FX Daily Strategy: Europe, November 27th

US data unlikely to have a big impact with market moving mostly on Trump speculation

CAD may recover on pre-Thanksgiving position squaring

AUD/NZD has upside scope even though RBNZ unlikely to cut more than 50bps

Eurozone CPI data a focus ahead, with the USD biased a little lower in general

US data unlikely to have a big impact with market moving mostly on Trump speculation

CAD may recover on pre-Thanksgiving position squaring

AUD/NZD has upside scope even though RBNZ unlikely to cut more than 50bps

Eurozone CPI data a focus ahead , with the USD biased a little lower in general

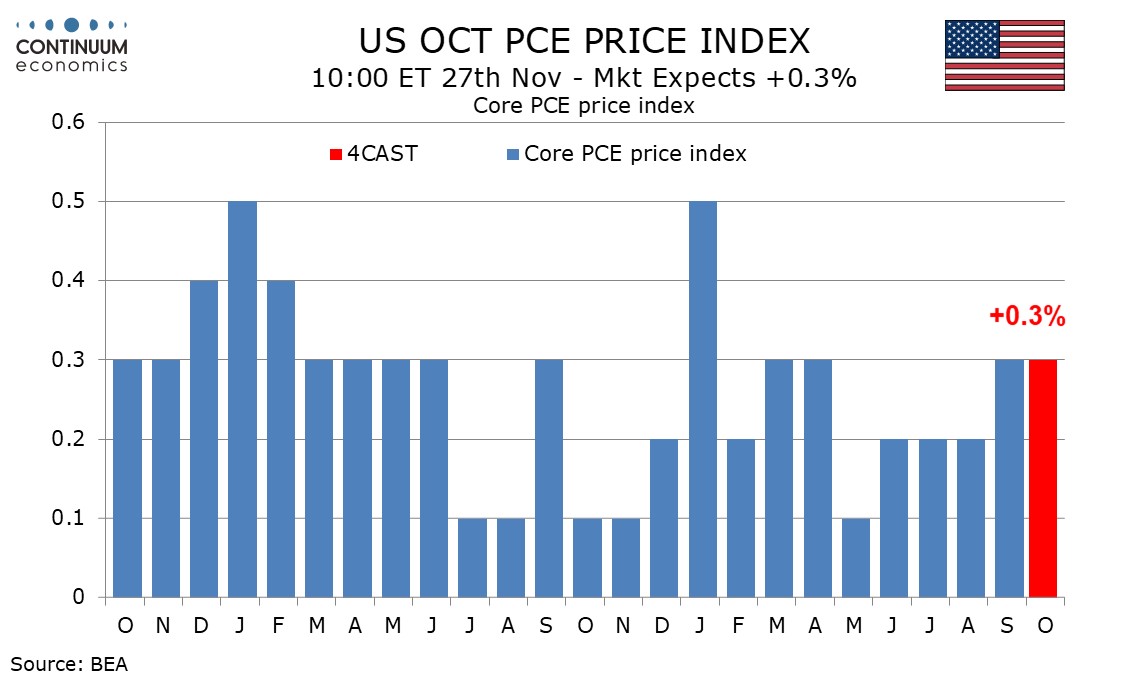

Wednesday sees a bunch of US data, most of which is second order of importance. Probably the core PCE price index will be the most closely watched. October’s CPI increased by 0.2% with a 0.3% rise ex food and energy, matching the gains of September. While PCE prices tend to underperform the CPI they matched the CPI in September and we expect they will again. However, this is also the market consensus, so we wouldn’t expect a large reaction.

We expect a marginal upward revision to 2.9% in the second (preliminary) estimate of Q3 GDP from an already healthy first (advance) estimate of 2.8%. We expect October durable orders to increase by 1.0% overall following two straight modest declines with a 0.4% increase ex transport. This would be a third straight rise, if slightly slower than in the preceding two months. So in general we see the data as being USD supportive. However, to some extent all the data is seen as slightly old news, with the focus much more on what will happen next year with the Trump administration and the potential for significant tax cuts and tariff increases. The plan for big tariffs on Mexico and Canada Trump announced on Monday is potentially quite negative for all three economies, and while it was initially USD positive, USD gains have only been sustained against the CAD and MXN. So for now we wouldn’t expect much impact from the data, and are reluctant to assume that the Trump plans will have positive impact on the USD, especially since it is far from clear what will be implemented.

