FX Daily Strategy: N America, September 25th

SEK little changed as Riksbank turns more dovish

NOK/SEK has most potential for gains

Risk positive tone may start to fade, helping the JPY

GBP strength starting to look excessive

SEK little changed as Riksbank turns more dovish

NOK/SEK has most potential for gains

Risk positive tone may start to fade, helping the JPY

GBP strength starting to look excessive

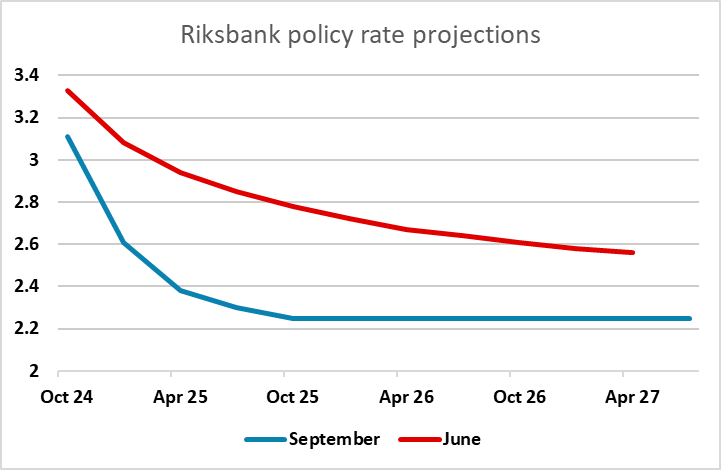

The Riksbank cut rates 25bp as expected, but the statement was more dovish than expected and the projections in the monetary policy report show a much lower trajectory for the policy rate. The statement also indicated that there was a possibility of a sharp 50bp cut in rates at one of the two remaining meetings this year. Ahead of the meeting, the market was pricing 78bps of rate cuts this year. In the wake of the statement this has been increased to a total of 88bps (63bps in the last two meetings).

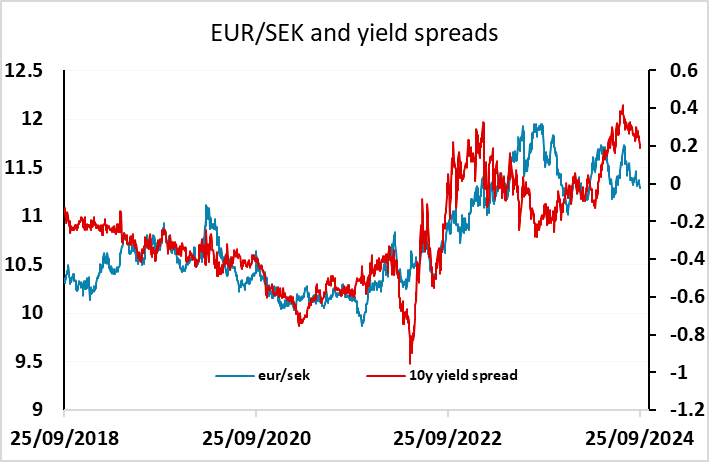

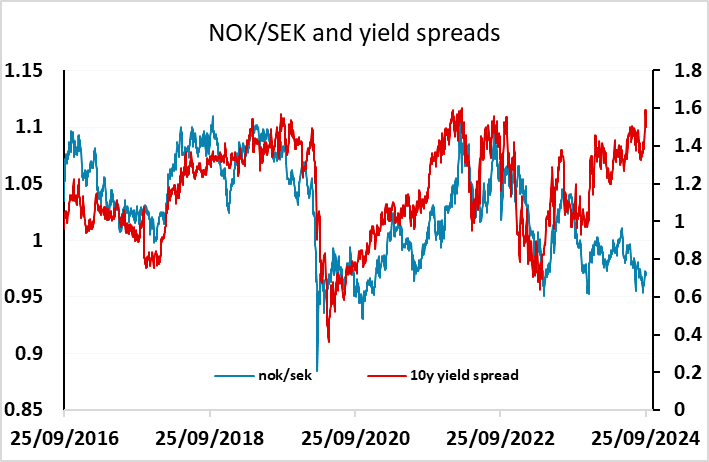

So the statement was clearly more dovish than the market had been pricing in, but after a brief surge higher, EUR/SEK is now nearly unchanged form opening levels. This is partly because Swedish yields beyond the very front end are not much changed, but the correlation with yield spreads has been fairly weak this year in any case. Even so, there does look to be some downside scope for the SEK from here due to the easier policy outlook, both against the EUR and the NOK, but particularly the NOK with the Norges Bank holding a much more hawkish policy line and yield spreads pointing to substantial NOK/SEK gains.

