USD flows: USD little changed despite firmer CPI

USD reveses initial gains on CPI

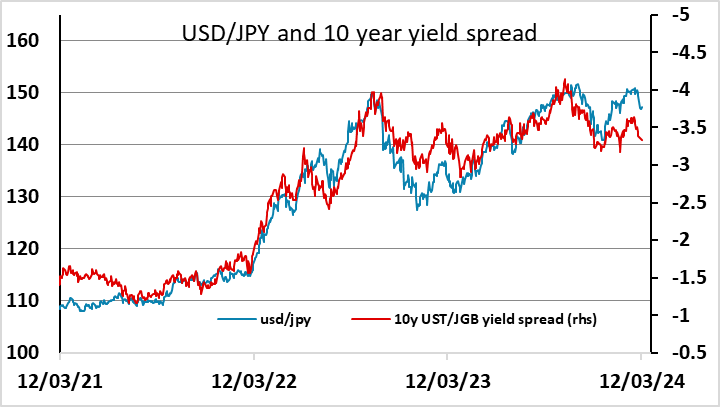

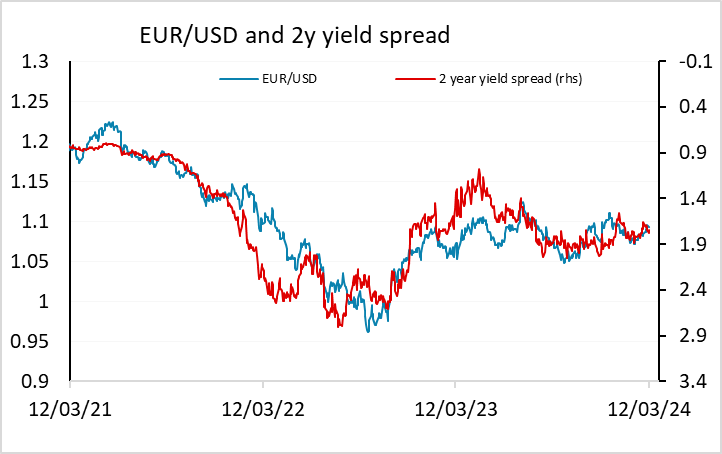

US CPI has come in stronger than expected at 0.4% for both core and headline CPI. The headline had been expected to rise 0.4%, but the headline y/y was also stronger than expected at 3.2%. However, the core was only just 0.4% - before rounding it was 0.358%, so the data is less strong than it appears. Even so, this second consecutive 0.4% rise in core will be of concern to the Fed. The market response has been minimal, with the initial USD rise quickly reversed and no significant change in US yields. USD/JPY has actually started to edge lower, perhaps reflecting rising expectations of BoJ tightening. But the USD should still gain some support against the EUR and the riskier currencies as this data still makes it hard to see the Fed easing this year by more than the three 25bp cuts indicated by the dots at the December meeting, and the market is currently pricing in nearer four than three cuts. Even against the JPY, a proper test of the main support levels below 146.50 is unlikely without some clear news out of Japan. EUR/USD risks remain slightly lower, with a break back below 1.09 possible.