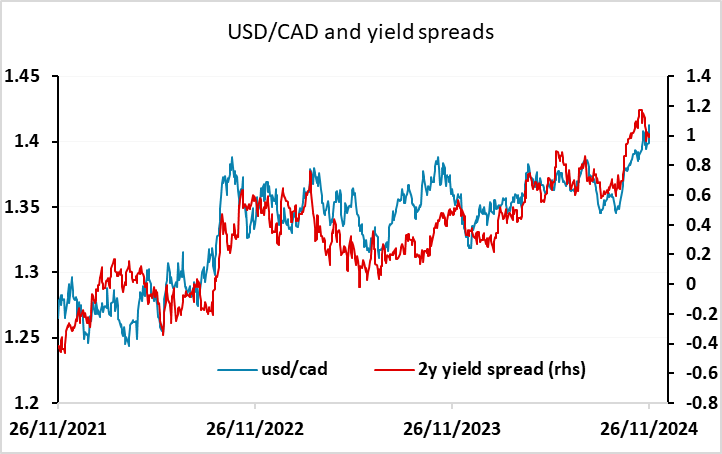

With Thanksgiving approaching, Wednesday may therefore be driven as much by positioning as by news. In FX, USD/CAD is the most extended speculative position according to the CFTC data, and the data from last Tuesday probably doesn’t capture the full extent of CAD shorts. The risks for USD/CAD may therefore to the downside, with yield spreads having edged in the CAD’s favour in recent days.

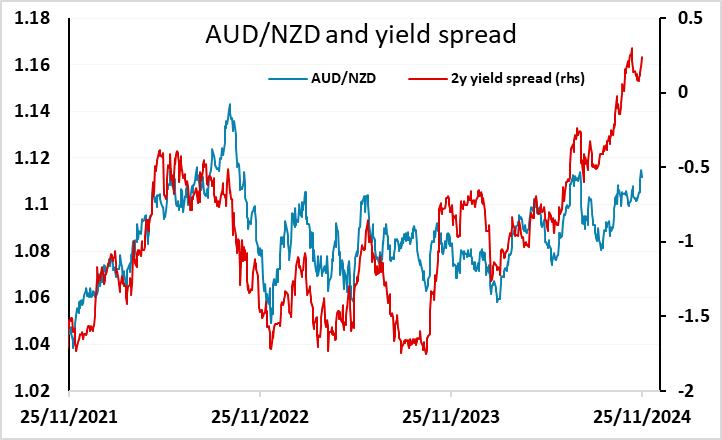

Elsewhere, the RBNZ monetary policy meeting is the first significant event of the day. A 50bp rate cut looks much the most likely outcome, although the market is pricing a risk of an even bigger cut. This seems a little far-fetched, but may mean that the NZD manages a modest rally if the policy rate is cut 50bps as expected. But we continue to see upside scope for AUD/NZD as yield spreads have moved substantially in the AUD’s favour in the last few months with thus far only modest benefit to the AUD.

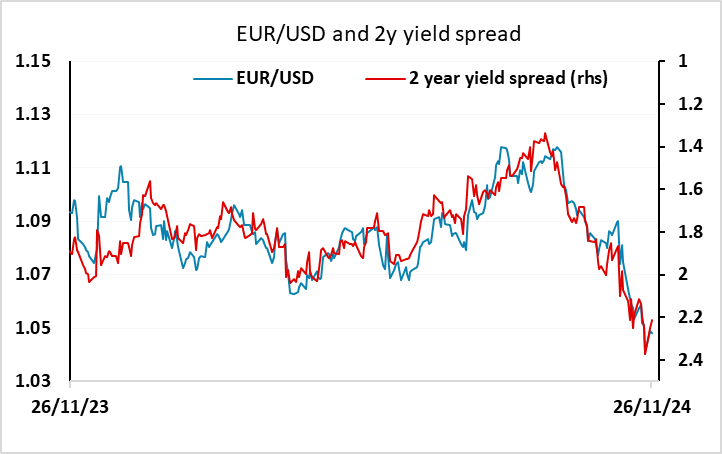

As far as the majors are concerned, preliminary November CPI data from Spain and Germany will be the focus for the EUR this week, out on Thursday. The market is currently pricing a 25bp ECB cut as around a 65% chance against 35% for a 50bp cut, so there is potential to move either way on strong or weak CPI data. Yield spreads suggest there is some USD downside as yields haven’t fully recovered from the dip seen after the announcement of Bessent as the Treasury secretary nomination. The JPY continues to look the most undervalued, both fundamentally and relative to current yield spreads, but there is also some upside scope for the EUR and we would favour the USD downside unless the CPI data is strong.