FX Daily Strategy: APAC, January 15th

US and UK CPI the main focus

USD biased lower given the strong post-election performance and minimal Fed easing now priced in

GBP also has downside risks as inflation daa should support a more dovish BoE view

US and UK CPI the main focus

USD biased lower given the strong post-election performance and minimal Fed easing now priced in

GBP also has downside risks as inflation daa should support a more dovish BoE view

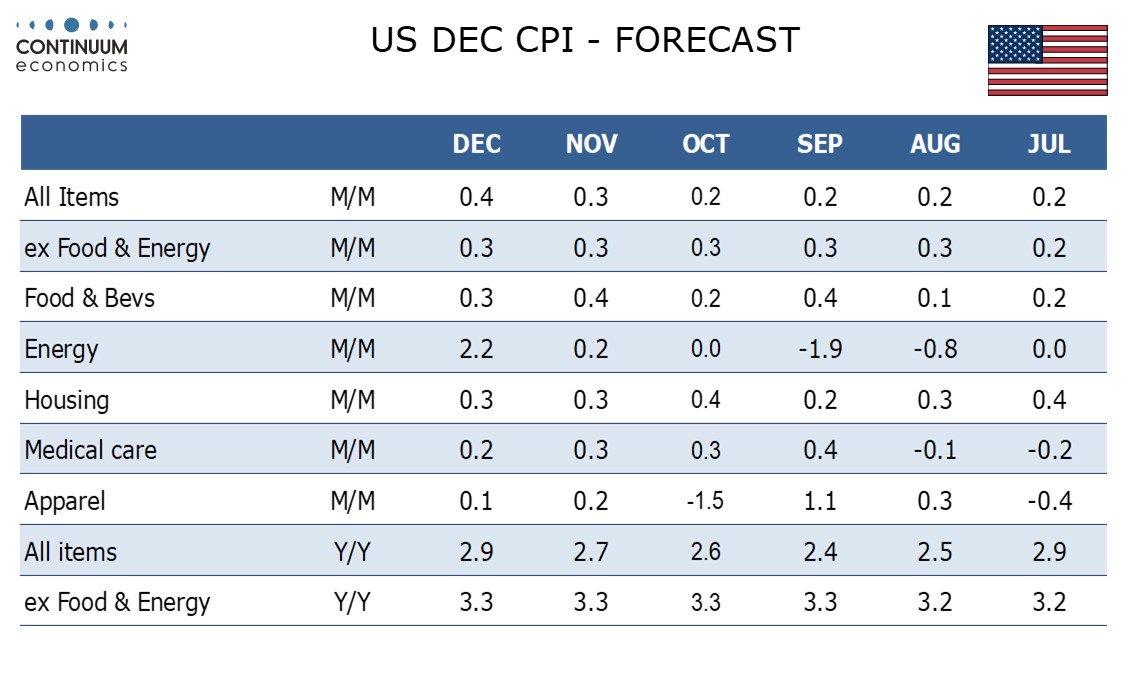

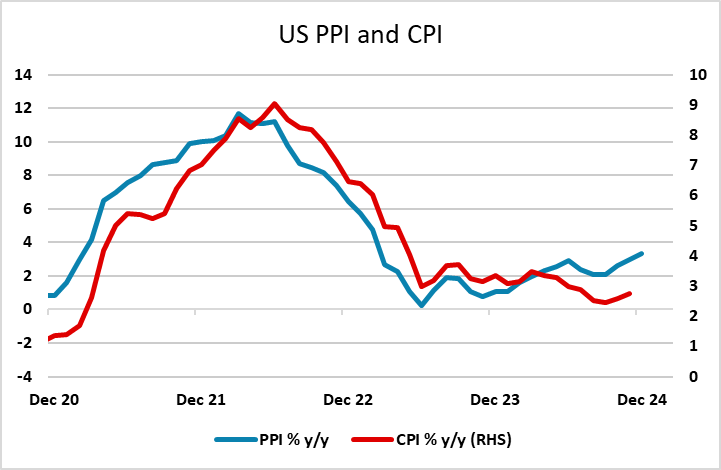

US and UK CPI will be the main focuses on Wednesday. We expect December’s CPI to increase by a nine-month high of 0.4% overall with a fifth straight 0.3% increase ex food and energy. We expect the ex-food and energy index to increase by 0.26% before rounding, which would make it the softest of the five straight 0.3% gains in the core rate. However, this is still above the market consensus of a 0.2% rise, although the consensus is also looking for a 0.4% rise in the headline. While the PPI data was weaker than expected on Tuesday, PPI is not a reliable guide to CPI on a month/month basis. The rising y/y rates on PPI if anything suggest some upside risks to CPI.

