FX Daily Strategy: Europe, July 31st

BoJ kept rates on hold as expected

JPY upside favoured as equities edge lower

EUR still has potential to correct lower

AUD weakness should fade as we approach 0.6400

BoJ kept rates on hold as expected

JPY upside favoured as equities edge lower

EUR still has potential to correct lower

AUD weakness should fade as we approach 0.6400

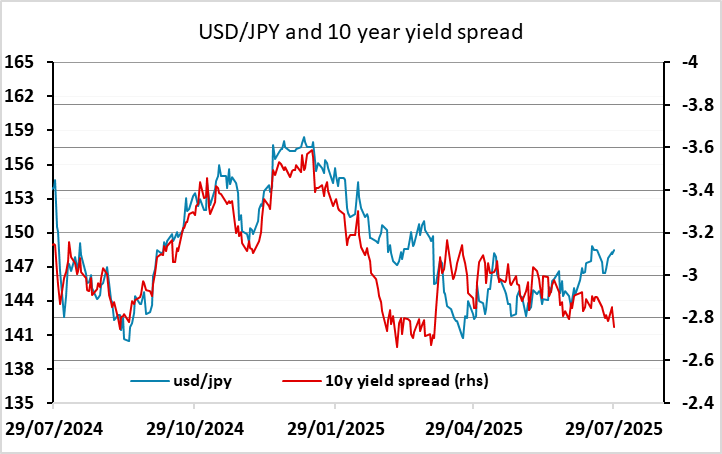

The BoJ meeting is the most significant event for Thursday. While no-one expects any change in policy, it’s clear that Ueda wants to raise rates at some point if the economy allows it, and the trade deal with then US reduces uncertainty and brings a rate hike closer. At the moment, there isn’t enough information on the impact of the tariffs for the BoJ to be comfortable raising rates, but it is conceivable that there will be by the time the next meeting comes around in September. As it stands market pricing is a little odd, suggesting only 4bps of tightening are priced in for the September 19 meeting, but 15bps for October 30 and 19bp for December 19. This both looks to be too little priced in in total, given the BoJ’s desire to raise rates, and too much favouring of the October meeting. We see scope for Ueda to sound more hawkish in this meeting and for the market to increase the possibility of a September hike and also to see generally tighter policy.

As expected, BOJ leaves rate at 0.5% as expected with inflation forecast revised higher. Core CPI for 2025 is revised to 2.7% from 2.2%, 1.8% in 2026 and 2% in 2027; while core-core is revised to 2.8% from 2.3%, 1.9% in 2026. The inflation forecast suggest the BoJ will be in no rush to tighten multiple times with 2026 revision remain below 2%.

