FX Daily Strategy: Europe, December 14th

Central bank meetings dominate Thursday’s calendar

EUR risks may be slightly on the upside on ECB

GBP downside slightly favoured on BoE

NOK may edge lower on unchanged Norges Bank, but sharp rise may be seen on a hike

Central bank meetings dominate Thursday’s calendar

EUR risks may be slightly on the upside on ECB

GBP downside slightly favoured on BoE

NOK may edge lower on unchanged Norges Bank, but sharp rise may be seen on a hike

Central bank meetings dominate Thursday, with decisions from the SNB, Norges Bank, the Bank of England and the ECB (in that order).

The ECB meeting will obviously be the main focus. Another unchanged policy decision is certain, but there will still be interest in a few aspects. In particular, the market will be interested in whether the (somewhat optimistic) ECB economic projections (Figure 1) are amended and to what degree the envisaged drop inflation to below target is brought forward from the current Q4 2025 schedule. Also, whether the sharp and (to some) surprise drop in inflation (to below ECB thinking) is seen to be an aberration or something more fundamental. And while there may be some suggestion the ECB needs to address bank's excess liquidity, markets may be keener to see if any changes to the outlook are on the cards, most specifically an early end to PEPP reinvestments.

Figure 1: ECB Too Optimistic on Growth

Almost certainly the ECB will revise back its 2024 thinking for 2024 GDP (Figure 1). But any such a downgrade may be small and possibly even offset by an upgrade to the 2025 outlook, all on the basis of the large fall in market interest rates seen in the last few months. As a result, it is entirely possible (but maybe not plausible) that the ECB's 2025 inflation projection will not change materially. In addition to which the ECB will unveil its first glimpse for the economy in 2026 and could very easily project inflation at or above target whatever they indicate for 2025.

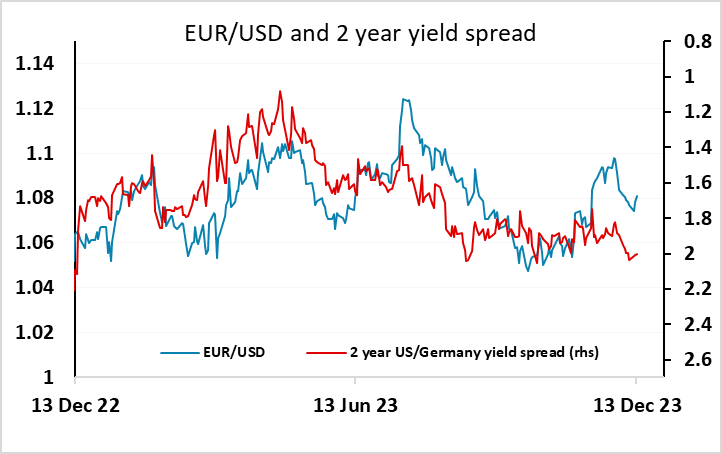

So while the revisions to the forecasts may be mildly on the dovish side, they may not justify any further decline in rate expectations beyond what we have already seen in recent weeks. The ECB are currently priced to ease more aggressively than the Fed or the BoE over the next year, and the forecasts are likely to have to be somewhat weaker than we expect if this view is to be sustained, never mind extended. So given current dovish pricing of ECB policy, we would see some risks to the EUR upside, with the projections perhaps less weak than anticipated and the commentary from Lagarde still unlikely to sound particularly enthusiastic to cut rates. But we are starting from a place where the EUR already looks a little extended relative to yield spreads, so any rally may be short-lived, especially if a less dovish than expected ECB stance undermines equities.

