EUR, JPY, GBP flows: JPY and GBP firm, EUR soft

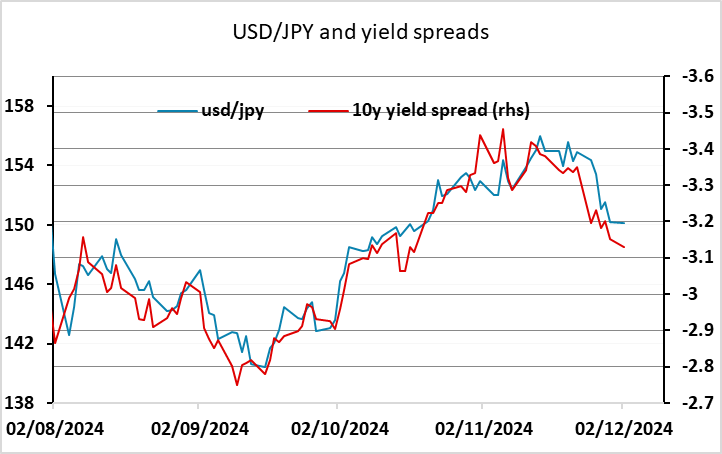

JPY strength continues, GBP gaining ground against the EUR

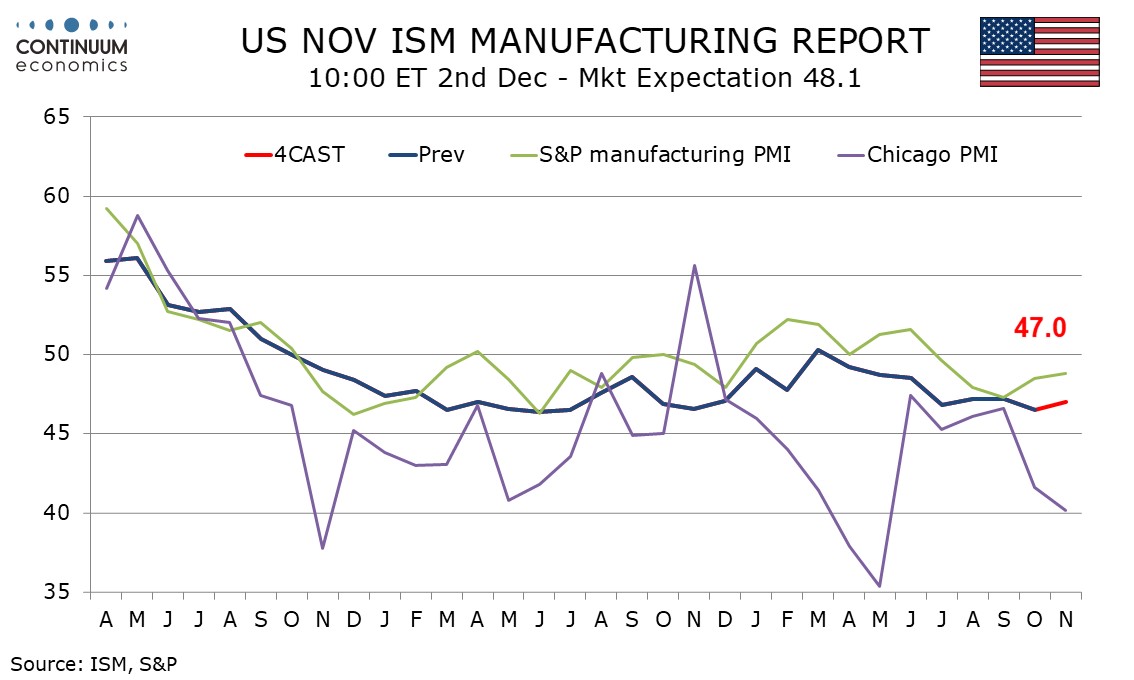

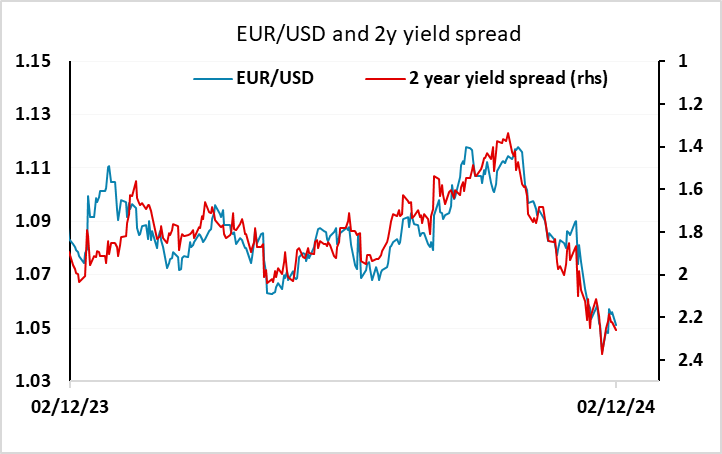

It’s a fairly blank calendar until the US ISM data later. The main trend in recent days has been JPY strength, with US and European yields dropping back while Japanese yields hold firm. EUR/USD looks close to fair based on the yield spread correlation, but risks look to be to the downside of the recent range, with a Fed hold still possible in December. The ISM manufacturing data later will be of interest after the strong US PMI data for November already released, but there will be more interest in the services ISM later in the week, although the US employment report takes centre stage.

USD/JPY still looks biased lower based on recent yield spread movements, but we wouldn’t expect major moves this side of the employment report in the absence of significant Fed comments or major geopolitical developments.

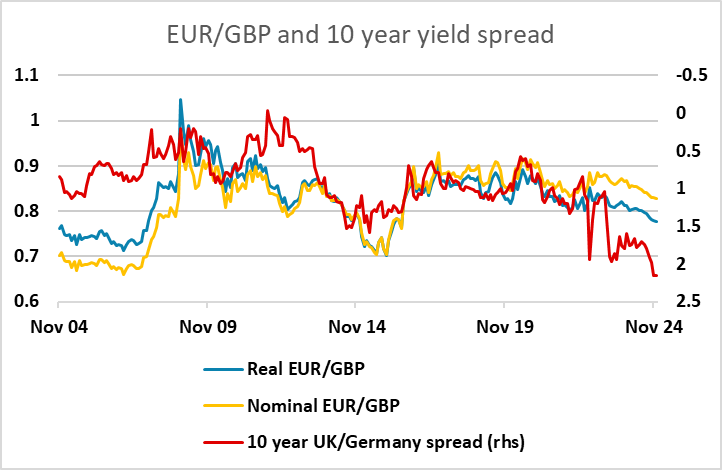

Early trading is seeing some GBP strength, with EUR/GBP testing recent lows in the 0.8260/70 region. This is more a function of EUR weakness than GBP strength, but EUR/GBP is trading above levels that look historically consistent with current yield spreads, suggesting there is further downside if there is seen to be less justification for a risk premium on GBP relative to the EUR.