Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

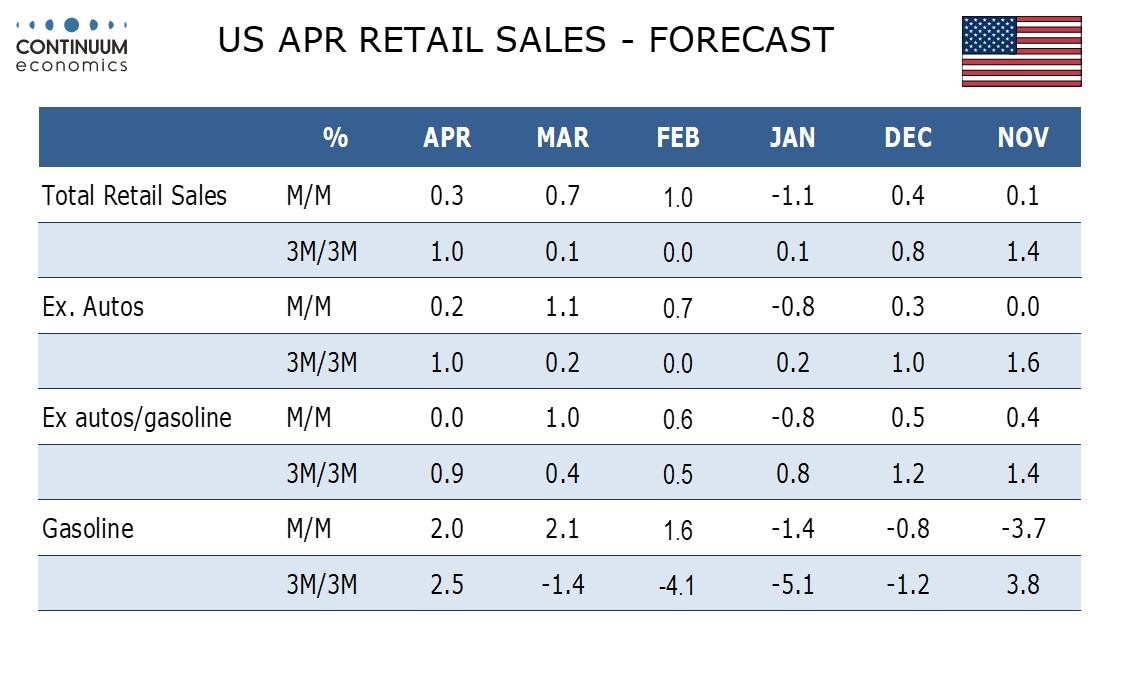

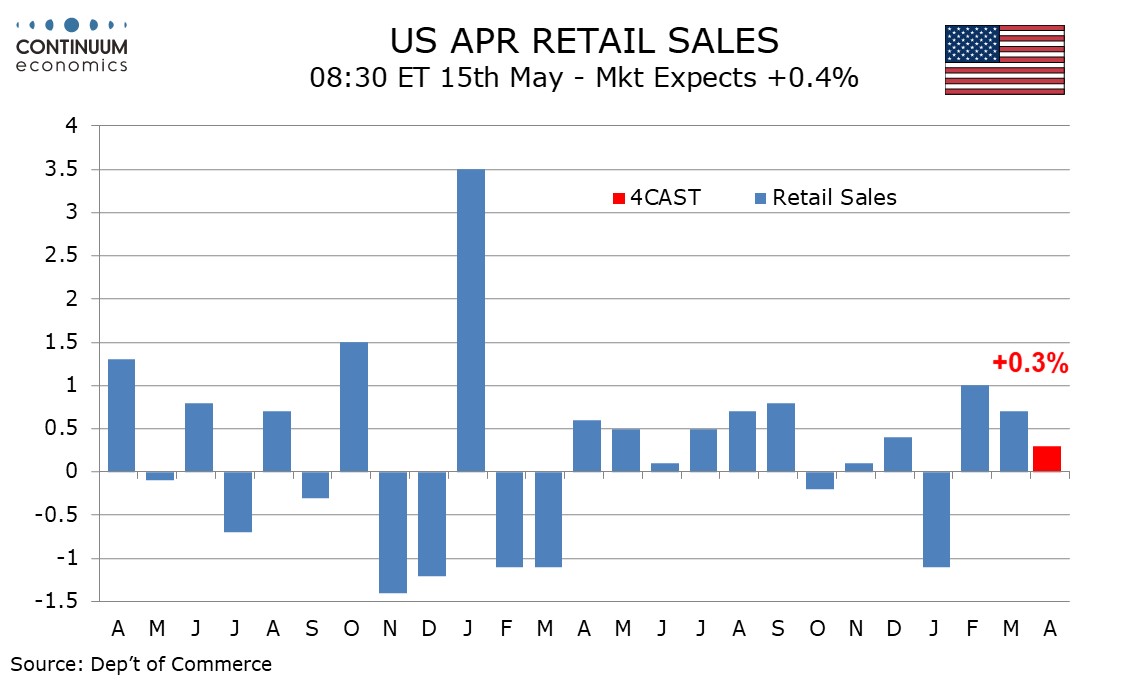

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

Recent strength in consumer spending has been outpacing disposable income, probably supported by the fading effects of savings built up during the pandemic and more recent gains in equities. Consumer confidence, while not a reliable guide to spending, slipped in April.

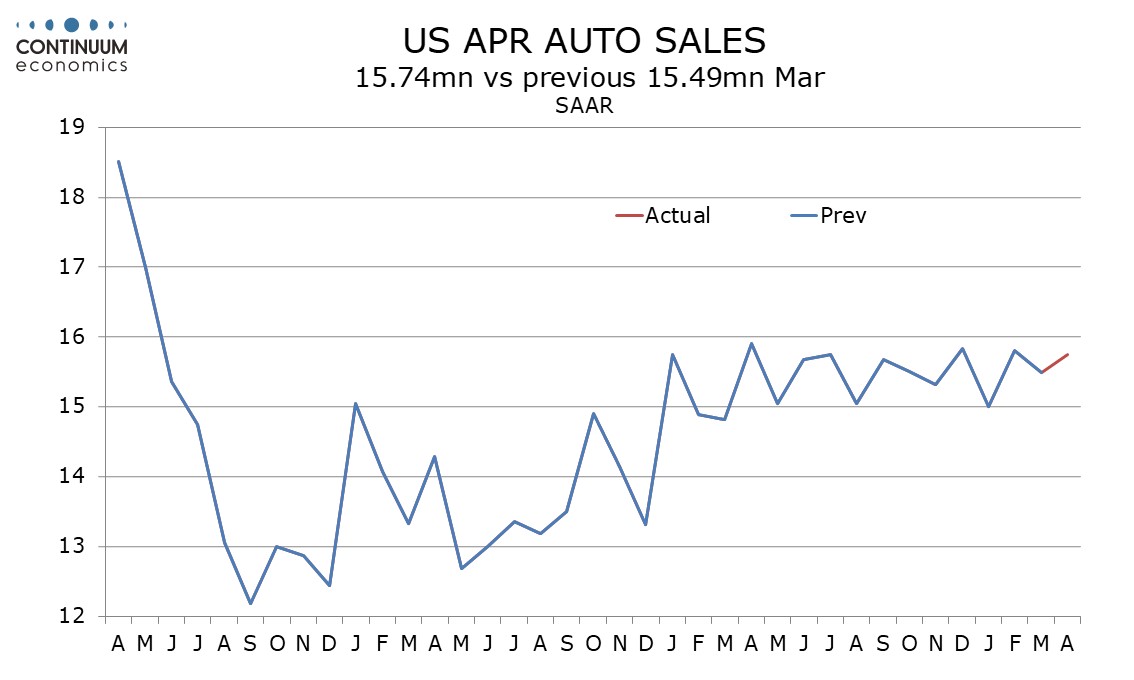

Industry data suggests a small rise in auto sales after a small fall in March, though trend in auto sales has little direction. Gasoline prices are likely to be supportive for sales for a third straight month.

The strong rise in March retail sales may have been a delayed correction from a weak January, which was hit by bad weather. Retail sales seasonal adjustments do take the timing of Easter into account, but it is possible that an early Easter was not fully compensated for in March.

A pause in sales ex auto and gasoline after a particularly strong March seems likely. In late 2023 trend appeared to be losing some momentum, while above trend gains in July and September of 2023 were followed by marginal gains of 0.2% in the following month.