FX Daily Strategy: APAC, December 9th

AUD still looks well supported into RBA

GBP could be impacted by MPC testimony

JPY may recover after earthquake

CHF could have more downside

AUD still looks well supported into RBA

GBP could be impacted by MPC testimony

JPY may recover after earthquake

CHF could have more downside

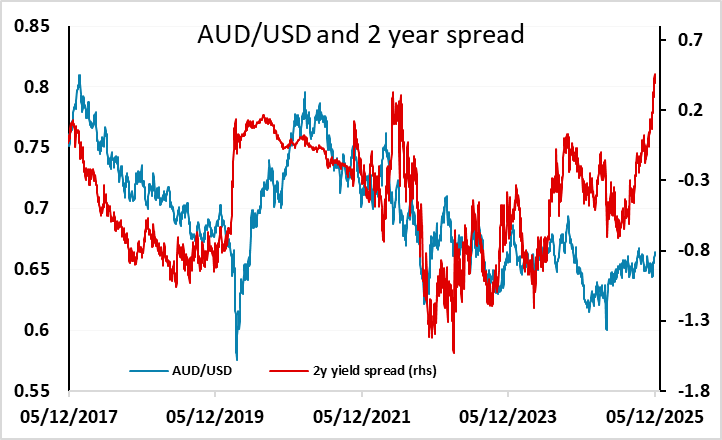

Tuesday kicks off with the RBA rate decision, which is not expected to produce any change in policy, and any move would be a huge surprise. However, with the AUD curve now pricing the next move in rates as up, there will be interest in any RBA commentary. The market is only pricing the first hike as coming in the second half of 2026, but the November Statement on Monetary Policy was based on one more rate cut in 2026, so currently looks out of line with the RBA’s official position. We doubt the RBA will be prepared to explicitly indicate that they expect to be hiking rates in 2026, but they also seem unlikely to restate an expectation of an easing. A neutral tone would probably not have much immediate AUD impact, but we continue to favour the AUD upside given the favourable yield spread moves we have seen this year., and as long as the RBA don’t indicate a preference for easing, the AUD can extend recent gains.

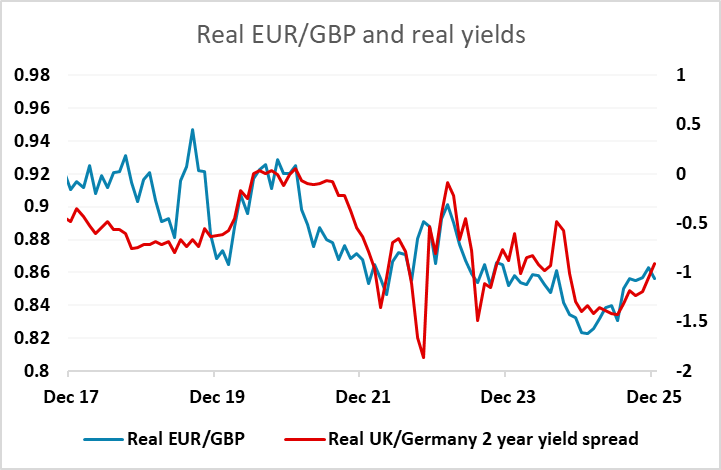

In Europe, there is testimony from UK MPC members Mann, Dhingra and Ramsden to the UK Treasury select committee on the November Monetary Policy Report. This could influence market thinking on both the likelihood of a December rate cut and prospects for monetary policy through 2026. In truth, Mann is a confirmed hawk and Dhingra a confirmed dove, so Ramsden’s comments should be the most significant. A December rate cut is 86% priced in, so it would take something hawkish from Ramsden to derail these expectations. But there is only one further cut priced by the end of 2026, so any comments about the likely landing spot for UK rate will be important. The current end-2026 level of 3.5% is on the high side relative to other major economies, and while UK inflation has been higher than most, there is evidence of recent decline, so we do see some scope for larger declines. If we hear anything along these lines, there could be some GBP downside.

There isn’t a lot else on the calendar, but the JPY will once again be in focus after losing ground on Monday on the reports of a big earthquake off the Japanese coast which triggered Tsunami warnings. At the time of writing we have no significant information on the impact, but it is rare that such events have a persistent impact on major economies. If Japanese nuclear facilities are unharmed, the JPY ought to be able to recover back to pre-earthquake levels.

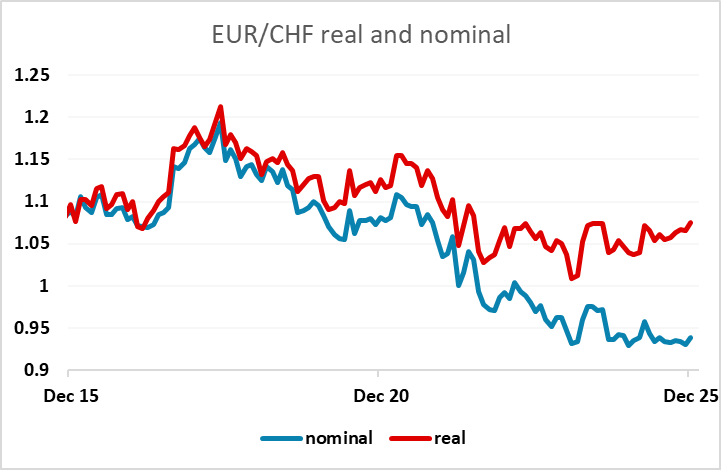

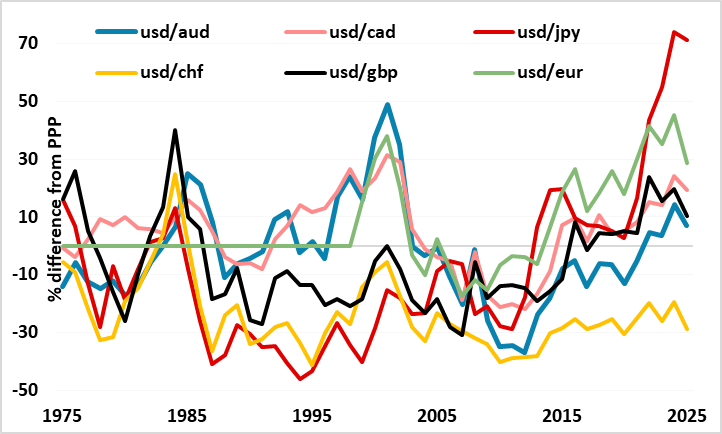

In fact, the JPY’s weakness on Monday was primarily against the USD which showed general strength, and the CHF was actually the biggest victim, with EUR/CHF reaching its highest since early September. This came even though risk sentiment turned somewhat lower through the session, and the CHF even lost a little ground against the JPY. How much more downside there is for the CHF is hard to judge, since in valuation terms it remains extremely expensive, and enjoys no yield support. However, its strength against the EUR is less extreme in real terms than it appears in nominal terms. Indeed, EUR/CHF in real terms is now the highest it has been since mid-2022. This doesn’t mean it can’t see further significant losses due to big picture valuation, but such losses against the EUR seem less likely if the EUR is falling against the USD.