FX Daily Strategy: Europe, July 25th

JPY focus on Tokyo CPI

Potential for earlier BoJ easing to be priced in

GBP could be at risk on retail sales data

EUR supported by Lagarde comments

JPY focus on Tokyo CPI

Potential for earlier BoJ easing to be priced in

GBP could be at risk on retail sales data

EUR supported by Lagarde comments

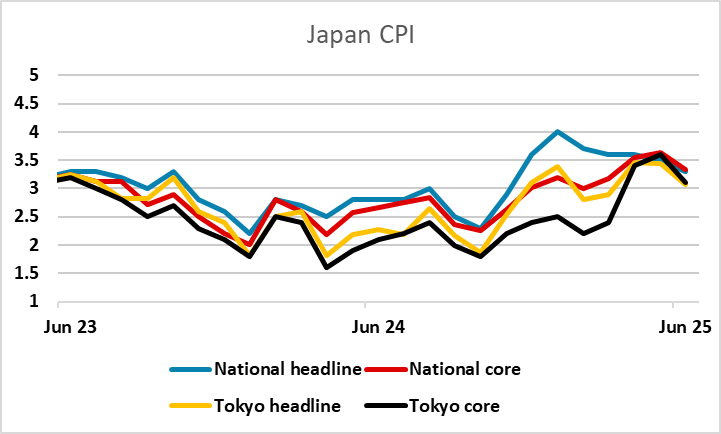

Friday sees some potentially significant data, starting with the Tokyo CPI data from Japan, which is effectively the equivalent of preliminary CPI for July. After the trade deal with the US was announced, Japanese yields rose as the market saw this as suggesting an improved economic picture as removing a barrier to BoJ tightening. CPI has been holding above target for some time, and the July data is expected to stay well above target at 30%, albeit easing a little from 3.1% in June. Nevertheless, it is clear that real rates are too low here from a long term perspective, and if CPI holds near 3% there is a good chance of a BoJ tightening as early as the September meeting, provided there is also evidence of wage growth picking up.

An once again all y/y measures remain elevated with ex fresh food at 2.9% and ex fresh food & energy at 3.1%. While it does implicate a certain level of moderation, the inflationary pressure is above BoJ's target of 2%. With trade uncertainty fading into the backdrop, BoJ's hands could be untied. Yet, the forward guidance in the July meeting is unlikely to change along the inflation forecast revision.

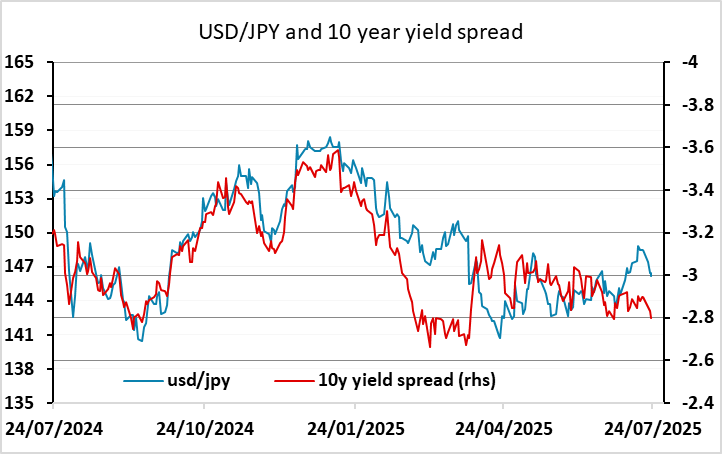

As it stands, the market is only pricing around a 30% chance of a September hike, so we do see some upside risks for the JPY, although there is already a case for a stronger JPY based on yield spreads. It continues to be the resilience of equity markets limiting the JPY upside, so while domestic factors could argue for a decline in USD/JPY, we are unlikely to see much of a move unless there is also general USD weakness or a significant decline in risk sentiment, neither of which looks likely to be triggered by any of Friday’s scheduled events.

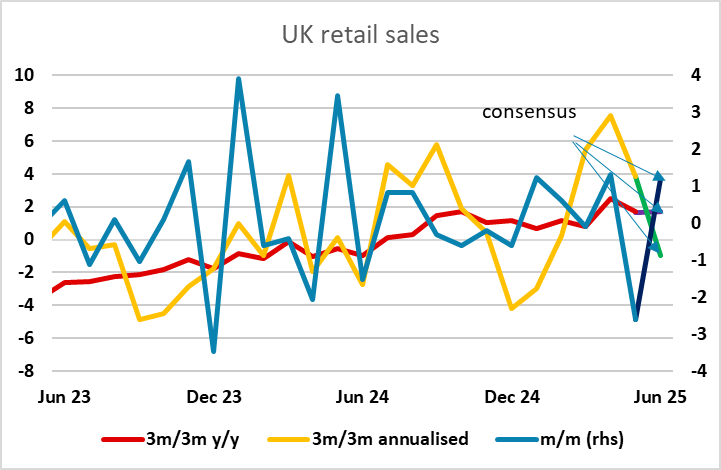

UK retial sales could also be of interest, as the May data saw a very sharp declne of 2.7% m/m, and another weak number could create real concerns about the health of the UK consumer. The market consensus is for a strong rebond of 1.2%, and the underlying trend at the moment still looks healthy, and would remain reasonably healthy if we saw that sort of rise. However, anything less than a 1% rise would suggests a weakening trend and increase expectations of early BoE easing, suggesting some downward pressure on GBP.

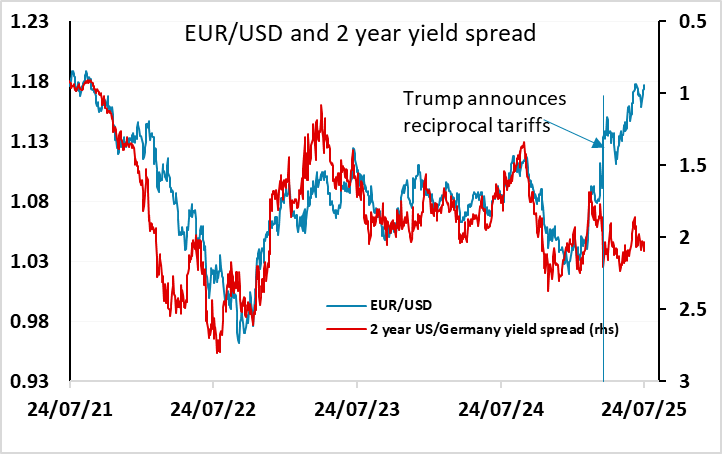

The German IFO survey is unlikely to be of major interest after the PMI data showed a marginal improvement. However, there was a significant move in EUR yields on Thursday. Lagarde sounded more hawkish than expected at the ECB press conference, particularly with her comment that she would not exclude a shift to considering rate rises. Front end EUR yields were up more than 10bps on the day and the market is now no longer fully pricing another rate cut this year, with this being priced as just a 60% probability by December. The EUR rallied on the statement, gaining across the board, but EUR/USD hasn’t been particularly rate sensitive of late, so the upside for the EUR may be more clear cut against the CHF, GBP and scandis.