In general, Tuesday’s trading reflected a generally positive risk tone mainly due to the announcement of further Chinese stimulus. This supported Chinese equity markets in particular and equity markets in general. But we don’t see the Chinese stimulus as a game changer, and while it may marginally boost GDP growth, the overhang of the ongoing property bust will be with us for some time. We still view the US equity market as overvalued here, and with equity risk premia falling in the last couple of weeks both due to strong equities and rising US yields, we are likely approaching a short term peak. The USD lost a little ground on Tuesday after weaker consumer confidence data, and the US slowdown still seems likely to weigh on the equity market in the coming weeks and months. The recent rally in the risky currencies may therefore start to fade with any USD losses now more likely to come against the lower yielders, particularly the JPY.

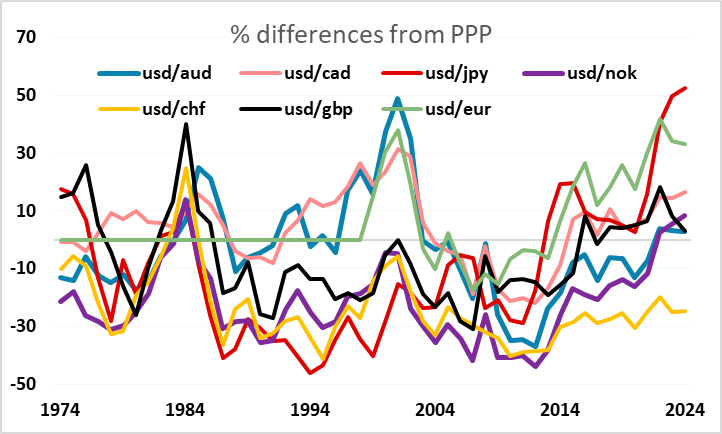

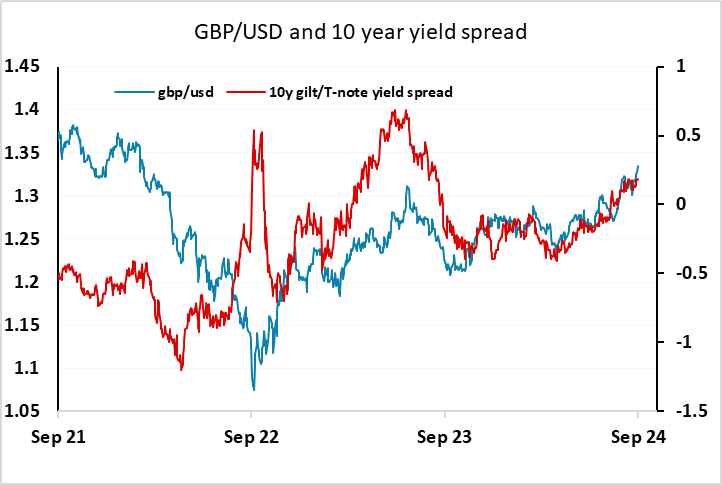

GBP has continued to be one of the strongest performers, reaching its highest against the USD since March 2022. As we pass the 2 year anniversary of the infamous Truss/Kwarteng budget that triggered the GBP/USD dip to a low of 1.03, market sentiment has gone full circle. While sentiment then was likely excessively negative, we now may be getting too positive. Although long term correlations with yield spreads suggest GBP/USD may yet have more upside, this is true of almost all the major currencies against the USD. On the crosses, the attraction of GBP is less clear, especially with a fairly austere budget on the way next month which may lead the market to increase the expected pace of BoE easing. Of the G10 currencies only the CHF is now higher relative to PPP against the USD than the pound.