AUD, JPY, CHF flows: Risk positive tone, some JPY resilience

Risk positive tone on talk of US/China deal, JPY gets some support from verbal intervention

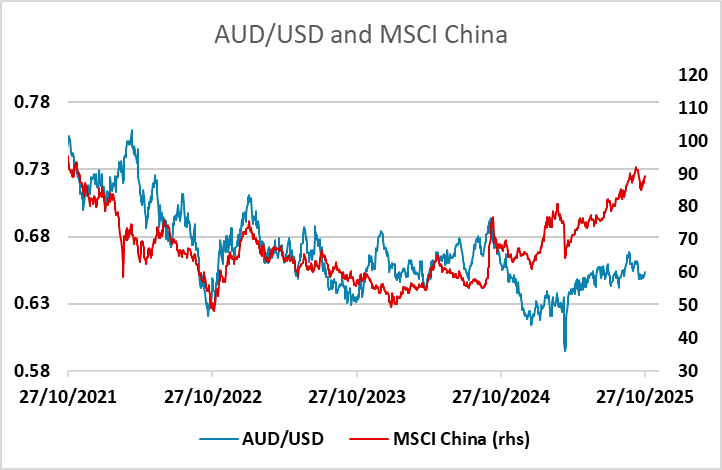

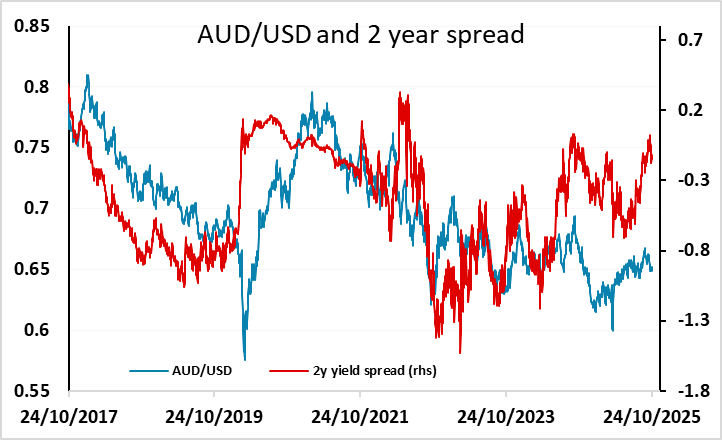

Markets have responded positively to news of a likely deal between the US and China to prevent the 100% tariff threatened by Trump, with China meant to increase its purchases of U.S. soybeans, restrict fentanyl supply and delay its rare earth export controls for another year. This has helped the AUD to make some progress overnight, in sympathy with a higher CNY and higher regional equities.

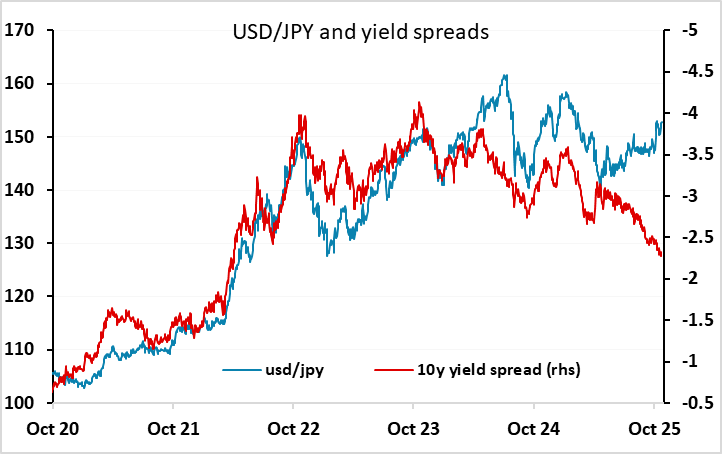

JPY also saw some initial weakness on the crosses, but has recovered most of the losses, perhaps helped by the comments from cabinet secretary Kihara who said it is important that currencies move in stable manner and reflect fundamentals. While this doesn’t suggest there will be action from the government to halt JPY weakness, it does suggest that the new administration is not looking for further weakness in the JPY as part of their economic strategy, and this may to some extent discourage JPY bears.

Most European currencies are little changed over the weekend, but the CHF did see some losses on the Asian open in response to the talk of a US/China deal. The positive risk tone does seem likely to prevent a EUR/CHF break below the strong 0.92 support. This week’s tech earnings data from Microsoft, Amazon, Apple, Alphabet, and Meta will be important for risk sentiment, given the extended equity market valuations, but a major turn seems unlikely at this stage without some economic evidence of weakness, even if a correction is possible if earnings disappoint.