FX Daily Strategy: N America, Sep 23rd

PMI data the focus but US data of limited interest

European data seen as more relevant

SEK resilient despite Riksbank rate cut

JPY weakness remains extreme

PMI data the focus but US data of limited interest

European data seen as more relevant

SEK resilient despite Riksbank rate cut

JPY weakness remains extreme

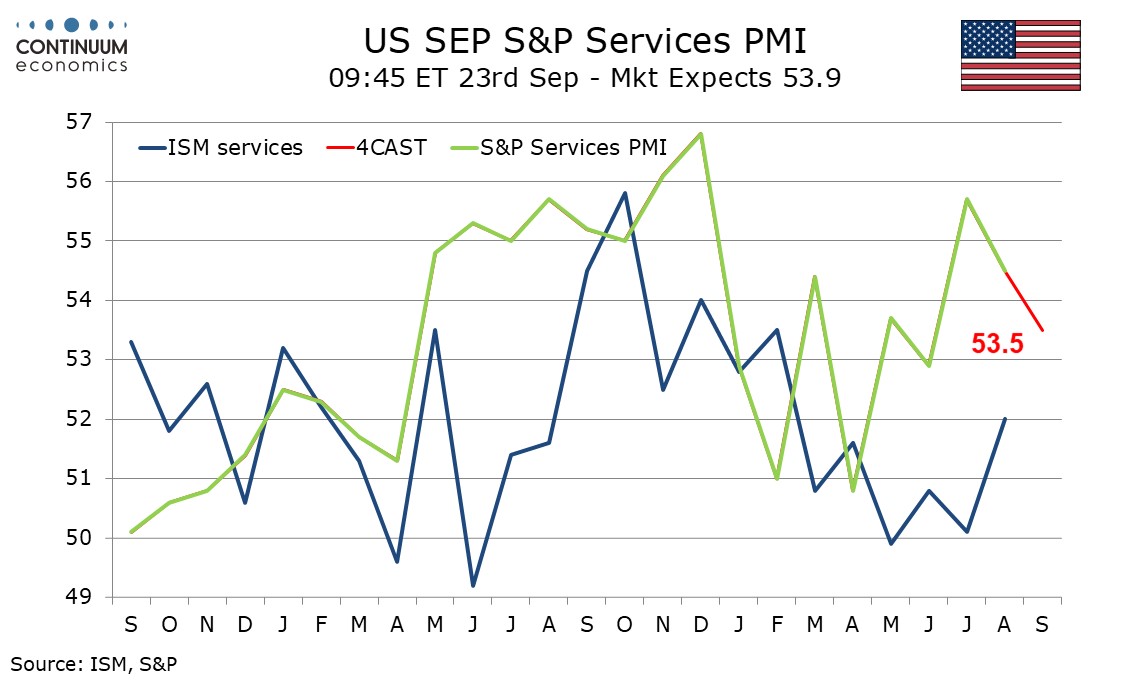

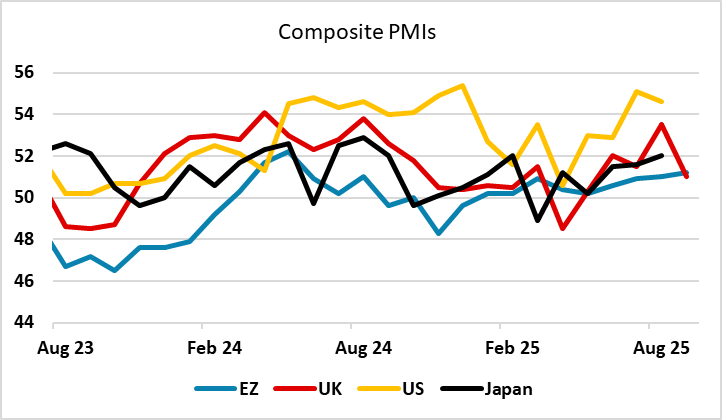

PMI data will be the main focus for Tuesday. The European numbers have been broadly steady in recent months, while the US (and UK) numbers have show significant gains. There is usually less focus on the US and UK data, largely because they are less strongly correlated with official measures of activity than the Eurozone data. Indeed, the UK manufacturing PMI has barely any correlation with the official manufacturing output data. In the US case, the ISM data has shown a much weaker picture than the S&P PMIs, so the S&P data has limited impact. We do expect to see some decline in the US and UK PMIs this month, and this may be mildly USD negative, but the impact is unlikely to be large.