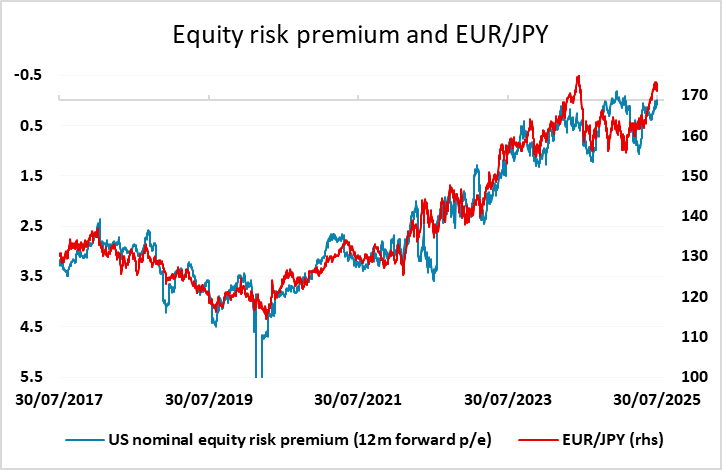

As it stands, USD/JPY has been rising on the back of the general USD recovery on the trade deals, but the case for USD/JPY gains is far weaker than the case for a EUR/USD decline. While the USD suffered against the EUR after the April tariff announcement, substantially underperforming the usual yield spread relationship, the USD has outperformed yield spreads against the JPY. Much of this is due to the resilience of equity markets, with the JPY still suffering on the crosses when risk premia decline. However, the softer equity tone in the last couple of days is allowing some decline in EUR/JPY and other JPY crosses, and as these pairs turn so there is more scope for USD/JPY to reconnect with yield spreads. It is possible that Ueda is underwhelming, and the market maintains the current view of BoJ policy, but we don’t see much chance of him showing a more dovish stance. If he is neutral we wouldn’t anticipate much change in USD/JPY, but there looks to be a significant risk of JPY gains on a more hawkish Ueda.

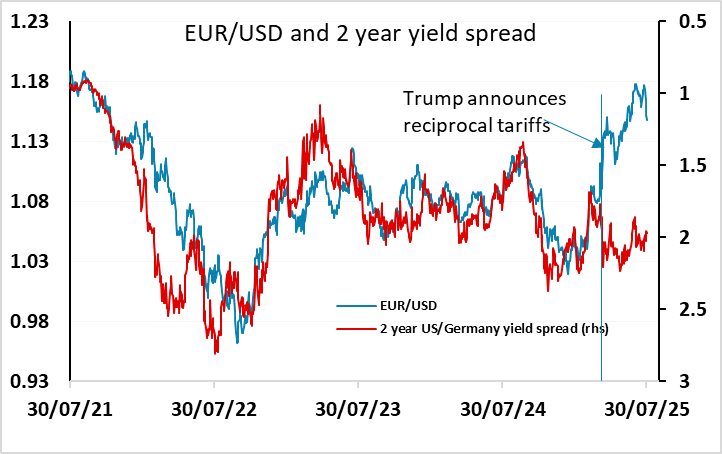

Otherwise we have preliminary CPI data from France, Italy and Germany. Consensus expectations suggest am small rise in the y/y rate in France and a small fall in Germany and Italy. This sort of mixed picture won’t have much impact on the EUR, which has continued to struggle against the backlash from the EU/US trade deal. The positive USD reaction to the deal has to be seen in the context of the USD decline after the initial tariff announcement in April, and while many are seeing it as a reflection of the favourable terms for the US, we believe it should be seen more as a relief that the tariffs weren’t higher and should consequently not be too damaging to the US economy. There is still scope for further declines in EUR/USD retracing the gains form April, with EUR/USD starting from around 1.09 before the tariff announcement, but there should be support in the 1.1400/50 area.

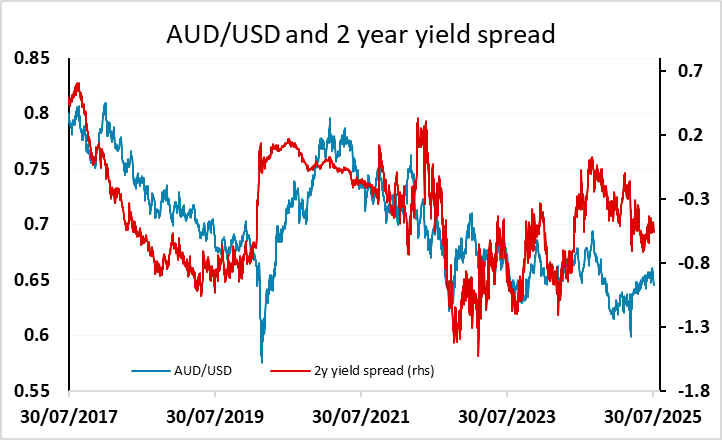

The SUD has been the weakest currency in the last couple of days, with the general USD recovery, the turn slightly lower in equities and the softer CPI data from Australia all weighing. Yield spread support for the AUD has diminished in recent weeks, but AUD/USD still looks good long term value and we would expect good support to emerge before the key 0.6400 level