FX Daily Strategy: Europe, May 29th

EUR/USD may struggle to extend recent gains as ECB talks dovish

German CPI data may lead to market pricing more ECB rate cuts

SEK strength could extend as market takes Riksbank comments on board

AUD upside looks limited

EUR/USD may struggle to extend recent gains as ECB talks dovish

German CPI data may lead to market pricing more ECB rate cuts

SEK strength could extend as market takes Riksbank comments on board

AUD upside looks limited

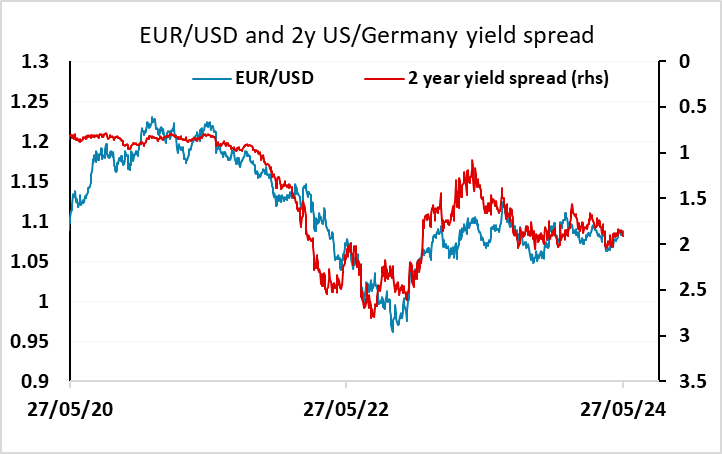

After a quiet start to the week Wednesday offers the first significant data in the form of German CPI, Eurozone money data and consumer confidence data from Germany, France and Italy. The Eurozone CPI data on Friday will be more important, but the German numbers normally give a strong lead. Comments this week from the ECB’s Lane and Villeroy suggest there is some confidence at the ECB that the inflation genie is back in the bottle, so that the second half of the year is likely to see more than one rate cut to follow the expected cut at next week’s June meeting. Softish German data would support this view, and there is still plenty of potential for more easing to be priced into the EUR curve, with just 58bps of easing currently priced by the end of the year. This suggests to us that for now, there isn’t likely to be a lot of upside for EUR/USD with the scope for Fed easing looking more restricted.

However, we also wouldn’t expect the pricing of more downside risks for rates to be hugely negative for the EUR. As the ECB’s Knot indicated on Tuesday, the risks to the Eurozone economy are receding, and if there is some evidence of this in improving money growth data it ought to help protect the EUR downside even if yields slip lower. The EUR will tend to benefit if equities perform well, particularly if the strength is greater in European equities, and that seems a likely scenario in the event of relatively softer Eurozone inflation coupled with evidence of relative improvement in Eurozone growth. So we may see a dip in EUR/USD as the market prices in more ECB easing, and this could come today if the German CPI data is soft, but there should be good support above 1.08 provided that European equities continue to perform solidly.

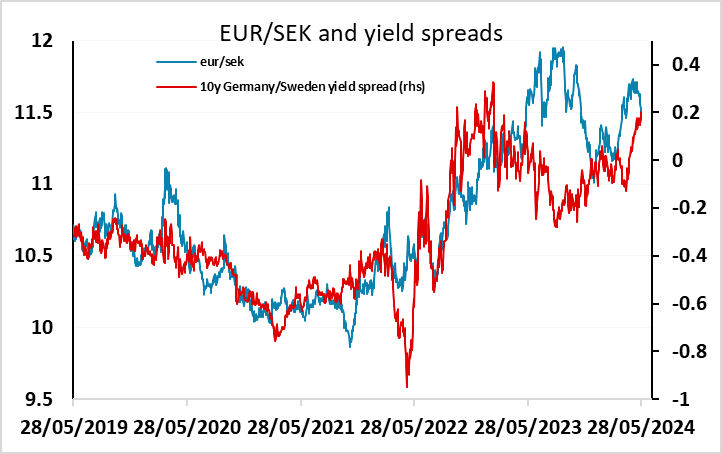

The SEK performed well on Tuesday after comments from Riksbank governor Theeden indicating that a June rate cut was unlikely following on the from the cut already seen in May. EUR/SEK dropped around 4 figures, but the market is still pricing a June rate cut as around a 33% chance, which looks too much in the wake of Theeden’s comments. EUR/SEK has fallen back into line with the historic relationship with yield spreads, but if the market reprices to no change in rates in June, there should still be more upside for the SEK and EUR/SEK might dip sub 11.40. Wednesday sees money supply, lending and retail sales data, but these are unlikely to provide reasons for renewed expectations of a rate cut.

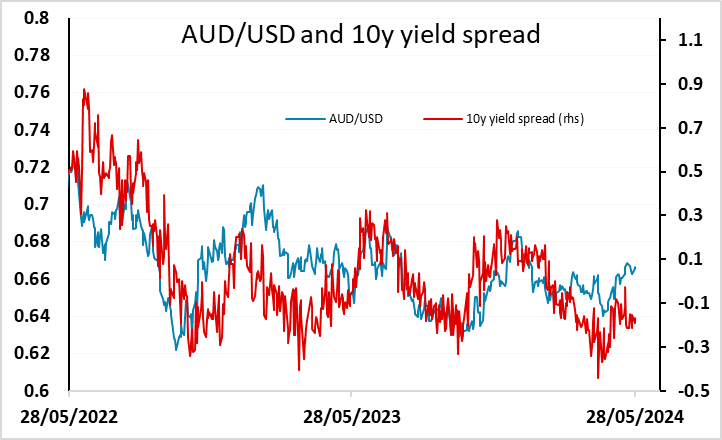

The AUD has started the week strongly, moving off support at 0.66 towards the recent highs above 0.67. Wednesday sees AUD data on business confidence trend CPI data, which might influence the market pricing of the next RBA move. Currently, yield spreads don’t really support further AUD strength, even with the market not pricing any RBA rate cuts until well into 2025, so we suspect the data will need to be on the strong side to sustain the gains seen this week.

The Australian April monthly CPI has come in higher than expected at 3.6% y/y. While it is not as comprehensive as the quarterly CPI, it is likely the q2 CPI will likely come in higher than expected and further delay the pace of cut. The level of inflation is still moderating towards RBA's target range of 3% and we are not forecasting the RBA to restart tightening for a small bump.