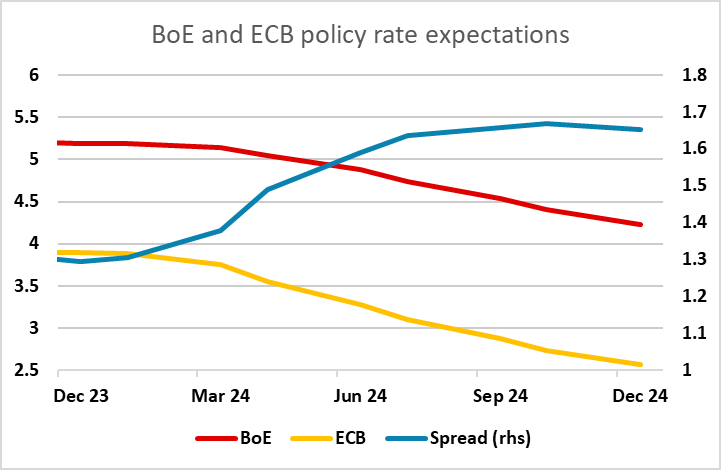

The risks for the Bank of England may be in the opposite direction, with the market pricing in considerably less easing from the BoE than the ECB in 2024, despite a higher starting point. No formal forecast update is due so this will be something of staging post meeting ahead of more data that will help form a fresh policy assessment for the Feb 1 verdict. But we remain of the view that policy has peaked permanently after 515 bp of tightening, dating back to December 2021. Indeed, as the downside risks we envisage materialize, we expect the BoE will be forced to start easing from Q2 next year. The MPC must be aware that conventional policy easing is on the cards for 2024. Historically the average gap between the final rate hike and the first cut is under seven months (in the pre-pandemic period of BoE independence). We would expect at least one of the three MPC hawks to rescind their vote for a tightening this time around, and on top of the softer GDP and labour market data seen this week, this suggests some downside risks for GBP.

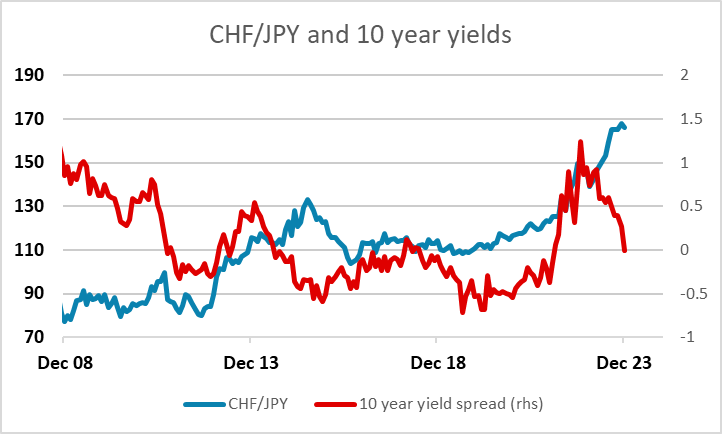

The SNB meeting is unlikely to produce any change in policy, but we would not be surprised to hear a significantly more dovish tone as growth downside risks have risen, house price inflation has dissipated and CPI inflation has fallen and undershot SNB thinking. EUR/CHF hit an all time low (excluding the January 2015 spike) at 0.9401 last week, and while some of the CHF strength is justified by the relatively low Swiss inflation in the last few years, it’s hard to see the case for CHF strength given the lack of yield attraction and relatively benign risk conditions. CHF/JPY continues to look obviously and substantially mispriced.

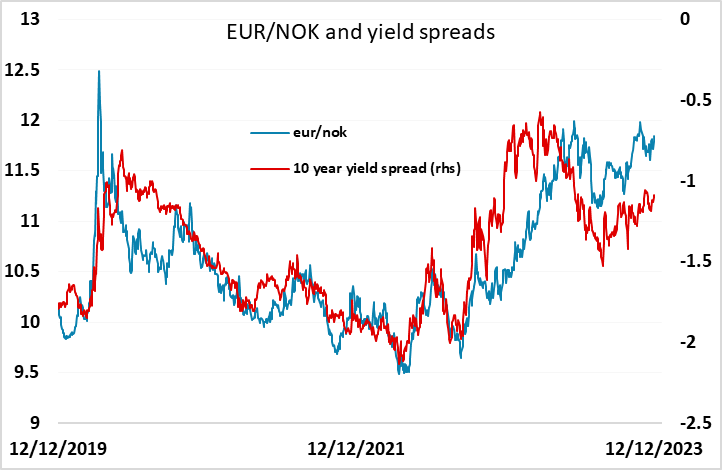

Norges Bank is the only central bank that is seen as potentially raising rates on Thursday. The market consensus is for no change, but only just. While the latest inflation numbers were softish relative to expectations, inflation remains high, and the weakness of the NOK could convince Norges Bank that a hike is necessary. We still marginally favour no change, which could trigger a move to 11.90, but a 25bp hike could see a bigger move back down to 11.70.