Weaker UK PMI has seen EUR/GBP gain 20 pips after trading lower for much of the morning. Eurozone PMI has come in broadly in line with consensus due to the strength of German services, but there are weak aspects. New orders failed to maintain the growth seen in August and were unchanged over the month. Employment was also kept unchanged as business confidence dipped to a four-month low. Meanwhile, inflationary pressures softened, with both input costs and output prices increasing at weaker rates at the end of the third quarter. Still, for now the decline in the UK PMI will be taken as GBP negative and the EUR will hold firm due to the marginal improvement in the headline EZ PMI index. The UK PMI is not a reliable indicator so we would not ascribe too much significance to the numbers, and the year’s high in EUR/GBP at 0.8763 from July should hold.

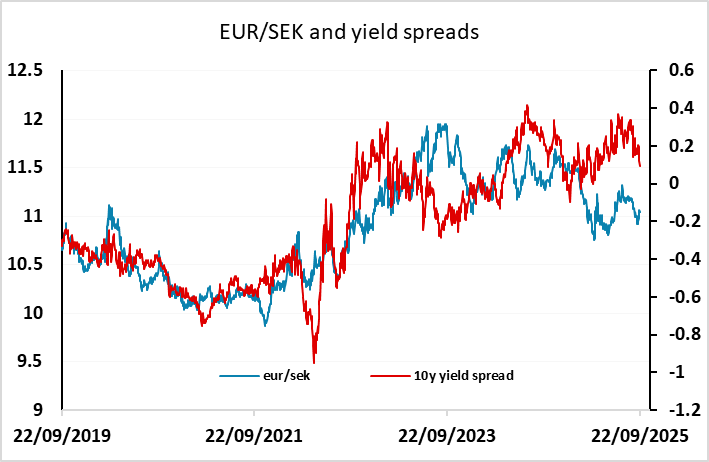

EUR/SEK is slightly lower in response to the Riksbank’s decision to cut rates 25bps at the latest meeting. The cut was a slight surprise, having been priced as only around a 35% chance ahead of the meeting. However, the Riksbank indicated that this is now likely to be the last cut for some time, with the next move likely to be a tightening in late 2026/early 2027. This has prevented a negative SEK reaction, as a cut had been fully priced in for the end of the year, and the tightening is now seen coming earlier. The Riksbank justified the cut in spite of the expansionary budget in part because the indirect tax cuts would reduce inflation next year, and while they would boost growth, growth is starting from low levels. EUR/SEK nevertheless has scope to edge a little higher having moved lower ahead of yield spreads this year, but gains are unlikely to be substantial.

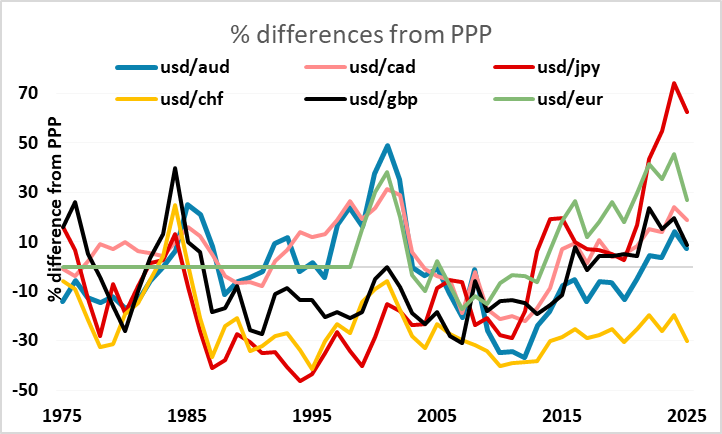

The general market tone remains quite sleepy, with a relatively quiet week for news. FX markets look quite stable, but we would continue to emphasise that this stability is coming at some extreme levels, particularly for the JPY, which made a new all time low against the CHF on Friday, and remains at extremely undervalued levels relative to all the majors. This is primarily a consequence of the low level of volatility and risk premia and the high level of the equity market. Quiet markets serve to sustain the status quo, but any pick up in volatility would increase the risk of a sharp JPY recovery.