FX Daily Strategy: Europe, December 10th

RBA unlikely to move rates, but focus on guidance

AUD biased higher on neutral meeting

NOK upside also favour if Norway CPI doesn’t show weakness

JPY weakness starting to look overdone

RBA unlikely to move rates, but focus on guidance

AUD biased higher on neutral meeting

NOK upside also favour if Norway CPI doesn’t show weakness

JPY weakness starting to look overdone

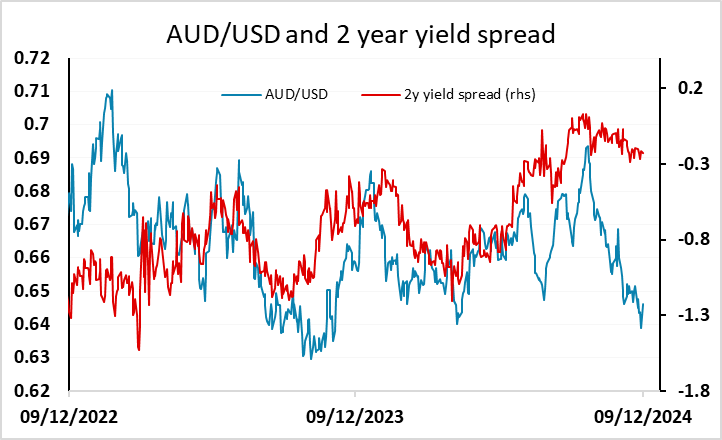

Tuesday kicks off with the RBA rate decision. There seems little doubt that they will leave rates unchanged, with 100% of forecasters looking for no change in rates and the market pricing less than a 10% chance of a cut. However, any signals about the potential for a cut in February will be important. The market is pricing 12.5bps off rates or a 50% chance of a 25bp cut (although a smaller cut is also possible). The recent weak Q3 GDP data suggests a more dovish stance is possible. But the weak AUD may also have an impact on RBA thinking, discouraging aggressive easing. The AUD bounced from just above the year’s lows and there does look to be good support in the 0.6350/60 area, especially if regional sentiment continues to improve on the back of the more dovish monetary policy in China announced on Monday. Yield spreads have been favourable for some time, so if regional equity sentiment improves, it could be enough to give the AUD a substantial boost if the RBA doesn’t indicate a more dovish stance.

And indeed the RBA kept the cash rate on hold at 4.35% as per previewed in the November meeting when the RBA downplayed latest moderation in headline CPI, instead referred to the middle of target range and progress in underlying inflation before the chance of easing. The forward guidance statement did not change from the November statement, citing "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA has not changed their view since. The RBA viewed the headline moderation of Q3 CPI to be partially attributed from the government subsidy of energy prices and stated that underlying inflation did not show the same pace of moderation. However, they also acknowledge that wage growth is slowing despite tight labor market. Combined with the weaker growth in Australian economy, the RBA should be getting ready to ease once underlying inflation shows more cooling.

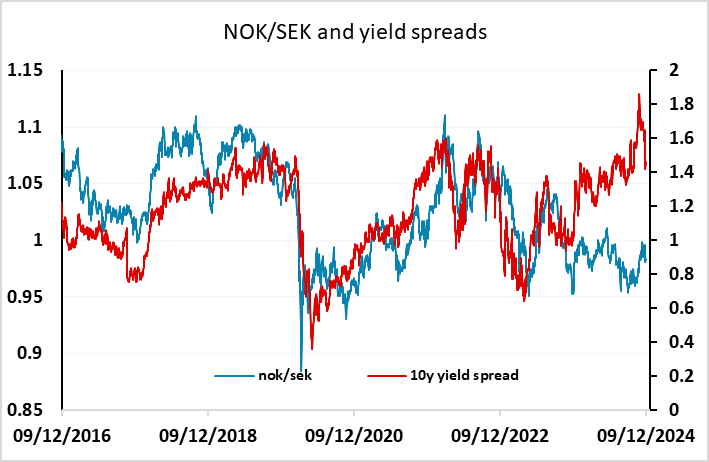

There is also Norwegian November CPI. The targeted inflation measure (CPI-ATE) may rise a notch or two from October’s 2.7% y/y on base effects but remain below the Norges Bank’s projection of 3%, so is unlikely to have much influence on policy. The NOK recovered a little on Monday after last week’s losses, and continues to look good value, especially if global risk appetite improves, with a good yield advantage over the EUR and SEK, so a modest rise in inflation may be enough to trigger a NOK/SEK move back towards parity.

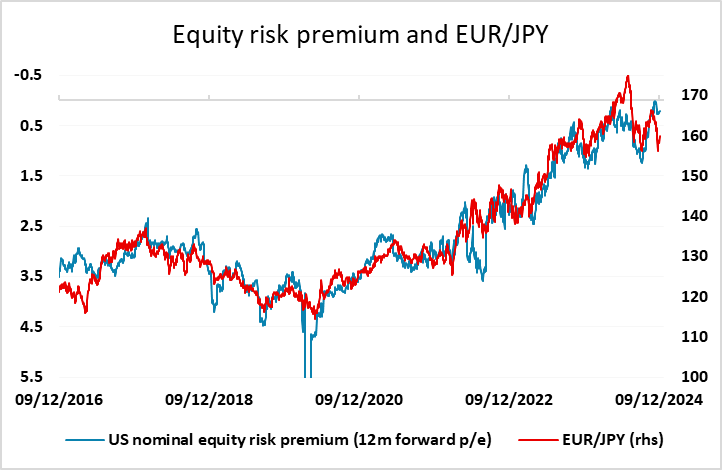

The JPY was the big loser on Monday, undermined by the recovery in regional Asian sentiment leading to general JPY losses on the crosses. As long as risk sentiment remains positive, it will be hard for the JPY to make sustained gains, particularly on the crosses, there the correlation with risk premia is very clear in recent years. But current valuation is still very low, and yield spreads suggest USD/JPY is toppy above 150, so we suspect the JPY will bottom out close to current levels.

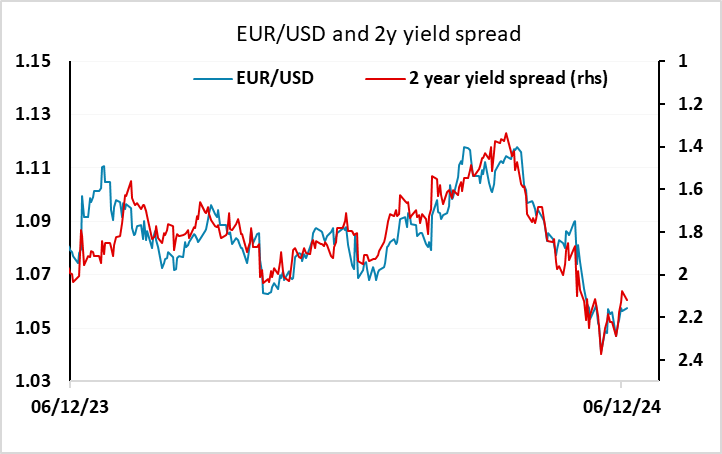

For EUR/USD, yield spreads have moved slightly in its favour in the last few days, and there is scope to retest above 1.06. But there is unlikely to be much near term upside beyond that, as the market has now pared back the probability of a 50bp cut at this week’s ECB meeting to about 15%. There certainly looks to be more of a case for the AUD to outperform the EUR if we continue to see risk sentiment improve.