EUR, JPY flows: EUR little changed despite stronger EZ data, JPY weakens

Stronger French GDP suggests EUR upside scope. JPY weakening ahead of tomorrow's BoJ meeting

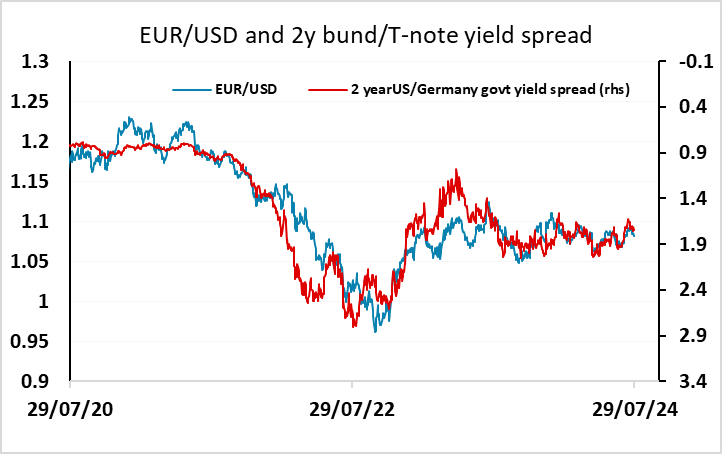

EUR/USD not much changed in early Europe, but the French GDP data have come in stronger than expected this morning, suggesting some upside risk for the EUR., despite weaker Spanish CPI. German CPI and German and Eurozone GDP later could yet trigger a move.

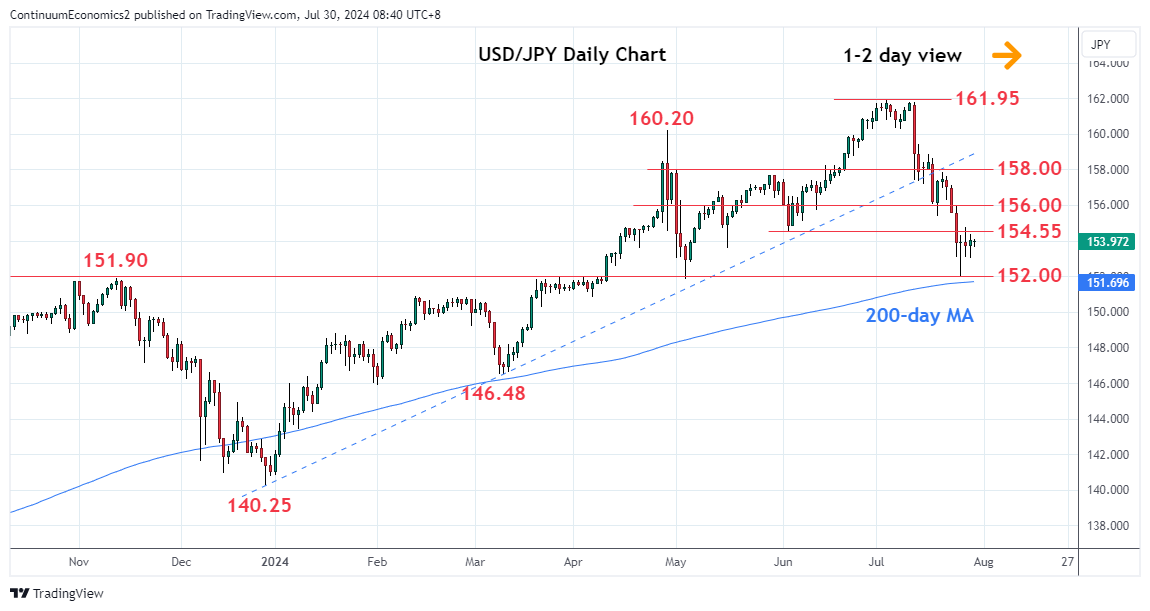

However, there has been a substantial move in USD/JPY, which has risen a big figure in the last two hours. This may reflect position adjustment ahead of the BoJ meeting tomorrow, and may also be end of month related. More than three-quarters of economist polled by Reuters expect the BoJ to stand pat on interest rates, whereas money markets are pricing in a 64% chance of a 10 bps hike. We are also in the no change to the policy rate camp, so there are downside risks for the JPY on the announcement. 10 year JGB yields have also fallen overnight, perhaps suggesting that the market is adjusting its view of the likely scale of reduction in JGB buying the BoJ will announce. However, the JPY decline is all within the parameters of a technical correction to the 10 figure decline in USD/JPY seen from early July, and while we see scope for a knee-jerk JPY sell off on the BoJ announcement, we would also see this as representing a medium and long term JPY buying opportunity.