JPY flows: JPY firmer o/n but little impact from BoJ

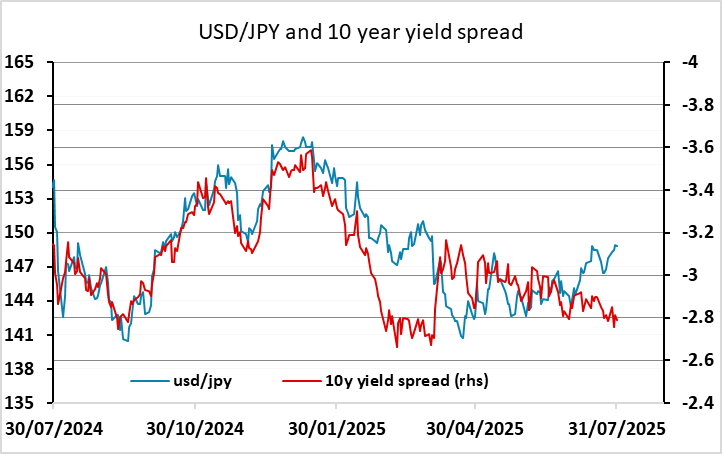

USD/JPY a little lower overnight but decline came pre-BoJ. Increase in inflation forecast maintains lieklihood of future tightening, but little indication that tightening is imminent.

The BoJ meeting was the main news overnight. There was no change in policy as expected, but the BoJ did raise their inflation forecasts and some are speculating that the chances of a rate hike in September or October have increased. However, money market rates haven’t risen to suggest any increase probability of a hike this year. The JPY gained ground overnight, but most of the gains came before the BoJ decision, so the market will be watching the Ueda press conference to determine whether there is a greater chance of a hike now that we have a US/Japan trade deal. Ueda has so far called the trade deal a significant step forward, but has also indicated that it could lead to a short term growth slowdown, so at this point we doubt there will be any indication that rates are likely to rise imminently.

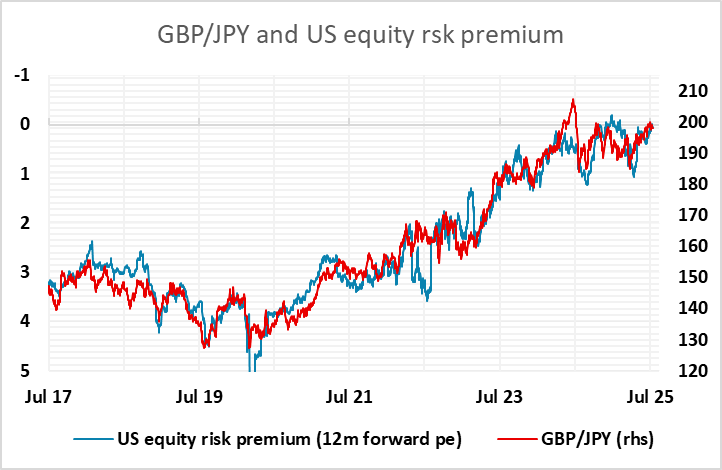

This likely means that the JPY wont get a significant short term boost, but we would continue to see upside scope for the JPY based on the current yield spread with the US and the likelihood of rising risk premia in the autumn which would typically mean JPY gains on the crosses.