JPY flows: JPY soft in early trade, crosses most attractive for JPY bulls

USD/JPY is close to fiar based on yield spread correlations, but CAD/JPY and CHF/JPY look vulnerable

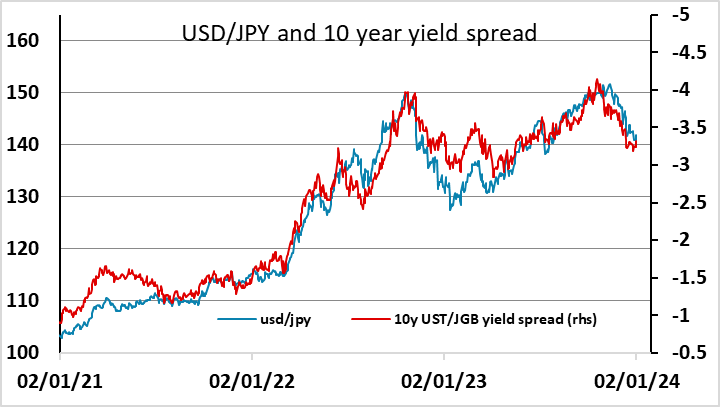

We probably aren’t going to see a lot of action ahead of the US employment report on Friday, but the early moves this morning are seeing some JPY weakness. While we expect the JPY to be the best performer this year, USD/JPY currently looks close to fair based on yield spreads, and the near term risks may be to the upside with the market pricing quite an aggressive Fed easing over the next year. While we see only a slightly smaller decline in the funds rate than the 150bps priced by the market this year, the near term risks may be to higher US yields if the data don’t show some weakness in support of rate cuts. While the Fed language did appear to pivot dovish at the last meeting, it’s hard to see more than the 150bps priced in for this year unless we see some significant data weakness.

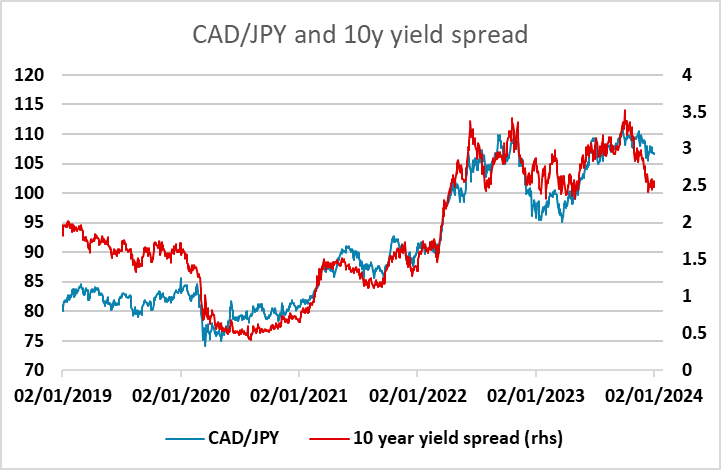

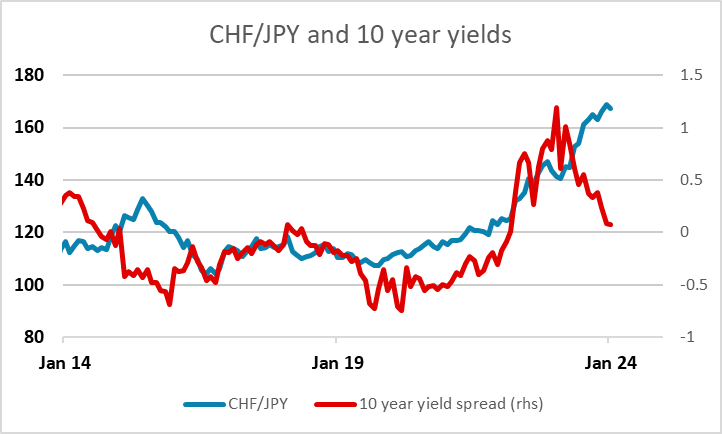

JPY bulls like ourselves may therefore prefer crosses. If we do see US yields tick higher, it is likely to undermine equity market sentiment and weigh on the riskier currencies. We see EUR/JPY as vulnerable to a turn in sentiment, but CAD/JPY and CHF/JPY looks the more clear-cut cross plays for JPY bulls. CAD/JPY has been well correlated with yield spreads in the last few years, and looks substantially out of line with current spreads, while CHF/JPY is a pure value play reflecting the similar risk characteristics of the CHF and JPY and the huge CHF/JPY rise in the last few years which has no support from yield spreads.