EUR, NOK flows: NOK slightly firmer after Norges Bank, EUR PMIs mixed

Stronger composite but weaker manufacturing PMIs leave the EUR little chnaged. NOK slightly firmer as Norges Bank resists pressure for faster easing

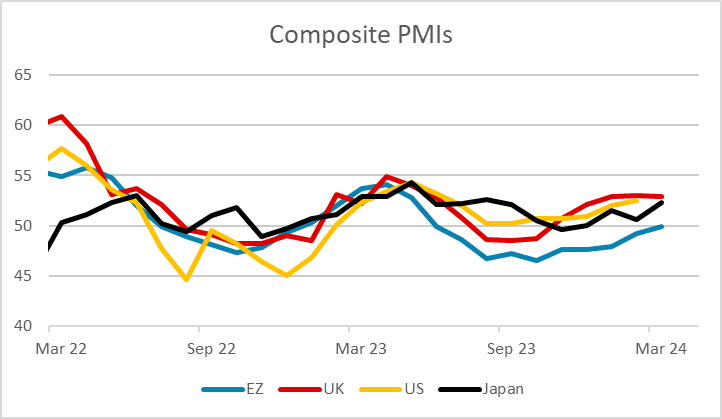

European PMIs have come in mixed this morning, but broadly in line with expectations. Eurozone manufacturing is a little weaker, but services stronger so the composite is a little higher than expected. The UK has the opposite balance with better manufacturing but weaker services and the composite is marginally softer. But the data doesn’t deviate far enough from expectations to have much of an FX impact.

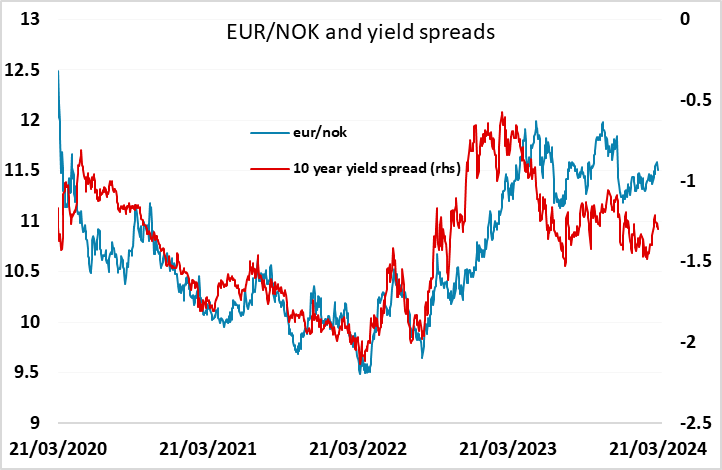

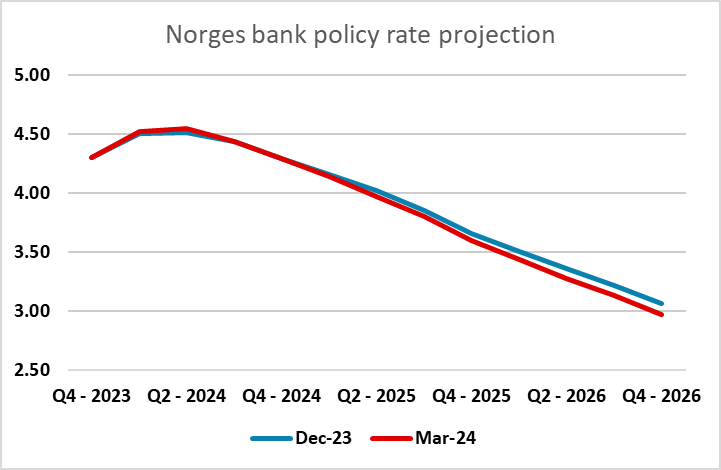

The NOK has firmed slightly on the Norges Bank decision to leave rates unchanged and their reiteration that the cost of borrowing could start to fall in the autumn. There had been some expectation that Norges Bank would turn more dovish and look for earlier rate cuts in view of the lower than expected inflation outcomes we have seen. But even though they have reduced their inflation forecasts for 2024 to 4.1% for core CPI from 4.8% in December, they have refrained from indicating an earlier rate cut, and have only marginally reduced their policy rate forecast. This may reflect a concern not to weaken the currency, which continues to look undervalued, but may have scope for some more recovery.