FX Daily Strategy: APAC, February 23rd

IFO unlikely to have much impact on the EUR

EUR dip on Thursday may well be temporary if equities stay firm

ECB easing expectations may pick up come the March meeting

JPY cross weakness may extend as equity risk premia continue to decline

IFO unlikely to have much impact on the EUR

EUR dip on Thursday may well be temporary if equities stay firm

ECB easing expectations may pick up come the March meeting

JPY cross weakness may extend as equity risk premia continue to decline

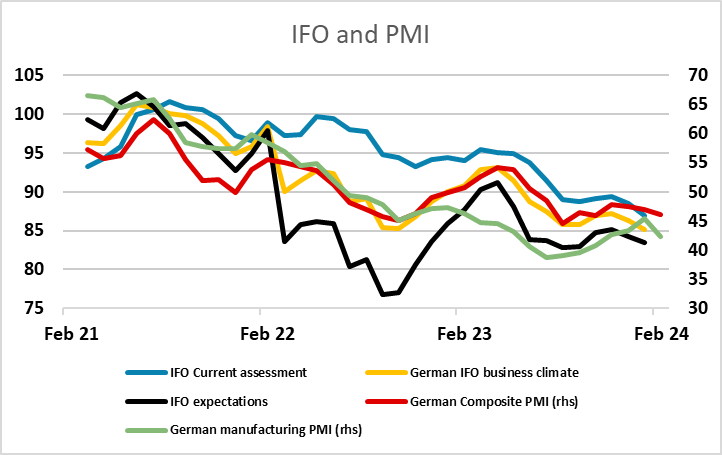

Friday is another quiet day for data, but the German IFO survey will attract some attention, even though its thunder tends to be stolen by the PMIs already released. However, while the IFO business climate index had essentially mirrored the composite PMI for the last 18 months or so, the IFO data rather underperformed in January. The market consensus of a small increase in the index would mean some closing of the gap created in January, but the impact on the EUR is likely to be minimal, in part because the German data have not been a good representation of the Eurozone as a whole in recent months. The PMIs highlighted this, with the German composite PMI falling even though the Eurozone PMI rose.

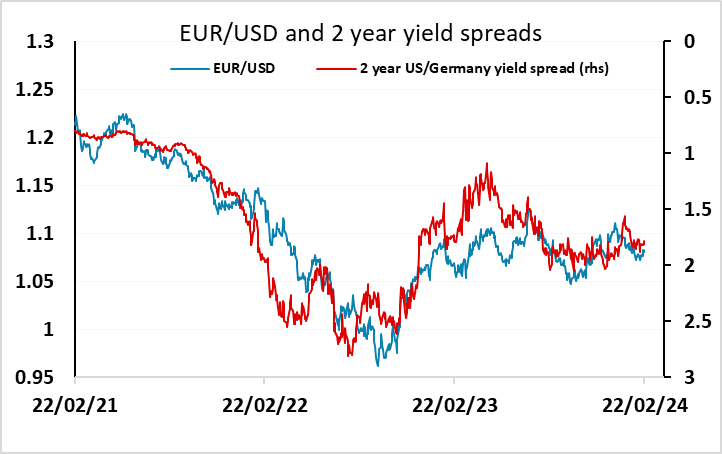

In any case, the EUR’s fortunes continue to depend as much or more on the performance of global and European equities as on the European data. Our short term model for EUR/USD suggests there is still some further upside scope because of the strength of global equities and the outperformance of European equities in the past week. The USD remains negatively correlated with equity strength, particularly when US equities underperform. While the US managed general gains on Thursday, helped by the decline in the latest jobless claims data, the lack of any widening of yield spreads in favour of the USD suggests to us that the dip in EUR/USD will prove temporary.

Things may change going forward if EUR yields start to show expectations of relatively more rapid ECB easing as seems to be justified by the relative performance of US and European economies. The account of the January 24-25 ECB Council meeting on Thursday was interesting is anticipating some downward revision to growth and inflation projections at the looming Mar 7 meeting. While the account regarded it premature to discuss easing, this was only by consensus, implying a minority wanted such a debate. This is not surprising given the manner in which important data is both highlighting an ever clearer disinflation process and underscoring the manner in which policy tightening is still to bite anywhere near fully. The debate next month may be much more biased towards a very clear easing discussion, and if this is clear in the statement, the EUR may suffer some weakness. But for now the lack of movement in USD/EUR yield spreads and the strength of European and global equities makes it hard to see much EUR/USD decline, and the upside is favoured from 1.08.

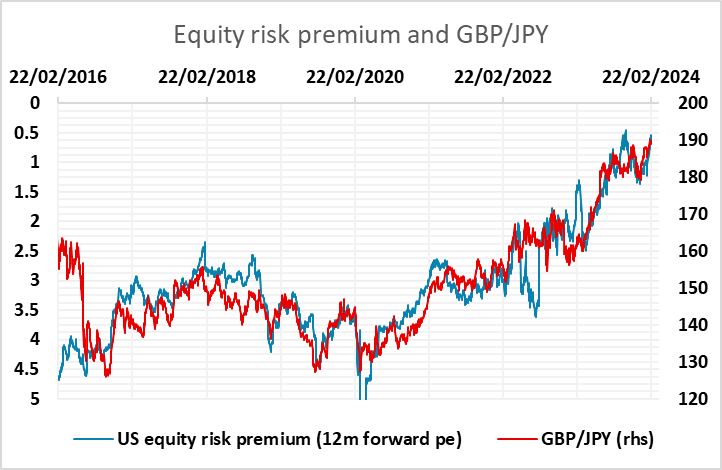

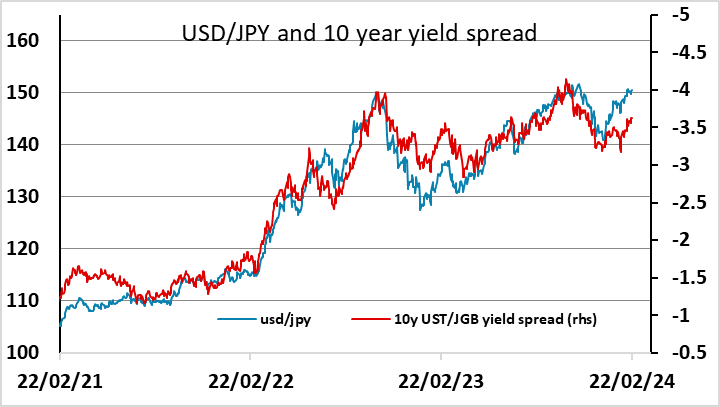

JPY weakness was a feature on Thursday, starting in Asia with many of the JPY crosses making new multi-year highs, including AUD/JPY, CAD/JPY and GBP/JPY, which hit their highest levels since 2014, 2008 and 2015 respectively. However, by the end of Thursday the JPY had managed something of a recovery on the crosses, even though equities had continued to make gains. The JPY has continued to move lower with equity risk premia this year, and the strength of equities through Thursday while yields edged higher implied further declines in equity risk premia, which might have been expected to trigger more JPY weakness. But USD/JPY continues to look stretched relative to yield spreads, and there has been sufficient jawboning from the MoF and BoJ to make USD/JPY bulls nervous. JPY cross weakness looks more likely to come via USD declines against the riskier currencies than more USD/JPY gains. But the USD made general gains after the jobless claims data on Thursday, triggering a correction to earlier JPY cross weakness. Even so, as we note above, we doubt the USD gains seen on Thursday will be sustained unless we see some decline in equities.