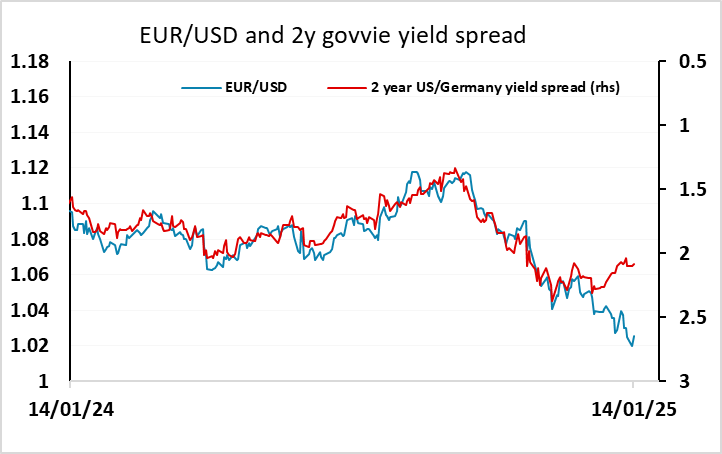

As expected CPI data might be mildly USD negative, as the market continues to price in a hawkish view of the Fed that requires data to be on the strong side of consensus to justify it. However, our forecast is marginally above consensus so should see the USD at least hold its own. Even so, we see the USD strength since the election as being somewhat overdone, and with yield spreads pointing towards a lower USD despite the rise in short dated US yields, it looks difficult for the USD to extend recent gains unless the data is clearly strong and drives US yields higher. Even then, we saw after the employment report that while this may support the USD against riskier currencies, the equity market looks unable to absorb any further rises in yields so that the equity impact of strong data could turn out to be positive for the JPY.

Before the US data we have the UK CPI data, with the market looking for headline CPI to be steady at 2.6% y/y and core CPI to edge lower to 3.4% y/y. But the December figure will be driven by higher petrol costs and the headline may mask a drop in both the core and services inflation, thereby providing a more reassuring message than the November data. Exceeding both our and BoE thinking, November CPI inflation jumped 0.3 ppt to 2.6%, an eight month high. Services inflation remained at 5.0% while the core rose 0.2 ppt to 3.5%, also exceeding Bank projections.

UK CPI slowing in recent months

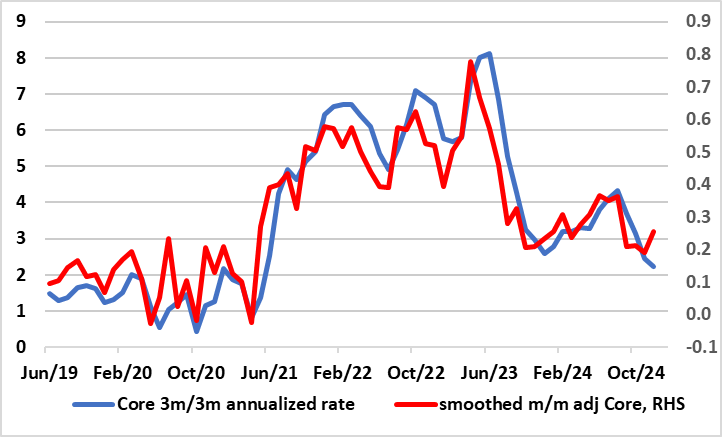

lear Adjusted Core Inflation Drop Continues?

Source: ONS, Continuum Economics

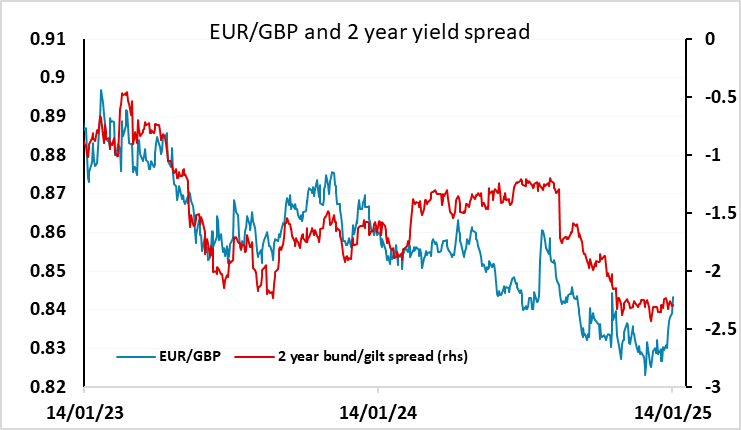

However, looking at the CPI details, adjusted data painted a much softer picture than base-effected y/y numbers and may do likewise in the upcoming figures (see chart). While the y/y services inflation data are still likely to be well above desired levels, most of this is due to base effects, and the recent data shows annualised services inflation near the 3% area, which is consistent with the inflation target given the tendency of services inflation to run ahead of goods inflation. GBP has been trading on the soft side in recent sessions, despite rising UK yields, which has been seen by many as an indication of a loss of confidence in the UK economy. This may be the case, but GBP is starting from historically high levels against the EUR due to high levels of UK yields. We anticipate lower UK yields at the front end of the curve as the market prices in more BoE easing in the next couple of years, and this suggests that GBP has further downside scope.

lear Adjusted Core Inflation Drop Continues?