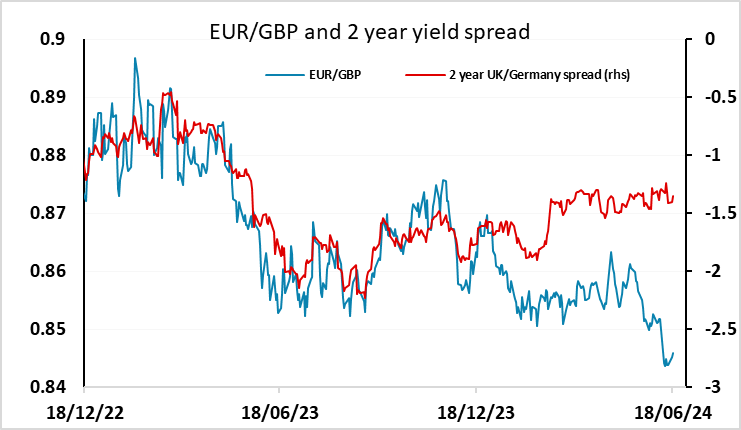

For GBP, the focus in the last week or so has been the French political picture after the surprise election announcement. EUR/GBP has fallen in response, hitting new lows for the year, even though there has been little change in market expectations of policy and consequently little movement in front end yield spreads. With market expectations of the French situation stabilising, there may now be scope for a bounce in EUR/GBP unless we see surprisingly strong UK data.

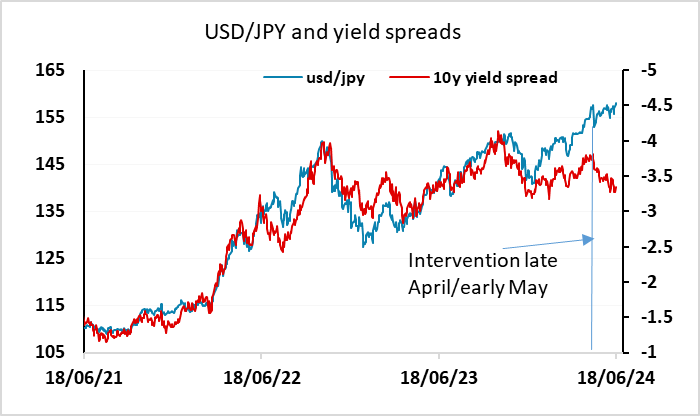

Otherwise, the US is on holiday on Wednesday so markets are likely to be relatively quiet. But the BoJ may have to be on watch given the weakness of the JPY which continued on Tuesday with new all time highs in CHF/JPY and USD/JPY and EUR/JPY both making significant gains in spite of narrowing yield spreads. It looks increasingly like the BoJ will have to act again if they are to break the JPY downtrend, but they are likely to be cautious partly because they don’t want the JPY to rally too sharply. The gains in USD/JPY since the intervention in late April/early May have come against a background of falling yield spreads, and a reconnection with the yield spread correlation would suggest a move back below 150. We expect this will happen in the coming months, and the BoJ will want it to, but they don’t want it happening all in one day.

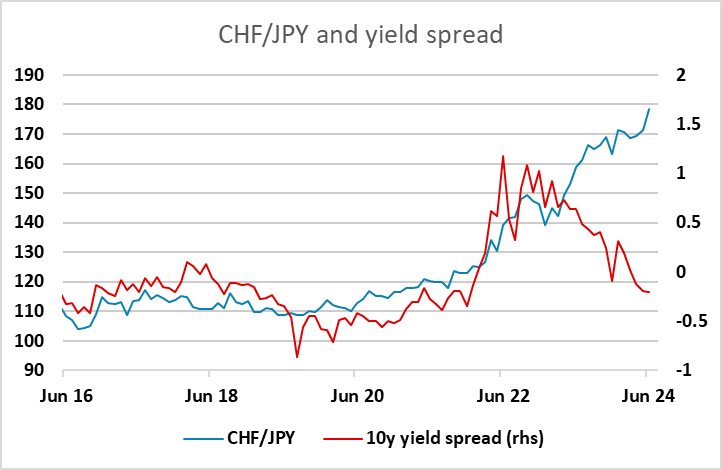

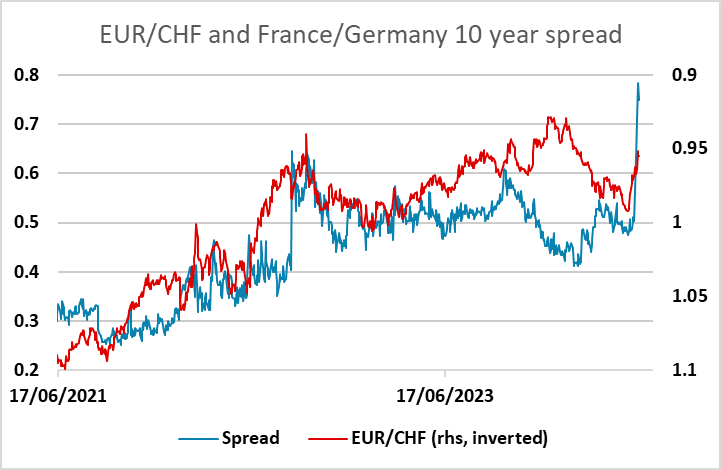

The new all time high in CHF/JPY seen on Tuesday was partly about JPY weakness and partly about CHF strength. CHF strength has been helped in the last week by the concerns about the French elections and the widening of the France/Germany yield spread, but this has stabilised in the last couple of days, so the dip below 0.95 in EUR/CHF looks a little overdone, especially with an SNB rate cut looking likely on Thursday. CHF/JPY, meanwhile, is at a level that is very hard to justify on fundamentals, as yield spreads have fallen to close to zero and CHF/JPY is up more than 56% in the last 4 years.